As a seasoned crypto investor with a background in data analysis, I closely follow CCData’s Exchange Review for valuable insights into the digital asset industry. The latest edition of this comprehensive report sheds light on the significant decline in trading volumes across spot and derivatives markets in April 2024.

CCData, recognized by the Financial Conduct Authority as a benchmark administrator, emerges as a global frontrunner in digital asset information. Catering to the needs of institutional and individual investors alike, CCData delivers top-tier, real-time, and historical data. Leveraging extensive expertise in data management, CCData presents industry-leading reports and analytics, offering unbiased perspectives on the digital asset market.

As a dedicated researcher delving into the dynamic world of cryptocurrency exchanges, I meticulously track significant developments within this market through the CCData Exchange Review. This monthly publication provides detailed analyses of exchange volumes, with a focus on various aspects such as crypto derivatives trading, market segmentation based on exchange fee models, and comparisons between crypto-to-crypto and fiat-to-crypto transactions. Furthermore, I examine Bitcoin trading across numerous fiat currencies and stablecoins, compile a ranking of leading crypto exchanges by spot trading volume, and explore historical volume trends for top trans-fee mining and decentralized exchanges. This comprehensive review caters to a diverse audience, from enthusiastic cryptocurrency users seeking an all-encompassing market overview to seasoned investors, analysts, and regulators in search of insightful analysis.

In April 2024, there was a noticeable change in the pattern of cryptocurrency trading on centralized exchanges, as highlighted in CCData’s most recent Exchange Review. After a strong performance in March, the aggregate volume of spot and futures transactions dropped by a substantial 43.8%, reaching a total of $6.58 trillion. This decrease can be linked to several reasons: unforeseen economic data, heightened political instability in the Middle East, and negative investment flows from Bitcoin ETFs based in the United States.

Impact of Bitcoin Halving and Macroeconomic Factors

The Bitcoin halving served as a key inflection point, markedly altering trading patterns. Traditionally associated with heightened market action, this year’s event occurred amidst dwindling investor faith and diminished market fluidity, leading to shrinking trading volumes. The geopolitical turmoil and disquieting economic indicators amplified the market downturn, undoing much of the progress registered in the preceding month.

Specifics of Trading Volume Declines

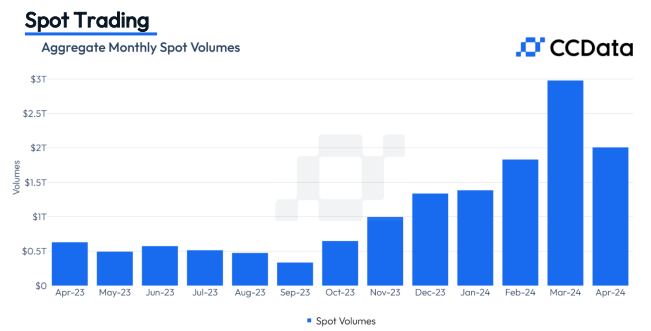

As a researcher studying trading volumes on centralized exchanges, I’ve observed a significant decrease of 32.6% in monthly spot trading activity, bringing the total down to $2.01 trillion. This marks the first decline in trading volumes over the past seven months.

The trading of derivatives took a significant hit, experiencing a 47.6% decrease in volumes amounting to $4.57 trillion. As a result, the dominance of the derivatives market dropped to 69.5%, marking the continuation of a seven-month declining trend.

Binance’s Market Position

As an analyst, I’ve observed that April proved to be a tough month for Binance, one of the major crypto exchanges. The volume of spot trading on the platform dropped significantly by 39.2% to $679 billion. Similarly, the derivatives trading volume took a hit, decreasing by 27.7% to $2.03 trillion. Consequently, Binance’s overall market share experienced a reduction of 2.41%, landing at 41.5%. This figure marks the exchange’s lowest spot market share since January 2024, which was 33.8%. The decline in Binance’s performance coincides with legal issues faced by its founder, Changpeng Zhao, who received a prison sentence of four months for infringements related to U.S. money laundering laws. Post the appointment of a new CEO in November 2023, Binance had initially shown signs of growth in market share, suggesting that leadership transitions have brought about contrasting outcomes.

CME’s Trading Volumes and Market Share

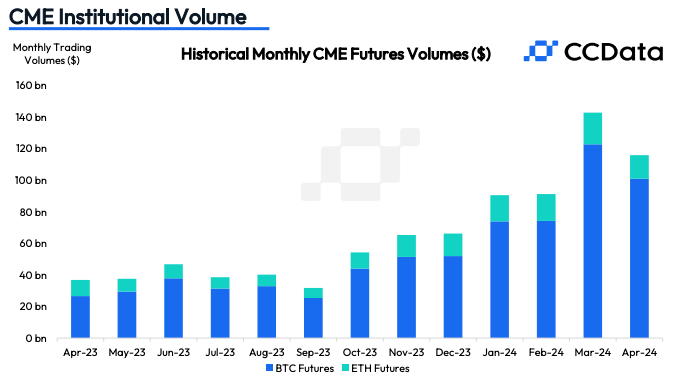

As a market analyst, I’ve noticed that the Chicago Mercantile Exchange (CME) reported a decrease in trading activity for their cryptocurrency futures offerings. Specifically, the aggregate derivatives trading volume dropped by nearly 20% to reach $124 billion.

As an analyst, I’ve observed a notable decrease in the value of Bitcoin and Ethereum futures contracts. Bitcoin futures dropped by approximately 17.7%, resulting in a market cap of around $101 billion. Similarly, Ethereum futures experienced a more substantial decline of about 25.9%, bringing their market cap down to roughly $14.9 billion. Despite these reductions, CME’s market share within the derivatives sector managed to expand slightly by 0.14 percentage points, reaching 2.66%. This growth can be attributed to steeper declines in other centralized exchanges.

The Broader Impact

As an analyst, I’ve observed a significant drop of 35.3% in open interest for Bitcoin instruments on CME, reaching $7.59 billion – the lowest level since February 27th. This decline aligns with the broader market trend, indicating reduced trading activity. The shrinking open interest implies that institutional traders are adopting a more cautious stance, possibly due to mounting uncertainties and regulatory concerns that have been building up in the market.

Read More

2024-05-08 20:05