It appears, dear reader, that the audacious world of Bitcoin (BTC) is not just a playground for technocrats and their mighty institutions; nay, they have been bested in their own game by the humble individual. A startling 69.4% of the 21 million treasured BTC in circulation are tucked away in the cozy coffers of private investors! 😲💰

Institutions with grand designs and visions of acquiring Bitcoin may find themselves in quite the pickle, facing a scenario where the ownership is almost as concentrated as a Mrs. A’s tea service during her exclusive garden parties.

Institutions Meet Their Match as Bitcoin Supply Dwindles

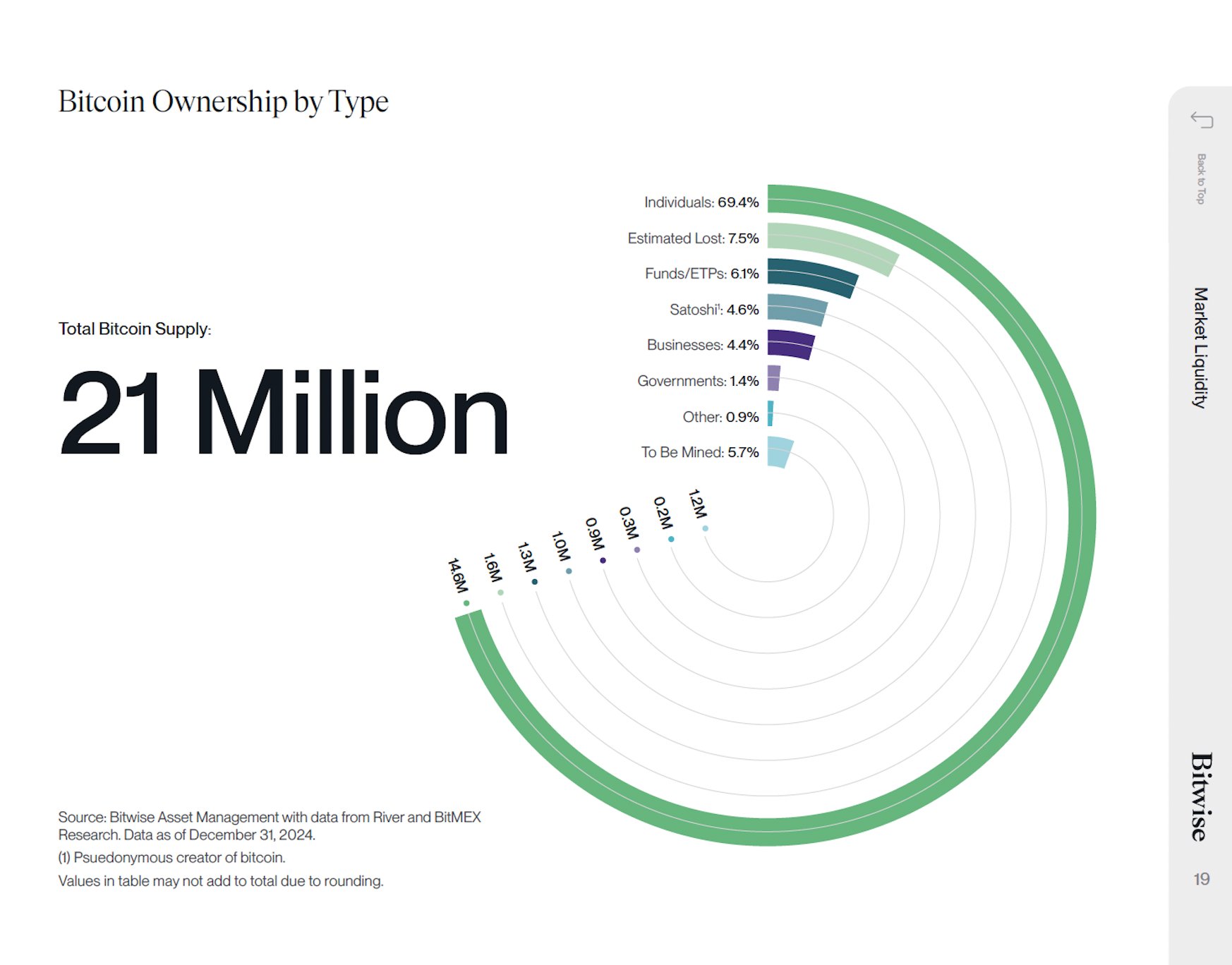

In an uproariously insightful post on X, Bitwise laid bare the dismal distribution of Bitcoin’s total supply. Other than the self-styled individual holders, it seems approximately 7.5% of Bitcoin has gone the way of all things lost. Exchange-traded products (ETPs) control a mere 6.1%. The wallet of the illustrious Satoshi Nakamoto, our pseudonymous hero, clutches 4.6% tightly, while governments and corporations combine to hold a paltry 5.8%. Talk about a bad day at the office! 🏢💔

