As a seasoned crypto investor with over a decade of experience navigating the volatile and rapidly evolving digital asset landscape, I find myself both excited and cautiously optimistic about the European Union’s Markets in Crypto-Assets (MiCA) regulation. Having witnessed the rise and fall of numerous cryptocurrencies and projects, I’ve learned that regulatory clarity can be a double-edged sword.

On one hand, MiCA promises to bring much-needed stability and investor protection to the European crypto market by establishing a harmonized framework for all crypto-assets. The potential to conduct business across multiple EU countries through “license passportization” is particularly appealing, as it could make Europe an attractive hub for crypto businesses.

However, as someone who has seen numerous compliance challenges and hurdles in the past, I can’t help but feel a sense of trepidation about the onerous nature of MiCA’s requirements. The stringent anti-money laundering (AML) and counter-terrorism financing (CTF) measures, as well as the exhaustive whitepapers required for issuers of ARTs and EMTs, could potentially stifle innovation and create barriers to entry for smaller players.

I’ve also observed that regulations can sometimes take longer to implement than anticipated, leading to unintended consequences. For instance, Tether’s withdrawal from the European market due to compliance challenges has reduced diversity and may impact liquidity. It remains to be seen how MiCA will affect the broader crypto ecosystem in the long run.

One thing I find particularly intriguing is the debate around Europe’s broader crypto strategy, such as the proposal for a strategic Bitcoin reserve. As someone who’s been through multiple market cycles, I can’t help but chuckle at the idea of governments hoarding digital gold – it’s like trying to catch water in a sieve!

In conclusion, MiCA represents an important step towards regulatory clarity and investor protection for the European crypto market. However, its stringent requirements may create challenges for businesses and innovators alike. As always, the key will be striking the right balance between regulation and innovation – a delicate dance that every jurisdiction must master if it hopes to remain competitive in the global digital economy.

Joke: You know you’ve been in crypto too long when you start dreaming about regulatory clarity…and it feels like a warm, fuzzy blanket!

MiCA (Markets in Crypto-Assets) is a plan designed to create a unified system for digital assets throughout the European Union, focusing on areas like investor safety, market fairness, and financial security.

Reaching this significant point doesn’t just mark a crucial change in how cryptocurrency businesses function within the EU, but it also triggers wider debates about its influence on worldwide crypto acceptance and advancement. As these rules are implemented, industry specialists are discussing the profound impacts they might have on the swiftly transforming digital asset landscape.

MiCA’s Promised Reforms and Market Impact

The MiCA regulation establishes a unified regulatory structure for cryptocurrencies throughout the European Union, encompassing assets that have not been governed by existing financial legislation. A key aspect of this regulation is “license portability,” which allows firms licensed in one EU member state to perform their activities across the union. Marina Markezic, Co-Founder of the European Crypto Initiative (EUCI), underscored the significant impact this could have as countries like Germany, France, and Portugal may emerge as new hubs due to their business-friendly regulatory environments.

As an analyst, I’ve observed that the regulatory landscape is significantly shaping market behaviors. For example, heavyweights like Tether have chosen to exit the European market due to complex compliance issues, thus decreasing market diversity and potentially impacting liquidity. Simultaneously, Bitcoin’s recent surge beyond $100,000 underscores an increasing fascination with digital assets, a trend likely accelerated by MiCA’s entrance, which strengthens consumer protection and combats market abuse.

Opportunities and Obstacles for Businesses

2025 is predicted by OKX Europe General Manager Erald Ghoos as a pivotal year for the crypto market, where the MiCA regulation will bring more stability and security to investors. However, this regulation comes with significant responsibilities: compliance demands will be tough – particularly for smaller entities. Those issuing ARTs (Asset-Referred Tokens) and EMTs (Electronic Money Tokens) must now prepare extensive whitepapers, and face rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) checks. Such requirements can create obstacles for new entrants and even add operational costs to their endeavors.

Critics argue that the stringent conditions set by MiCA might inadvertently stifle innovation. Furthermore, Markezic mentioned that regulators’ ambiguity regarding DeFi and NFTs could lead to friction, and there is a chance of confusion due to varying interpretations of MiCA across the EU’s 27 member states.

The Strategic Shift in Europe’s Crypto Policy

As MiCA gets implemented, discussions about a comprehensive crypto policy for Europe are heating up. European legislator Sarah Knafo recently suggested creating a strategic reserve of Bitcoins, similar to proposals made in the U.S. This idea has generated debate, but Markezic warned that such an action would need thorough examination of Bitcoin’s volatility and strategic relevance before moving forward.

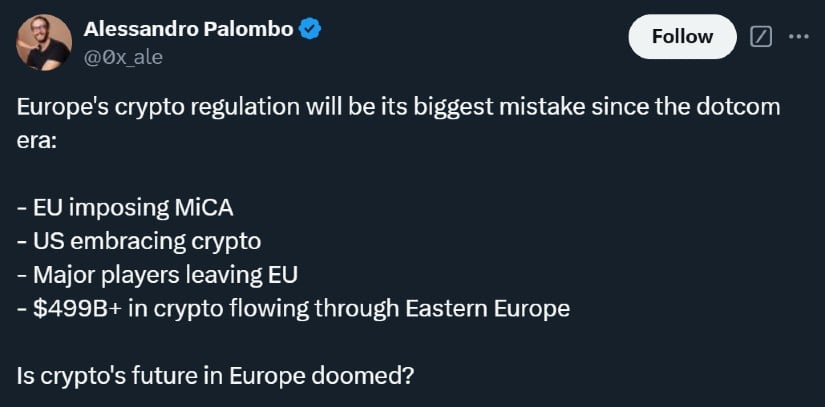

The influence of MiCA (Markets in Crypto-Assets) reaches beyond just market frameworks. It signifies a substantial change in the European Union’s strategy towards digital finance, which could establish a model for the world. Yet, as regulatory advancements unfold in the U.S., particularly a predicted more crypto-friendly policy under the incoming Trump administration, European territories might confront competition when attracting cryptocurrency companies.

The Road Ahead

Under the influence of MiCA, attention will turn towards its practical impacts. Companies will find themselves grappling with intricate regulatory terrains, all while striving for a delicate balance between fostering innovation and managing risks. The trend points towards an increase in formalization and mergers, making collaborations between conventional finance institutions and crypto-centric entities increasingly prevalent.

MiCA signifies a significant stride towards regulatory transparency, yet its rigorous standards underscore the importance of a unified effort between regulators and market participants. As the crypto sector progresses, Europe’s knack for nurturing innovation alongside strong protective measures will shape its influence in the global digital economy.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

2024-12-31 14:06