Years from now, when the dust settles on the grand cacophony of the artificial intelligence phenomenon, the world will reflect on how it reshaped lives, as the hungry roots of technology entwined themselves with the essence of our daily existence, yet, amid this digital renaissance, it is the quiet sentinels-the small but pivotal realms of power grids and data centers-who stand like ancient prophets in the shadows, watching over the unstoppable tide of progress. In this intricate web of relationships, Nvidia emerges as a titan, the architect of AI’s undulating thoughts, its processors acting like the brain cells of an ever-thirsty entity.

However, these ethereal machines, with their genius cores, rely heavily on the fundamental, almost sacred infrastructure that cradles them-the vast, humming temples of data centers and the life-giving veins of electricity that pulse through the lifeblood of our economic organism.

The Vital Breath of AI

To most, the true magic of artificial intelligence lies not in its bold proclamations but rather in the intricate tapestry of possibilities it weaves, producing staggering outputs from colossal torrents of data. Yet, for the market watchers-the vigilant seers seeking fortunes amidst the swirling chaos-the critical inquiry rests upon discerning which enterprise may rise as the titan of tomorrow in this electrified arena of intellect.

Even Nvidia, that dazzling future-bearer of today, holds no divine guarantee against the whims of innovation that might birth a challenger-a spark flickered of new chip technologies that could outwit its current reign. History whispers tales of mighty giants, like Yahoo!, whose overconfidence met with the swift embrace of its own dispossession by Google during the digital dominion shift, reminding us that the crown of early success is neither solid nor eternal.

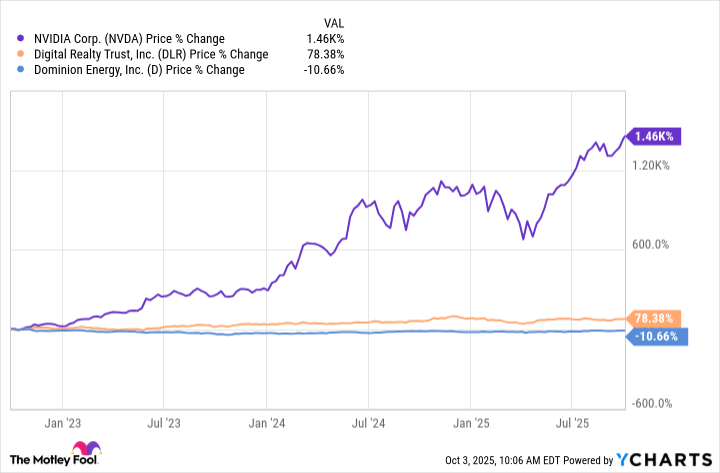

Yet, two certainties remain steadfast in this nebulous ambient of AI: it requires a dwelling-a sanctuary where it can flourish, and nourishment-electricity, the very lifeforce that powers its cerebral exertions. Thus, while indulging in dreams of direct investment in Nvidia and basking in its gargantuan 1,400% stock rise these past three years, one must be wary, for too many eager investors have likely projected tomorrow’s triumphs into today’s valuations.

Exploring the Labyrinth of AI Investments

For those yearning to take refuge behind a reputable fortress without the harrowing highs and lows of a meteoric rise, consider embracing a data center real estate investment trust (REIT) such as Digital Realty Trust (DLR). This entity reigns as a colossal landlord in the world of data sanctuaries, its realms spreading across North and South America, Europe, Asia, and Africa, echoing with the promise of 2.8 gigawatts of capacity and an additional 750 million megawatts under construction. With a dividend yield of 2.8% beckoning those in search of steady income, this avenue offers security amid speculation.

Alternatively, if casting your net wider seems prudent, WisdomTree New Economy Real Estate Fund (WTRE) presents itself as a sanctuary for those wishing to bask in the warmth of diversified investment. This exchange-traded fund (ETF) embodies the essence of modern infrastructure, cradling within its fabric the foundations of AI and visionary technologies. Not only does it cherish Digital Realty among its venerable ranks, but it also nurtures competitors like Equinix and enterprising souls like Prologis, who dip their toes into this ethereal realm.

Yet electricity serves as another illustrious patron in this saga. Within the realm of utilities shines Dominion Energy (D), orchestrating a harmonious monopoly over Virginia’s power supply, which nourishes one of the world’s principal data center markets. Although this company traverses the delicate dance of a modest transformation, lagging in stock performance, it still beckons with its alluring 4.3% yield-an oasis amidst a sector where the average yields just 2.7%.

However, the pursuit of individual victories invites the specter of risk. If you shun the idiosyncratic quest for winners, then the Utilities Select Sector SPDR ETF (XLU) may capture your attention. Although its yield matches the norm at 2.7%, it offers a diversified bouquet of utility stocks wrapped in a single investment, granting you exposure to the burgeoning electricity demands ushered forth by AI’s relentless march.

The Profound Insights in AI Investitures

When the wolves of Wall Street seize upon a narrative, they latch on with a fervor that seldom relinquishes its grip. All too often, the unwary follow the horde, entering an arena that has long been charred by the echoes of misplaced enthusiasm. Yet one need not surrender to the allure of the crowd; rather, one may delve deeper into sectors that thrive in the shadows of artificial intelligence’s luminary mist while offering a bounty of rewards to the discerning investor.

Venerable REITs like Digital Realty present reliable paths, yet beyond that lie industrious entities like Prologis, facilitating the metamorphosis of warehouses into vibrant data centers. Additionally, steadfast utilities such as Dominion Energy, yield a lucrative position amidst this transformative age. In this era, do not be ensnared in the snares of stock selection-let your venture flourish through ETFs such as the WisdomTree New Economy Real Estate Fund or the Utilities Select Sector SPDR ETF, offering you the artistry of diversification alongside your expedition into the heart of AI.

✨

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-06 16:33