The stock market, that most mercurial of beasts, has long been a patient companion to those willing to endure its whims. For generations, it has rewarded the steadfast with returns no other asset class dares rival. Yet this year’s 22% Nasdaq surge feels less like a triumph and more like a swan song, its grace tinged with the faint metallic taste of uncertainty.

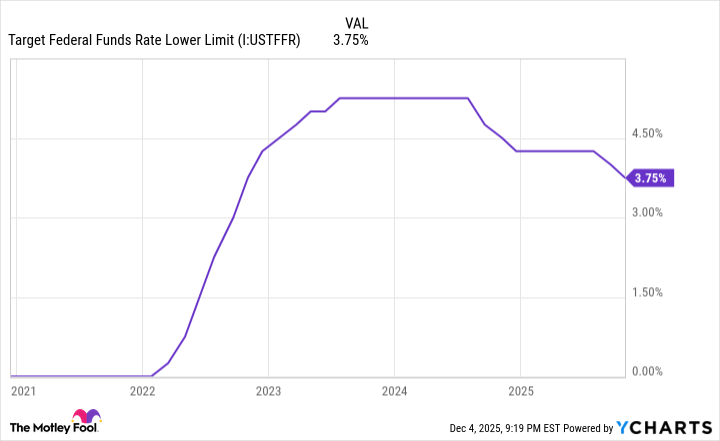

As December’s frost creeps into Wall Street’s bones, the Federal Reserve looms like a character from a Chekhovian drama – a once-reliable protagonist now mired in existential doubt. The central bank’s recent 25-basis-point rate cut, delivered with a rare 10-2 split decision, betrayed fractures deeper than mere policy disagreements. It was a family quarrel made public, the sort where old alliances crumble over inherited heirlooms and unspoken grievances.

The Illusion of Control

Monetary policy, that noble experiment in economic alchemy, seeks to transmute base metals into gold through the sorcery of interest rates. The Fed’s dual mandate – maximum employment and stable prices – sounds so orderly on parchment. Reality, as ever, proves less cooperative.

Consider the October meeting’s dissenters: one advocating deeper cuts, the other insisting rates remain untouched. Their discord echoed through trading floors like a poorly tuned violin. The market, that eternal optimist, had hoped for a symphony of certainty. Instead, it received a dissonant aria warning of storm clouds gathering on the horizon.

President Trump’s public sparring with Jerome Powell adds theatrical flair to this economic production. The Fed chair’s term expires in May 2026, a timeline that now feels less like a countdown and more like a ticking clock. Will the next steward of monetary policy prove a steadier hand, or merely another actor reciting lines from a crumbling script?

Stagflation’s Shadow Play

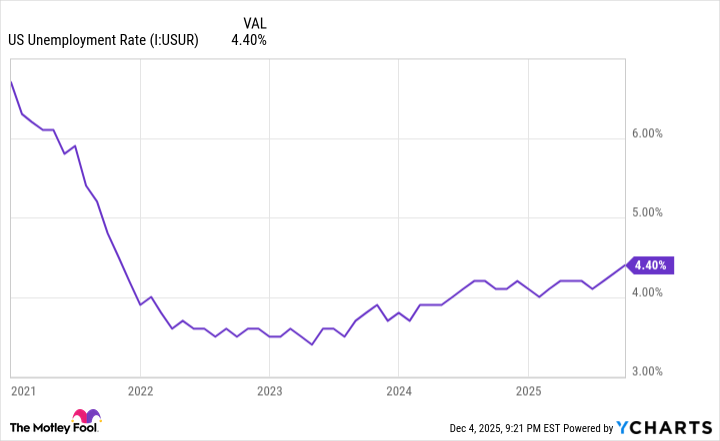

The specter of stagflation haunts economists like an unfinished sonata – familiar yet elusive, its final notes never resolved. Tariffs on imported goods have nudged inflation upward, while job market revisions paint a portrait of slow erosion. The Philadelphia Fed’s 1.9% GDP projection for 2025 whispers of growth, but the decrescendo from 2024’s 2.8% crescendo cannot be ignored.

Imagine a doctor treating fever with ice water, only to discover the patient’s hands have turned blue. Lower rates might soothe unemployment but stoke inflation; tighter policy could cool prices while freezing growth. The Fed’s usual remedies now resemble a physician’s dilemma in an age before antibiotics.

As 2026 approaches, the market watches the central bank like a child observing a magician whose tricks have grown less reliable. The curtain may yet rise on another year of gains, but the orchestra pit hums with dissonance. Perhaps the greatest truth lies not in forecasts or charts, but in the quiet understanding that markets, like Chekhov’s characters, often stumble forward through life’s fog, carrying both hope and regret in equal measure. 📉

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-07 11:12