The matter of allocation, it seems, is never truly settled. One finds oneself presented with choices, ostensibly for the purpose of enrichment, yet each path leads only to a more intricate and ultimately meaningless arrangement. We are here concerned with two such instruments: the iShares MSCI Global Silver and Metals Miners ETF (SLVP) and the VanEck Gold Miners ETF (GDX). Both promise access to the subterranean wealth extracted by unseen hands, but the precise nature of that access, and the attendant obligations, are… nuanced.

The prospect of ‘exposure,’ as it is termed, to metals and mining feels less like investment and more like a bureaucratic necessity. One must participate, it is implied, lest one be deemed outside the system, a silent observer in a world governed by the fluctuating value of inert substances. These ETFs, then, are not solutions, but rather designated channels within a labyrinthine structure. The following attempts to delineate the distinctions, though one suspects the differences are, in the grand scheme, inconsequential.

A Snapshot of Proportions

| Metric | SLVP | GDX |

|---|---|---|

| Issuer | iShares | VanEck |

| Expense Ratio | 0.39% | 0.51% |

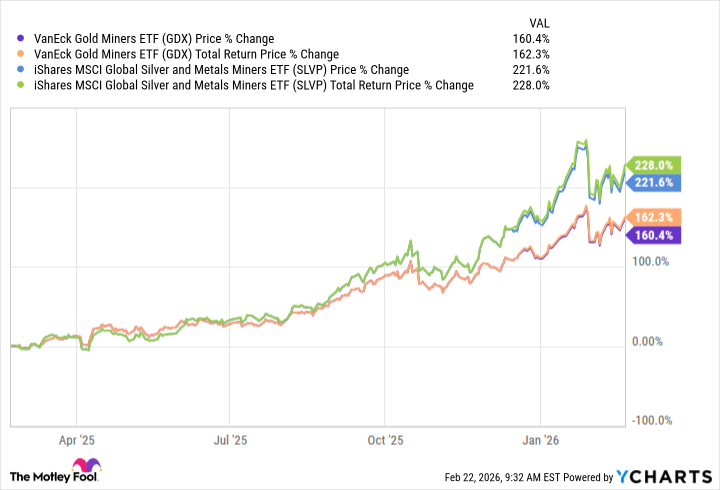

| 1-yr Total Return (as of 2026-02-21) | 228% | 162.3% |

| Dividend Yield | 1.5% | 0.6% |

| Beta | 0.63 | 0.41 |

| AUM (as of 2026-02-20) | $1.3 billion | $33.5 billion |

The ‘Beta’ value, a measure of volatility relative to an arbitrary benchmark, feels like assigning a personality to a stone. The 1-yr return, a fleeting moment in the geological timescale of finance, is presented as if it holds some enduring significance.

SLVP, it is noted, carries a marginally lower expense ratio, a reduction in the inevitable erosion of capital. The dividend yield, a small concession in the form of periodic distributions, is also slightly elevated. These are presented as advantages, but one wonders if they are merely variations in the degree of diminishment. The disparity in Assets Under Management (AUM) is, however, striking. GDX, with its vast holdings, represents a concentrated power, a weight that SLVP, comparatively, does not possess. This difference, one suspects, is not merely a matter of scale, but of influence.

Performance & Risk: A Dance with Uncertainty

| Metric | SLVP | GDX |

|---|---|---|

| Max Drawdown (5 y) | -56.18% | -49.79% |

| Growth of $1,000 over 5 years | $2,718 | $3,246 |

The Contents of the Vault

GDX, one discovers, holds 55 distinct entities engaged in the extraction of gold. Agnico Eagle Mines, Newmont Corp, and Barrick Mining Corp constitute the largest portions of this assemblage. It is a portfolio constructed with deliberate intent, a fortress built upon the foundations of established power. The sheer size – $33.5 billion in assets and nearly two decades of history – suggests an institution beyond reproach, yet one cannot help but feel a sense of unease. Liquidity, it is said, is paramount, but what is the cost of such effortless exchange?

SLVP, in contrast, presents a more concentrated profile. Hecla Mining, Indust Penoles, and Fresnillo Plc dominate its holdings, with a clear emphasis on silver. The smaller size – $1.3 billion in assets and a mere 30 companies – suggests a degree of specialization, a willingness to venture into less-traveled territories. But is this boldness, or simply a lack of resources? The concentration, one suspects, introduces a heightened degree of vulnerability.

For further guidance on this complex subject, a ‘full guide’ is available at a designated link. One imagines this guide will only deepen the confusion, offering more data points without providing any genuine illumination.

The Meaning, If Any

Precious metals, it is observed, have experienced a recent surge in value. Both gold and silver have reached unprecedented heights. The choice between SLVP and GDX, therefore, is not a matter of superior investment, but rather a preference for one form of metallic scarcity over another.

GDX, it is asserted, is the preferable vehicle for investing in gold mining stocks. It offers diversification, liquidity, and the reassurance of scale. Newmont, Agnico Eagle, and Barrick, the world’s largest gold miners, anchor this portfolio. But one must note a curious detail: GDX does not invest exclusively in ‘pure-play’ gold miners. Pan America Silver, a significant silver producer, holds a position within this ostensibly ‘gold’ fund. The lines, it seems, are deliberately blurred.

SLVP, meanwhile, focuses on silver, with exposure to top-tier global mining companies. Hecla Mining, Fresnillo, and Indust Penoles form the core of this portfolio. One might consider allocating funds to both ETFs, achieving a ‘balanced’ exposure to precious metals. SLVP, being cheaper and offering a higher dividend yield, could potentially enhance long-term returns. Or it could simply delay the inevitable erosion of capital. The choice, ultimately, is inconsequential.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 17:52