Gather ’round, dear friends, for the curious tale of Bitcoin, who danced up to $79,630 as the clock ticked on April 10, 2024! With a market grander than a giant’s feast at $1.57 trillion, this chap has been frolicking between a lowly $78,424 and a dizzy high of $82,401. The trading volume? A whopping $52.10 billion—enough to make even a dragon blush with envy! 🔥💸

Bitcoin

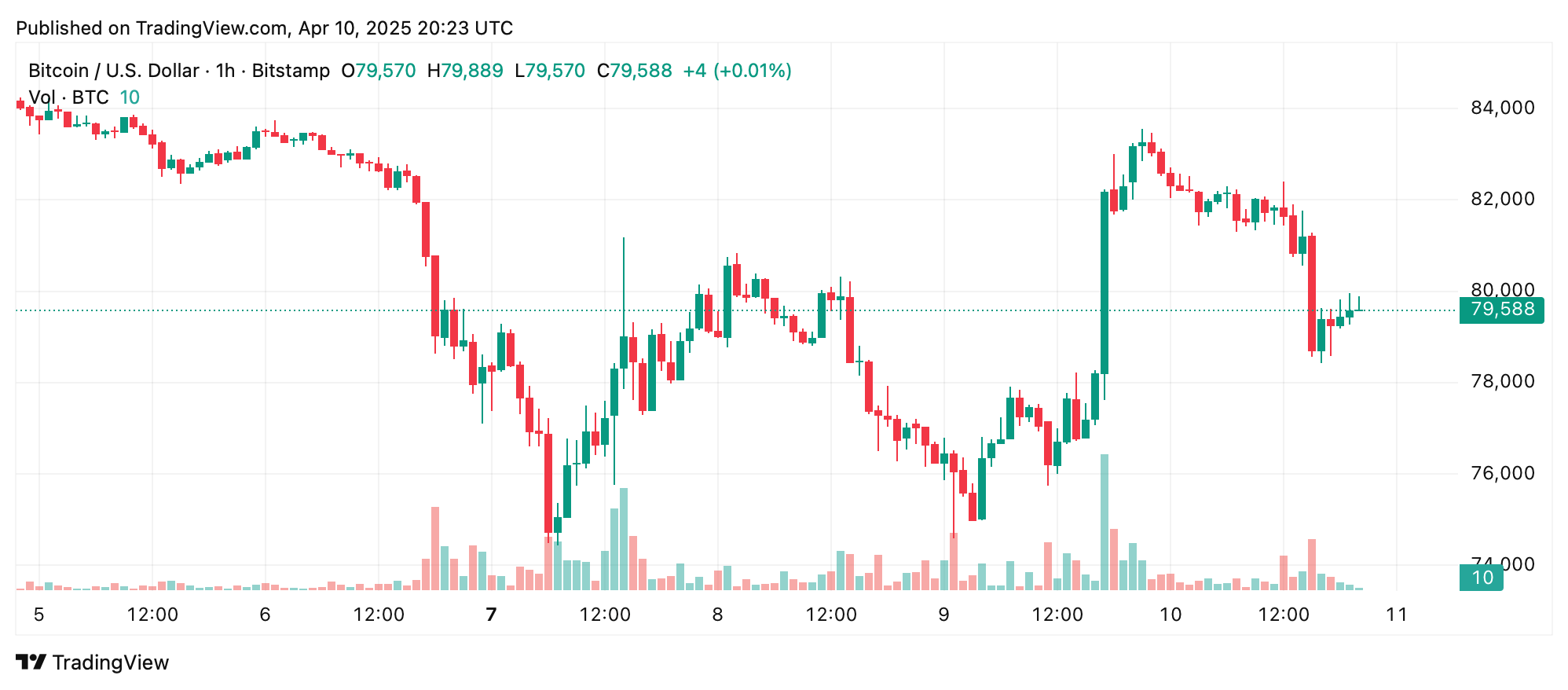

On the whimsical 1-hour chart, our dear Bitcoin pranced back to life after a tumble down to $74,434. A jolly little trend has formed with peaks that would make a mountain climber proud! Now, nestled cozily around the $79,000 snuggery, there’s a glimmer of bullish cheer. The buyers are coming in like clowns at a circus! 🎪 Should it leap above $80,200 with a hearty volume, a jubilant rally towards $82,000 could be just on the horizon! But beware, if it teeters below $78,000, the bear might come sniffing around! 🐻

