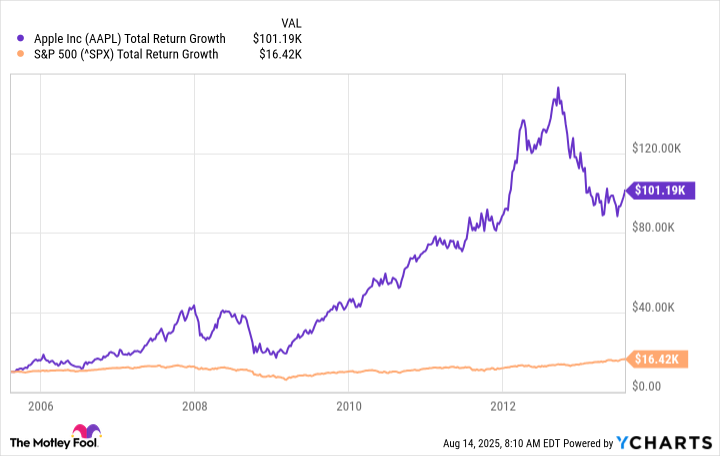

Apple stock, ladies and gents, is the stuff of legends-a veritable gold mine in the market’s underbrush. If you’d tossed a mere $10,000 into the pot two decades ago, you’d be sittin’ pretty today, with far more green in your pockets than you’d get from the ol’ S&P 500. And the farther back you look, the more you’ll see Apple outpacing its competition like a thoroughbred galloping ahead of a pack of turtles.

Sure, the last five years haven’t been the windfall folks were expecting, and this year’s been a downright dreary affair for the company’s stock. But let me tell you-Apple has been through rough patches before, where its stock took a dive faster than a squirrel in a hailstorm. It’s rebounded before, and I wouldn’t bet my boots it won’t again.

Take, for instance, 2007-right before the mortgage mess. Apple hit its peak, but it didn’t see that same level again until 2009. Such is the way with this company; it can lay low for a spell before rising from the ashes like a phoenix in a tuxedo. So, let’s chew the fat about where Apple might end up in five years, shall we?

Tariffs, iPhones, and AI: The Three Horsemen

Well now, if you’re asking what’s keeping Apple’s stock from soaring into the heavens, it’s a trifecta of trouble. Tariffs, the good old iPhone business, and that fancy newfangled AI are all pulling the company in different directions.

Tariffs, the Old Bane of Trade

Folks have been gnashing their teeth, wondering how these tariffs will hit Apple, seeing as how they’ve built their empire on cheap labor from China. Sure, they’ve spread their wings to India some, but don’t let that fool ya-the tariff wolves have followed right along, snapping at their heels. Apple’s answer to this mess? A whopping $600 billion investment in U.S. manufacturing. Now, whether that’s the smartest move, well, only time will tell, but it’s about as bold as a fox in a henhouse.

In five years, I suspect we’ll look back on this tariff scuffle as nothing more than a mild inconvenience. However, mark my words-shifting operations to the U.S. could lead to some unforeseen consequences. More domestic workers mean higher wages, and the tariffs might dip a little, but that doesn’t mean the cost of doing business will be any cheaper.

The iPhone Conundrum

Now, here’s the real kicker: iPhones. Apple’s bread and butter, its cash cow, and yet, one device makes up nearly half of its total sales. But in a world that’s changing faster than a river current after a storm, iPhones could become yesterday’s news. Innovation, that old bugaboo, is coming for Apple’s throne, and it won’t be kind. AI is shaking up the tech scene, and while Apple’s still got that loyal following (who wouldn’t want to be seen with an Apple in their pocket?), other companies might find a way to knock the iPhone off its pedestal.

Don’t get me wrong-iPhones aren’t going anywhere in the next five years. But if Apple doesn’t reinvent itself, it might be left chasing shadows, trying to keep its customers hooked on new versions of the same old thing.

The AI Dilemma

Now, if there’s one thing keeping Tim Cook up at night, it’s artificial intelligence. Sure, he gave a big ol’ pep talk about Apple’s progress in AI during the fiscal third-quarter earnings call (it was a fine speech, full of optimism and gusto), but let’s face it-investors aren’t exactly chomping at the bit. Apple’s lagging behind the competition, and the future ain’t looking as bright as it once did.

But Tim Cook’s not a man to back down easily. As he says, “In everything we do, we’re driven by transformative innovation,” which is a fancy way of saying they’ll keep at it, no matter the cost. And though some folks think Apple’s been a bit slow to the AI game, I reckon they’re not looking at the big picture. Apple’s not about to change its stripes like Amazon, which’s out there trying to be everything to everyone. No sir, Apple’s got its own way of doing things, and by gum, that’s what makes it stand out.

The Road Ahead: A Brighter Horizon? Maybe.

Now, let’s not get too carried away here. Apple, at this point, is the third-largest company in the world by market cap. And let’s be honest, can it keep up this blistering pace forever? At some point, the well runs dry, and the gains get smaller and smaller. Still, I wouldn’t count Apple out. The company’s still got value, and with a little luck, it’ll keep growing, though the days of astronomical returns might be behind us.

Let’s say Apple can manage to eke out an 8% compound annual growth rate over the next five years. If that’s the case-and I’m being generous here, considering their recent performance-we’re looking at about a 47% increase in revenue and stock price. Now, if they cook up a new product or make some headway in AI, well, who knows? That number might be a little higher.

All in all, I expect Apple to bounce back from its recent slump. But don’t expect it to return to the breakneck growth rates of its earlier years. The future’s looking more steady and less like a rollercoaster ride, but hey, steady wins the race… most of the time.

💰

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-17 01:53