For generations beyond counting, equities have stood as the solitary titan of wealth creation, its dominion unchallenged by the feeble pretensions of real estate, commodities, or bonds. These lesser vessels may swell the nominal coffers of the fortunate, yet none have matched the relentless arithmetic of stocks’ long-term ascendancy.

Of late, the S&P 500 (^GSPC), the Nasdaq Composite (^IXIC), and the venerable Dow Jones Industrial Average (^DJI) have scaled new summits, their trajectories illuminated by the twin beacons of artificial intelligence and the Federal Reserve’s whispered promises of rate reductions. The market’s celebrants chant of a new era, their voices carrying the weight of algorithms and quantum ambitions.

Yet the markets, like the human condition, are cursed to progress not in straight lines but through jagged suffering. The euphoria surrounding Jerome Powell’s nascent easing cycle masks a truth as old as Babylon: central banks, in their hubris, believe they can calibrate prosperity through interest rate levers, only to unleash deeper dislocations.

The Fed’s Dual Tyranny: Inflation and Growth

Jerome Powell and his council of economic architects labor under a Sisyphean paradox: to inflate without inflating, to grow without stagnating. Their mandate, a contradiction etched into the bedrock of monetary policy, demands both 2% inflationary “stability” and perpetual economic expansion – a feat akin to commanding the tides to rise without wetting the shore.

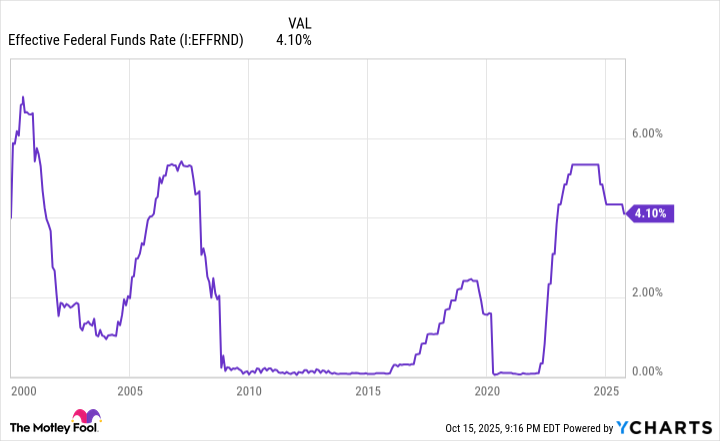

Their instruments are crude: the federal funds rate, a blunt cudgel swung at the hydra of credit; open market operations, where Treasury bonds become both weapon and shield in the endless war against economic reality. When rates ascend, the Fed strangles the lifeblood of enterprise; when they descend, it injects morphine into the veins of a moribund system.

Yet beneath this mechanistic facade lies a deeper pathology: the Fed’s reactive nature. Like a physician diagnosing ailments through postmortem reports, it acts only when the patient is already bleeding out. Rate hikes arrive as the economy thrives, rate cuts descend when the abyss yawns wide. Its interventions, intended as remedies, often become the poison.

Three Cycles, Three Catastrophes

Since the new century’s birth, the Fed has embarked on four rate-cutting crusades. Each previous expedition ended not in salvation, but in financial Golgotha:

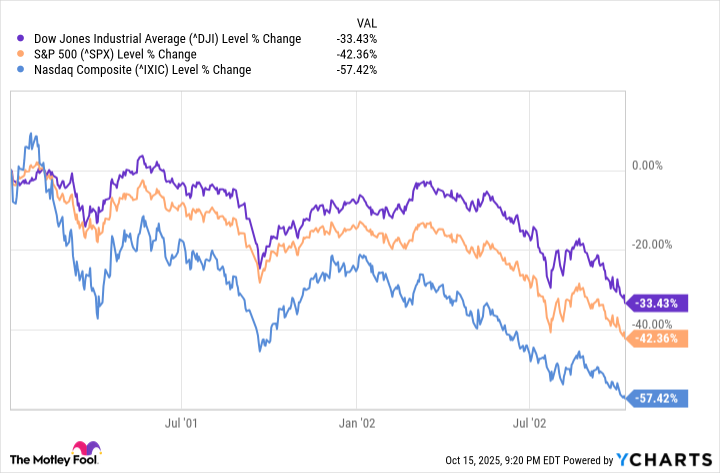

- 2001: As the ashes of the dot-com delusion smoldered, the Fed slashed rates from 6.5% to 1.75%. The S&P 500 plummeted 42%, the Nasdaq Composite collapsed 57%.

