The long march toward accumulation – this is the doctrine preached by the architects of our present financial order. To believe that consistent, upward trajectory is not merely possible, but assured—this is the foundational delusion. Exchange-Traded Funds, these convenient bundles of hope, are presented as a means to mitigate the inherent volatility, to smooth the path to wealth. But even these carefully constructed instruments are not exempt from the fundamental uncertainties that plague all human endeavors, particularly those driven by avarice.

To select a single vessel for decades of investment—a preposterous notion, really, to place such faith in any system. Yet, if compelled to choose, one observes a pattern, a carefully curated semblance of stability within the broader chaos. The allure lies not in genuine security, but in the appearance of it, a palliative against the anxieties of the modern investor.

The Promise and the Peril of Concentrated Advancement

Most funds operate under a binary principle: preservation or expansion. The former seeks to avoid loss, a defensive posture. The latter, a relentless pursuit of gain, often at the expense of prudence. A few, however, attempt a precarious balancing act, a compromise between the two extremes. These are the most intriguing, and the most suspect.

The Vanguard S&P 500 Growth ETF (VOOG 2.41%)—a label, a designation, a promise etched upon the surface of a transaction. It draws its constituents from the S&P 500 (^GSPC 2.06%), the purported bedrock of American commerce. These are the behemoths, the established powers, those who have weathered storms past, largely unscathed. But to include all is to dilute the potential, to accept mediocrity alongside achievement. This fund, instead, selects, filters, concentrates. It seeks those within the established order exhibiting the highest potential for further expansion. A refinement, perhaps, but also a narrowing of the horizon.

This focused approach, while seemingly rational, introduces a new vulnerability. It is a gamble on the continued dominance of a select few, a reliance on a narrow band of success. Should these chosen entities falter, the entire structure is imperiled. The illusion of diversification is maintained, but the underlying risk is merely concentrated, not eliminated.

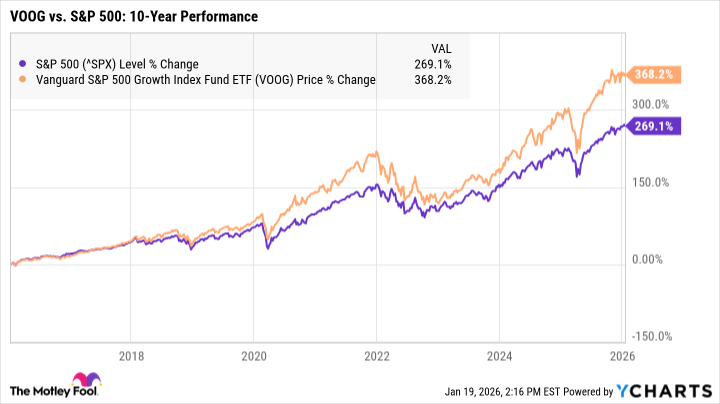

Over the past decade, the numbers are presented as evidence—a 368% return, exceeding the broader index. A tenfold increase, they proclaim. But numbers are easily manipulated, narratives constructed. A decade is a fleeting moment in the grand sweep of history, a period of artificial calm before the inevitable turbulence. To extrapolate from such a limited timeframe is a dangerous exercise in self-deception. $10,000 transformed into $47,000—a tidy sum, yes, but what is its true value when measured against the cost of complacency?

The Inevitable Recoil

Let us not pretend that past performance guarantees future results. The market is a capricious mistress, prone to sudden shifts in mood. Growth-focused funds, particularly those heavily weighted towards technology—a sector built on speculation and ephemeral trends—are especially susceptible to volatility. The recent past, so favorable, is no shield against the storms to come. A reckoning will occur.

To invest, therefore, requires a commitment not merely of capital, but of time. Five, seven years—a paltry span in the face of historical cycles. One must be prepared to endure periods of significant loss, to witness the erosion of accumulated wealth. The temptation to abandon ship during these downturns will be immense. But to sell in panic is to confirm the loss, to surrender to the forces of despair. To remain steadfast, to ride out the storm—this is the true test of an investor, and a testament to the power of denial.

The Vanguard S&P 500 Growth ETF offers a semblance of stability, a comforting illusion of control. But beneath the surface lies a fundamental truth: all investments are inherently risky. To believe otherwise is to succumb to the siren song of the market, to forfeit one’s critical faculties in the pursuit of illusory gains. It is a gamble, dressed in the garb of prudence. And in the long run, the house—as always—will win.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-21 16:32