In a world gone topsy-turvy, where the mere mention of the stock market incites as much dread as an uninvited dinner guest, investors have turned their googly eyes to the Swiss franc and gold—those stalwart companions in times of economic angst. Who needs digital currency when you have shiny objects?

Just the other day, the USD/CHF exchange rate took a nosedive to 0.8100, plummeting 12% from its extravagant heights of 2024. One must tip their hat to the Swiss franc, which has been prancing about like a newly minted celebrity on this year’s currency red carpet.

Conversely, our dear old U.S. dollar is wallowing in shame, slipping to 2018 lows as it wallows in the pit of financial despair. Why, you might ask? Switzerland’s charming neutrality and their delightful little banking secrecy laws ensure it remains a beacon of safety—much like a good pair of woolen socks in an English winter.

Now, let’s not overlook the Swiss National Bank (SNB), which has seen fit to invest in a rather impressive collection of American companies—think Apple, Microsoft, and the other shiny toys of the financial elite. Not to mention, it proudly holds its place as the tenth-largest holder of U.S. Treasury bonds. Quite the portfolio!

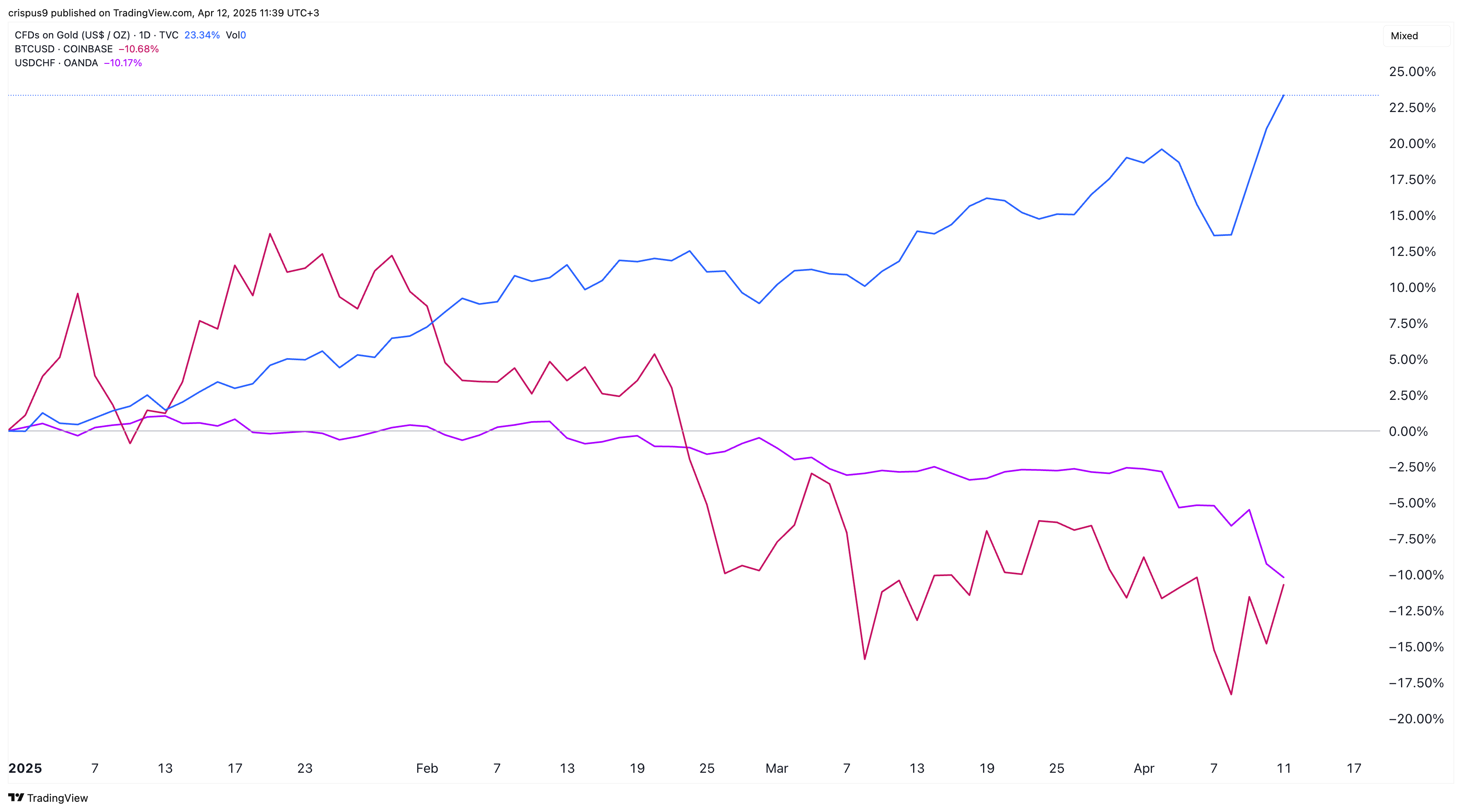

And then there’s gold—oh, glorious gold! Its price has rocketed to a staggering $3,240, soaring 125% from the pandemic’s pitiful lows, while the S&P 500 and Nasdaq 100 indices have chosen to retreat gracefully to the corner like an awkward teen at a school dance.

Gold and Swiss Franc: The New Kingpins of Wealth

It appears that gold and the Swiss franc have outperformed Bitcoin in the ongoing drama of safe havens, as trade tensions increase like a soap opera plot. Once revered as the digital darling of the currency world, Bitcoin has slipped from its dazzling year-to-date high of $109,300 to a rather less glamorous $83,000. The fall from grace is real, folks.

Despite its charm, Bitcoin is perceived as a haven primarily due to its exclusive club of 21 million coins. Wall Street’s fervent demand seems to suffer from a bout of temporary amnesia, especially as U.S. bonds are now feeling the pressure of rising yields like an undercooked soufflé. Oh, the agony!

The ten-year yield has ascended to 4.50%, while the 30-year and 2-year yields have joined the party at 4.85% and 3.97%, respectively. It’s a veritable yield fest!

With global risks escalating faster than the plot of a bad thriller, analysts have started to whisper about recession, placing the odds at a suspiciously high 60%. Larry Fink of BlackRock theatrically asserts that the U.S. is already knee-deep in economic muck, while Mark Zandi from Moody’s clearly needs to up his predictions—he’s boosted his odds to match Fink’s, citing steep tariffs like the cherry on a very unsavory cake.

Meanwhile, the economic soothsayers from Morgan Stanley to UBS have chimed in, declaring that U.S. GDP is on a slippery slope downward, with the jobless rate poised to ascend to 5%. Cheers all around!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-04-12 15:31