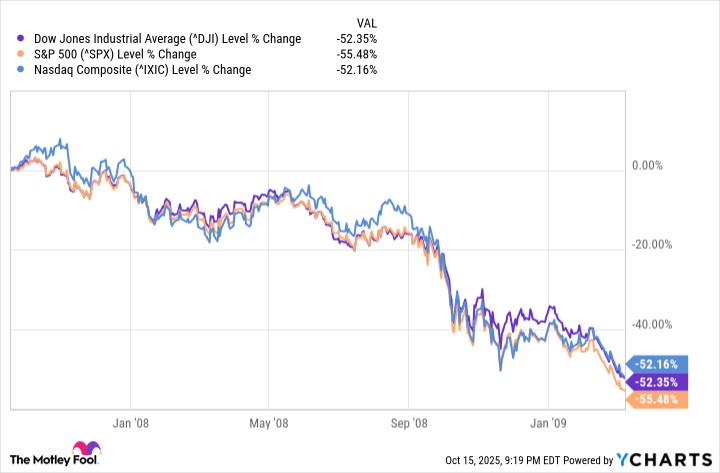

- 2007: Weeks before the housing inferno consumed Wall Street, rates fell from 5.25% to 0-0.25%. The Dow and Nasdaq each surrendered 52%, the S&P 500 55%.

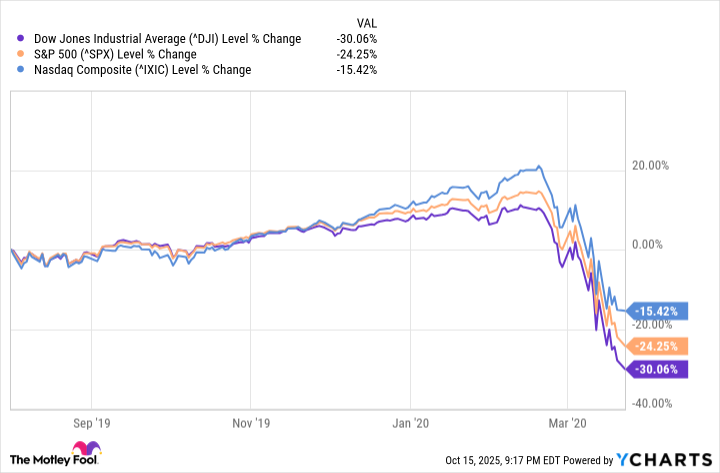

- 2019: Powell’s “mid-cycle adjustment” began at 2.25%. When the pandemic struck, rates hit zero. Stocks bled 15-30% before resurrection.

These are not coincidences but the inevitable harvest of central banking’s fatal conceit. Each easing cycle begins as an ambulance at the bottom of the cliff, only to discover it has become the cliff itself.

The Nonlinear Martyrdom of Capital

Yet within this chronicle of folly lies a paradox: time, that relentless destroyer, becomes the investor’s salvation. Since 1929, S&P 500 bear markets have averaged 286 days; bull markets, 1,011 days. Recessions, those necessary purges, last 10 months on average. Expansions endure five years, their corpses nourishing new growth.

Loading…

–

The market’s path is not a highway but a battlefield, where each crash scatters the weak and strengthens the patient. For those who survive the Fed’s “solutions” – that is, those who understand capital’s eternal struggle against systemic absurdity – the rewards await like a delayed justice.

In this grand theater of economic contradictions, the wealth builder’s creed remains unshaken: endure the storms engineered by those who mistake levers for wisdom, and you shall inherit the earth. 🕰️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-18 10:12