Ken Griffin, the head honcho of Citadel, is not the sort to be swayed by market gossip, the latest Silicon Valley sensation, or the latest trend in AI-powered avocado toast. No, Griffin’s movements are calculated with the precision of a Swiss watchmaker, but with the patience of someone who understands that, in the stock market, a few well-timed trades can outshine years of back-patting and flashy press conferences.

Thus, when the news broke that Citadel had slashed its position in Palantir Technologies by nearly 50%, while gobbling up a 167% increase in Chipotle Mexican Grill shares, you’d be forgiven for raising an eyebrow. Here was the man who once had one foot firmly planted in the future of artificial intelligence, now seemingly walking briskly toward the world of burritos and guacamole.

At first glance, this might seem like a move worthy of a comic strip: abandoning the promise of AI and algorithmic perfection for a company whose fortunes can swing wildly with the state of the salsa bar. But look deeper, and you’ll see that Griffin’s move is less about avocados and more about disciplined portfolio management.

Why Ken Griffin Trimmed Palantir: A Lesson in Valuation and Risk Management

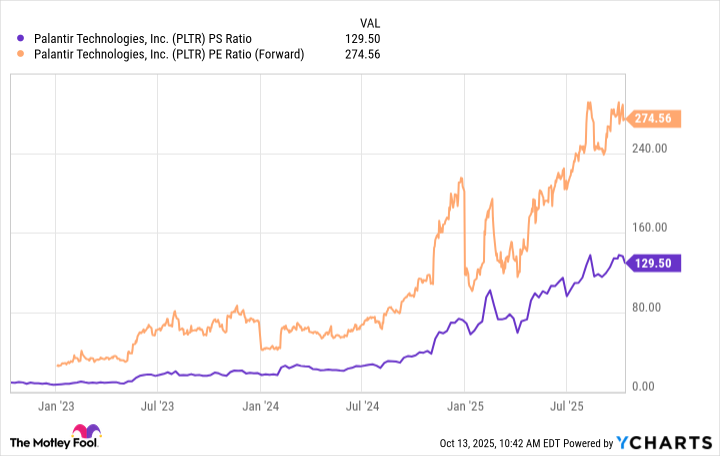

Palantir, for all its AI wizardry, has become a polarizing figure in the market. The company’s stock price, once lifted by the heady winds of speculative enthusiasm, now hovers at valuation levels that would make even the most generous of venture capitalists wince. With its price-to-earnings ratio still high and price-to-sales multiples soaring to dizzying heights, Palantir is far from a bargain, even if its technology could one day dominate global governance and the intelligence community.

From the standpoint of a hedge fund, this isn’t a case of “I don’t believe in AI anymore”-it’s more a matter of not getting carried away by the fevered whispers of market excitement. Griffin’s decision to scale back a little on Palantir represents a refined art: locking in profits when the value of an asset has become overly inflated by the undulating tide of investor optimism. You could say, it’s the professional equivalent of “selling high,” a sentiment we all feel when the stock prices of our favorite companies seem to defy reason.

This move doesn’t reject the premise that AI will revolutionize our lives, but it does acknowledge something often forgotten in the digital era-valuations matter, even when the future seems so bright. For Griffin and Citadel, the real trick is to spot the difference between ‘promising technology’ and ‘overblown expectations,’ a balance that is all too rare in the world of fast-talking tech salesmen.

In sum, Griffin’s decision to trim Palantir isn’t rebellious; it’s just good sense. When the market grows infatuated with a particular narrative, the wisest heads often step aside, quietly taking some chips off the table while others continue to dream of algorithmic utopias.

Why Citadel Might Be Chasing Chipotle: Buying Low, In a Fashionable Sort of Way

Now, let us turn our gaze to Chipotle, that famed purveyor of fast-casual burritos and guacamole. In June 2024, Chipotle executed a 50-for-1 stock split. Naturally, as with all stock splits, investors cheered and the stock climbed higher, as if propelled by a powerful gust of investor euphoria. But, as anyone with a modicum of market sense knows, these bursts of enthusiasm rarely last long.

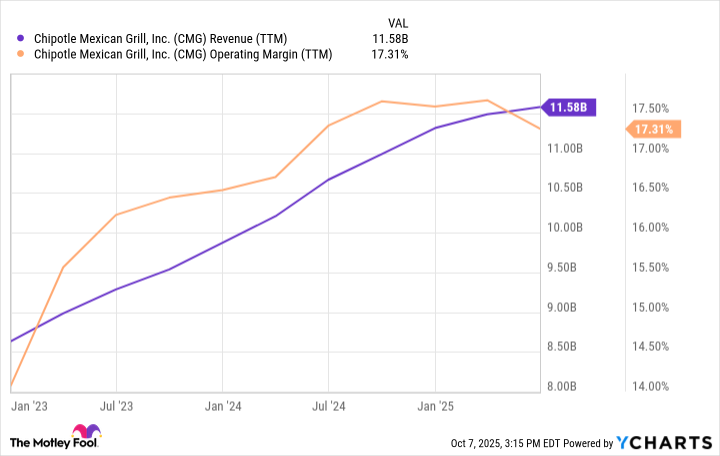

Once the split was over and the reality of market conditions set in, Chipotle’s stock tumbled and then proceeded to wobble in a manner befitting a company that had just lost its long-standing CEO, Brian Niccol, to the tempting allure of Starbucks. With its operational metrics falling flat, and sales growth turning as tepid as an overcooked burrito, Chipotle seemed to be heading towards a rather unappetizing future.

The market, ever quick to react, punished Chipotle’s stock to the point where its price-to-earnings ratio hit a five-year low. At a glance, this looks like a disaster, the sort of thing one might associate with a firm in decline. However, those with a discerning eye, like Griffin, might view it differently.

Inflationary pressures continue to eat away at consumer spending power, and restaurants like Chipotle are no longer the carefree, flourishing businesses they once were. But Griffin’s move is less about the struggles of the burrito and more about a calculated assessment of where the company stands relative to its historical performance. The market, like a mad scientist, has overestimated the severity of Chipotle’s troubles. Griffin, on the other hand, sees a company temporarily experiencing margin pressure, rather than one on the brink of collapse. This, dear reader, is the key insight.

Citadel’s purchase of Chipotle is not a blind bet on burrito demand, but rather a calculated wager that, once the dust settles, Chipotle’s excellent brand and operational strategies will emerge stronger than ever. This is a classic case of buying quality during a temporary downturn-something the best managers do with the subtlety of a master illusionist.

In the grander scheme of things, this is not a case of Griffin knowing something the rest of Wall Street doesn’t. Rather, it’s the classic move of trimming the fat where the narrative has run too hot, and loading up on value when the market has been too cold.

Palantir may remain a tech darling, but in the world of institutional investing, it is Chipotle that is likely to hold the more delectable long-term potential. 🍔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-15 13:39