As it stands, if businesses and governments wish to partake in the Bitcoin banquet, they’ll have to charm the individual holders to part with their golden morsels.

“That market dynamic between buyers and sellers could get very interesting,” it was noted with all the earnestness of a fox guarding a henhouse.

Hunter Horsley, the esteemed CEO of Bitwise, lamented that despite the steady onslaught of funds and ETFs, Bitcoin’s price has still been subjected to a rather unfortunate downward tug. Alas, the majority of Bitcoin’s dazzling worth continues to reside with those very same individual holders.

“Every new buyer must find a seller. Obvious but important as ever,” Horsley waxed philosophical – perhaps while secretly eyeing a lovely piece of BTC himself.

The Looming Bitcoin Supply Shock

In this riveting saga, a mere 5.7% of Bitcoin remains to be mined, much like the last piece of chocolate cake at a children’s party. On top of that, the OTC markets are drying up faster than a summer puddle! A crypto analyst, no doubt donning a monocle, stated that only 140,000 BTC are left in the OTC market.

“There’s almost no Bitcoin left even for institutions,” he claimed, shaking his head as if he had just seen a cat walk through a dog show.

This analyst outlined a scenario wherein ETFs’s eager hands had gobbled up 50,000 BTC just last month, but alas, price movements remained as flat as last week’s soda. Surely, institutions must procure their Bitcoin from OTC markets to avoid ruffling the delicate feathers of price checks!

But hold your horses, dear reader! This tactic may be running on borrowed time with the supply running frightfully low.

“Every billion dollars’ worth of money going into BTC raises its price by 3-5%. That’s why OTC drying up is so insane,” the analyst remarked with all the panache of an opera singer hitting the high notes.

If MicroStrategy (now fancifully termed ‘Strategy’) continues to flex its purchasing biceps, or if ETFs keep their acquisition fervor ablaze, we might see OTC Bitcoin vanish faster than a magician’s rabbit. And if the US and various states decide to jump in the fray, we might as well ring the bell for Bitcoin supply panic! 📉🏃♂️

Strategy, relentless as ever, has been on a Bitcoin shopping spree. On February 10, involved in some rather reckless purchasing, they splurged on 7,633 BTC for nearly $742.4 million. This marks their fifth shopping trip in 2025 alone! According to the Saylor Tracker (which surely is as accurate as the latest fashion trends), they now hold a staggering 478,740 BTC, worth a princely sum of $47.12 billion.

Institutions like BlackRock, meanwhile, are sharpening their knives, having reportedly devoured $1 billion worth of BTC this January. They didn’t stop there, for just today they acquired yet another 227 BTC, according to the ever-watchful Arkham Intelligence.

All the while, as supply tightens evermore akin to a too-small girdle, the institutions may yet have no choice but to shell out directly from exchanges, potentially sending Bitcoin prices rocketing higher—like a startled gazelle! 🦌🚀

This impending supply shock lurks ominously, much like the family cat during the weekly vacuuming. With Bitcoin’s adoption accelerating at a dizzying pace, BlackRock previously noted crypto has amassed 300 million users faster than any of that pesky internet or mobile nonsense.

Brian Armstrong, the captain of Coinbase, dove into this stylistic comparison, forecasting that Bitcoin’s popularity could very well soar to several billion users by 2030—assuming current rates hold, of course!

“Bitcoin adoption should get to several billion people by 2030 at current rates,” Armstrong confidently declared—his eyes gleaming with wild ambition.

He mused about how one might define the starting points for Bitcoin, the internet, and mobile phones. However, he graciously acknowledged that the path is rather clear, notwithstanding a few pesky variables.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE PREDICTION. DEXE cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- ‘Did Not Expect To See That Fiery Bully’: Hell’s Kitchen Alums Recall ‘sharp-tongued’ Gordon Ramsey’s Behavior On Set

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-02-11 12:18