THE Invesco QQQ Trust (QQQ), ladies and gentlemen, is not just a fund-it’s a GODDAMNED MANIFESTO of modern capitalism. It tracks what it tracks, does what it does, with the cold precision of a sniper on meth. But here’s the kicker: that sharp focus might just be its undoing. Or yours.

This isn’t some meek little ETF you can casually toss into your portfolio like spare change at a strip club. No, this beast demands RESPECT-and scrutiny. Let’s peel back the layers of this financial onion until we’re all crying tears of either enlightenment or despair.

What Does This Beast Even Do?

Ah yes, the Invesco QQQ Trust-an index-tracking ETF so simple in concept it could almost pass as innocent. Except IT’S NOT INNOCENT. Not when its puppet master is the NASDAQ 100 INDEX, which grabs the 100 largest non-financial stocks trading on the Nasdaq exchange and squeezes them into a market-cap-weighted straitjacket.

So far, so boring, right? WRONG. The top dogs-the Amazons, Apples, Googles-wield disproportionate power over the performance of this thing. And then there’s the expense ratio: 0.20%. Sure, it sounds small, but compared to the SPDR S&P 500 ETF’s 0.09% or the Vanguard S&P 500 ETF’s laughably low 0.03%, suddenly you’re wondering if someone slipped something into your coffee.

And don’t get me started on how the Nasdaq 100 pretends it’s not a tech-heavy monster while secretly being EXACTLY THAT. Technology companies dominate this index like Vegas showgirls dominate a stage-they’re everywhere, they’re dazzling, and they leave you broke if you stare too long.

A Portfolio Mix That Screams “BUBBLE!”

Now let’s talk about DIVERSIFICATION-or rather, the LACK thereof. While the S&P 500 spreads its bets across sectors like a seasoned gambler, the Invesco QQQ Trust throws caution to the wind and doubles down on TECHNOLOGY. Nearly 61% of its assets are tied up in tech stocks, versus the S&P 500’s more measured 34%. And the top 10 holdings? They account for OVER HALF THE PORTFOLIO. HALF!

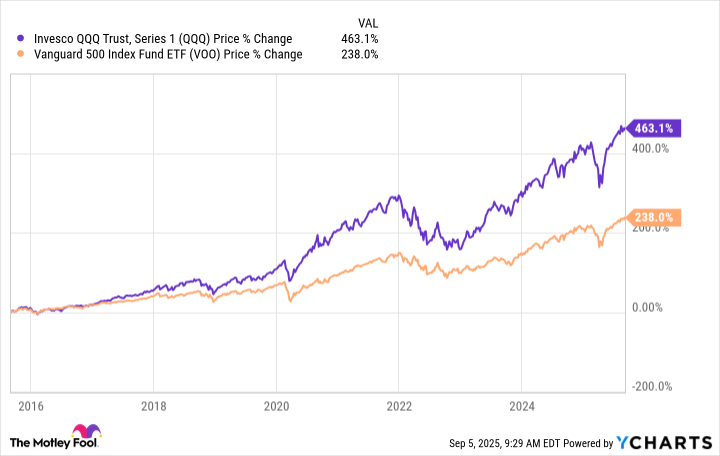

Is this ETF bad? No. Is it dangerous? Oh, absolutely. It swings between euphoria and despair faster than a drunk poet at a bar mitzvah. Yes, it has outperformed the S&P 500 over the past decade-but at what cost? VOLATILITY, my friends. Pure, unadulterated chaos.

Should You Bet the Farm on This Thing?

For most investors, making the Invesco QQQ Trust your CORE HOLDING would be like trying to build a house on quicksand. It simply doesn’t have the structural integrity to support your entire financial future. But as a SIDE BET? As a way to juice your returns by hitching your wagon to the tech supernova? Maybe. Just remember: THIS IS A HIGH-STAKES GAME.

You want stability? Look elsewhere. You want explosive growth potential wrapped in a ticking time bomb? Welcome to the circus, friend. 🎢

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-09-08 13:13