The crypto market at the dawn of the week kicked off with a cacophony of declines. Bitcoin, Ethereum, and XRP dove to depths unseen in weeks, dashing the spirits of many. A whopping $1.7 billion in leveraged positions were unceremoniously liquidated. Whispers of manipulation filled the air, shaking the stability of top assets.

The Market Stumbles in Its Sunday Best

The crypto economy, bless its heart, opened the week as red as a barn facade. Bitcoin (BTC) had a smack of sense to lose, tumbling to a low of $111,986, unseen since the sunny days of Sept. 10. Ethereum (ETH) performed a dramatic plunge to $4,059, making it the bell-bottomed sensation of over 30 days, before recuperating to trade shyly below $4,200 as the clock struck 1:37 a.m. EST on Sept. 22.

XRP stumbled to a humble $2.69, its lowest bow since July 11, before pirouetting to roughly $2.78. This tumble saw its market cap nimble itself down to $167 billion, forfeiting its third throne to USDT, which strutted past with a market cap of $172 billion. BNB, previously basking in its newborn all-time high of $1,072, saw its luster dim to $1,009, a drop of 5.5% in 24 crisp hours.

Elsewhere, high-capitalization climbers like DOGE, ADA, and LINK took even steeper tumbles, nosediving by 11.4%, 9.8%, and 10.5% respectively. The grand ensemble of high-cap altcoins watched their fortunes ebb between 5% and 10% over 24 hours, reducing the entire crypto economy’s market capitalization to a mere $4 trillion.

The Whirlwind of Liquidations and Accusations

This tumultuous ride washed away $1.7 billion in leveraged positions, extinguishing the hopes of some 406,202 traders. Liquidations of long positions took the lion’s share, accounting for $1.62 billion. A Coinglass 24-hour liquidation heatmap revealed frenzies across the board, with ETH’s losses ringing in at $495.10 million and BTC’s at $283.86 million. Altcoins also met their match, with SOL shedding $95.38 million, XRP bowing out with $78.97 million, and DOGE bemoaning $62.20 million.

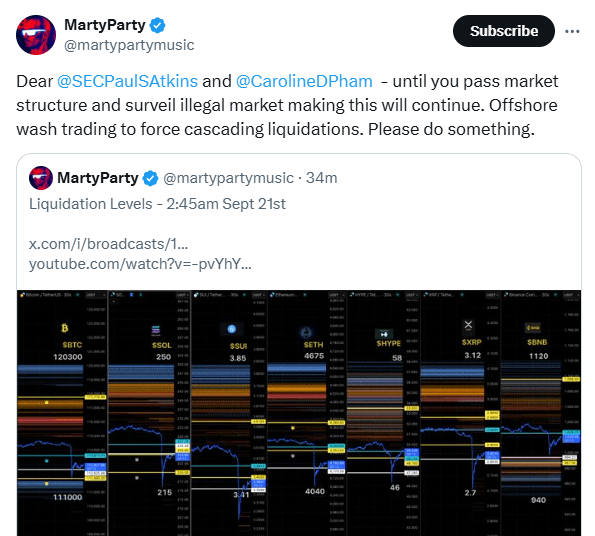

The sudden slide has fueled much chin-scratching and why-did-youths, with fingers wagged at potential manipulation. Crypto wag Marty Party proclaimed that centralized exchanges had fattened their wallets significantly during this downturn.

“Exchanges fattened their wallets by $631m from that bit of market shuffle. They’ll use those greenbacks to buy into their own token stocks. It’s the old razzle-dazzle until regulators catch on and put an end to their shenanigans,” Marty Party announced with a twinkle of mischief in a post on X.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-22 10:57