Many years later, as he stood before the altar of Wall Street’s insatiable hunger for novelty, Chamath Palihapitiya would remember that distant afternoon when he first realized the peculiar alchemy of money and myth-an equation where ambition often outweighs arithmetic. The air was thick with the scent of damp newspapers and freshly printed prospectuses, mingling uneasily with the metallic tang of desperation emanating from traders’ sweat-soaked shirtsleeves.

It had been nearly three years since investors last gathered around water coolers to discuss anything other than artificial intelligence (AI), which had come to dominate their conversations like an omnipresent deity demanding constant sacrifice. But now, amidst the cacophony of clinking coffee cups and murmured stock tickers, a new name rose above the din: American Exceptionalism Acquisition Corp., a SPAC born not merely of strategy but of something closer to prophecy-or perhaps hubris.

Palihapitiya, once crowned the “SPAC King,” returned to this arena bearing both scars and laurels. His earlier ventures into blank-check companies had sparked frenzies akin to gold rushes, only to leave many retail investors holding bags heavier with regret than riches. Yet here he was again, undeterred by history or skepticism, launching yet another vessel into the turbulent seas of speculative finance.

In the small hours of dawn, when even the most ardent day traders slept fitfully beneath the weight of their margin calls, one might almost believe that these SPACs were conjured rather than constructed-phantom entities summoned by incantations whispered in boardrooms far removed from ordinary lives. And yet they existed, tangible enough to trade on exchanges, intangible enough to defy conventional valuation methods.

A Man Who Walked Between Worlds

Chamath Palihapitiya began his career not as a king but as a humble acolyte, navigating the labyrinthine corridors of AOL and Facebook-Meta Platforms, as it is called today-with the quiet determination of a man who knows destiny favors those who wait. Beyond these corporate walls, however, lay a world more mysterious and alluring: the realm of venture capital, where fortunes were made not through labor but through foresight.

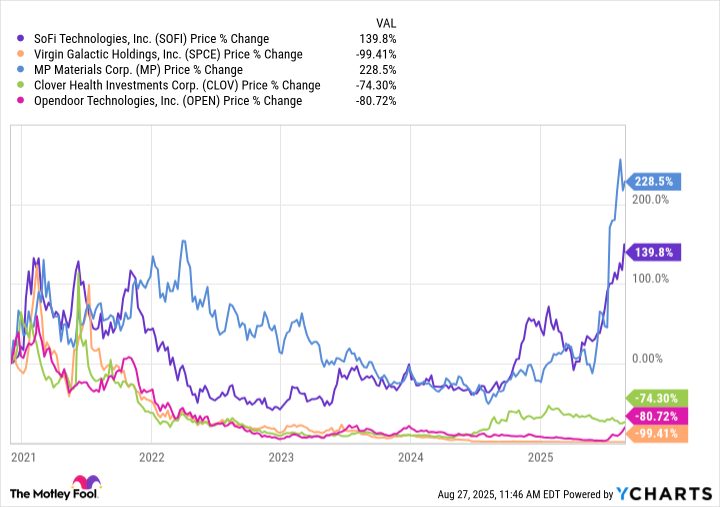

He founded Social Capital, a firm whose very name seemed to promise access to secrets hidden within society’s veins. When the SPAC boom erupted between 2020 and 2021, Palihapitiya emerged as its bard, spinning tales of unicorns and moonshots while others scrambled to keep pace. Deals bearing his imprimatur included SoFi Technologies, Virgin Galactic, MP Materials, Clover Health, and Opendoor Technologies-names that shimmered like mirages on the horizon of possibility.

But if admirers saw him as a rebel challenging Wall Street’s ossified traditions, critics found ample evidence of recklessness. For every success story, there loomed failures-companies swallowed whole by the maw of delisting or bankruptcy. Like the mythical Icarus, Palihapitiya soared perilously close to the sun, only to find wax melting beneath his wings.

The Enigma of Blank-Check Companies

To understand SPACs-one must imagine them less as financial instruments and more as vessels adrift on an ocean of dreams. These shell entities raise funds from eager investors, pooling capital in search of a private company yearning to go public without enduring the grueling rites of a traditional IPO. It is a process steeped in symbolism: a merger transforms obscurity into visibility, much as a caterpillar becomes a butterfly-or so the narrative goes.

Whereas an IPO resembles a meticulously choreographed ballet involving investment banks, roadshows, and valuation debates, a SPAC offers simplicity wrapped in enigma. Already listed on exchanges, SPACs allow target companies to bypass bureaucratic entanglements, emerging suddenly onto the stage fully formed, like Athena springing forth from Zeus’s skull.

Are SPACs Worthy Investments?

Asking whether a SPAC is a good investment is akin to asking whether love can conquer death-it depends entirely upon whom you ask and what they have wagered. Palihapitiya’s own track record reads like a cautionary fable: some SPACs soared gloriously; others plummeted ignominiously. Taken together, they form a mosaic of risk and reward painted in hues both vivid and somber.

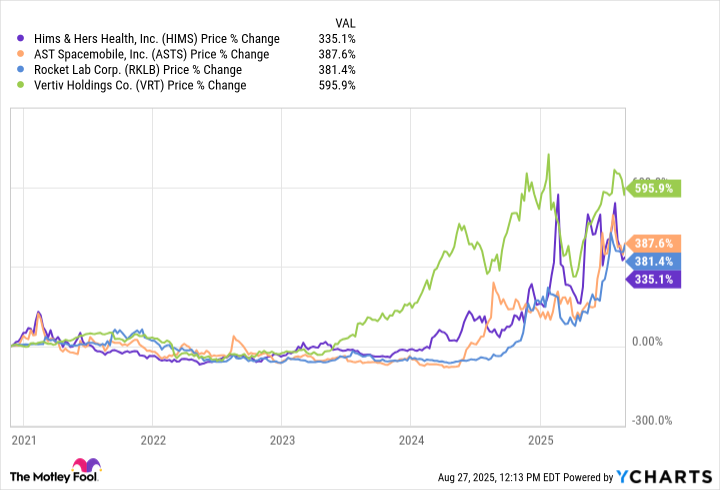

Consider Hims & Hers Health, whose audacious leap into the weight-loss market positioned it against pharmaceutical titans Eli Lilly and Novo Nordisk. Or AST Spacemobile and Rocket Lab, whose cosmic ambitions captivated imaginations starved for wonder. Vertiv, meanwhile, rode the crest of the AI wave, its liquid cooling systems essential to data centers humming with digital life.

Yet such triumphs are rare birds in a forest teeming with carrion crows. A study from the University of Florida revealed that SPAC stocks delivered median returns of negative 58% one year post-merger between 2012 and 2022. Across industries, SPAC performance lagged woefully behind broader markets-a testament to the perils of chasing illusions.

Thus, American Exceptionalism Acquisition Corp. arrives draped in grandeur but weighted with doubt. For value investors, it represents not opportunity but speculation-a gamble cloaked in patriotic rhetoric. History whispers warnings, urging prudence over passion.

And so we return to Palihapitiya, standing at the crossroads of fate and folly, his eyes fixed on horizons unknown. Whether his latest creation will ascend to glory or crumble under its own weight remains unwritten-a tale still unfolding, like ink spilled across parchment awaiting the author’s final flourish 🌟.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-08-30 01:09