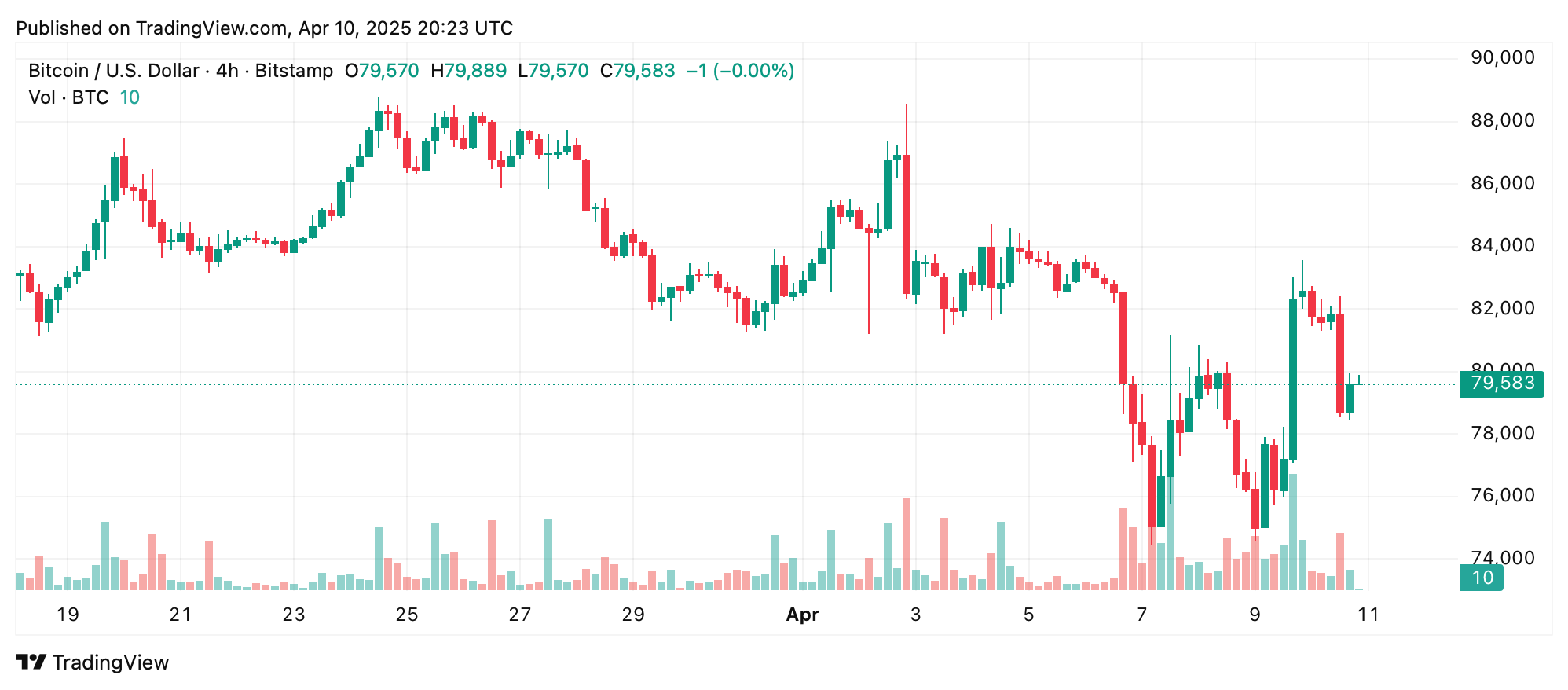

Now observe the magical 4-hour chart, revealing a classic V-shaped boing back from the same $74,434 foray! After a splendid sell-off, Bitcoin has found its footing somewhere between $77,000 and $78,000—like a tightrope walker who forgot their balance pole! Traders might want to snatch up some coins during the dips, aiming for the shiny $82,000 target. But hold your horses—until it skedaddles above $83,000, one must tread lightly! 🐴💰

Peering into the grand daily saga, Bitcoin remains rather gloomy after a high-flying peak of $109,356, like a cheerful bird waking to find winter outside its cozy nest! A recent dip down to $74,434 has it flirting with critical support, yet perhaps a glint of optimism lurks in that bounce. If it can keep its spirits above $75,000 and prance around with higher-low candles, bullish sentiments may just catch on like wildfire! 🔥 Traders be wise—watch for breakouts above $82,000 to hatch some long positions, but a slip below $74,000? Well, that’s a whole different kettle of fish! 🐟

Now, let’s peek at the daily oscillators, which most seem to be sitting rather neutrally, like cats on a fence! The relative strength index (RSI) idles at 43, with stochastic %K stretching to 36. The commodity channel index (CCI) is feeling gloomy at -90, while the average directional index (ADX) sobs at 19. Both the momentum indicator and the MACD are flashing sell signals, indicating whirls of uncertainty in our prices. Quite the topsy-turvy, isn’t it? 🤹♂️

As for moving averages (MAs), they’re grumbling a dark tune across the timeframes! The 10-period EMA and simple moving average hover above at $81,032 and $81,406, respectively. The 20-period EMA and SMA at $82,400 and $83,246 add weight to the ever-looming pressure. One must wonder, will the bulls muster the strength to march through these barriers or will they hide in dark corners? 🏰

Magical Fibonacci retracement levels peek through, revealing tale-worthy insights on potential support and resistance! The daily chart’s golden ratio at a shiny $87,774 beckons, while the fighting grounds on the 4-hour and 1-hour charts set up the stage for a battle of wits and wiles! 🛡️ If our hero Bitcoin holds strong above these key levels—oh, the journey upwards could be rich with treasure! Hoist the sails! 😄🏴☠️

Bull Verdict:

If Bitcoin can maintain its merry dance above the Fibonacci support and surges past $80,200 with glee, we might just see a cheerful bullish revolution unfolding. A leap over $82,000? Huzzah! The gates towards the $85,000 to $88,000 zone could swing wide, validating the enthusiasm of our daring traders. 🌈

Bear Verdict:

Yet, if Bitcoin flops below $78,000 and down to the $74,434 support floor, well—pity the poor souls who were hopeful! The bears would gain ground, ensuring a downward spiral. Brace yourselves for turbulent times, as even short-lived bounces could be sold off faster than you can say “crypto calamity!” 😱

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-10 23:57