Author: Denis Avetisyan

A new framework models financial markets not as static systems, but as dynamic ecosystems where diverse strategies compete and adapt, offering insights into systemic risk and policy effectiveness.

FinEvo uses ecological game theory and agent-based modeling to explore the evolutionary dynamics of heterogeneous financial agents.

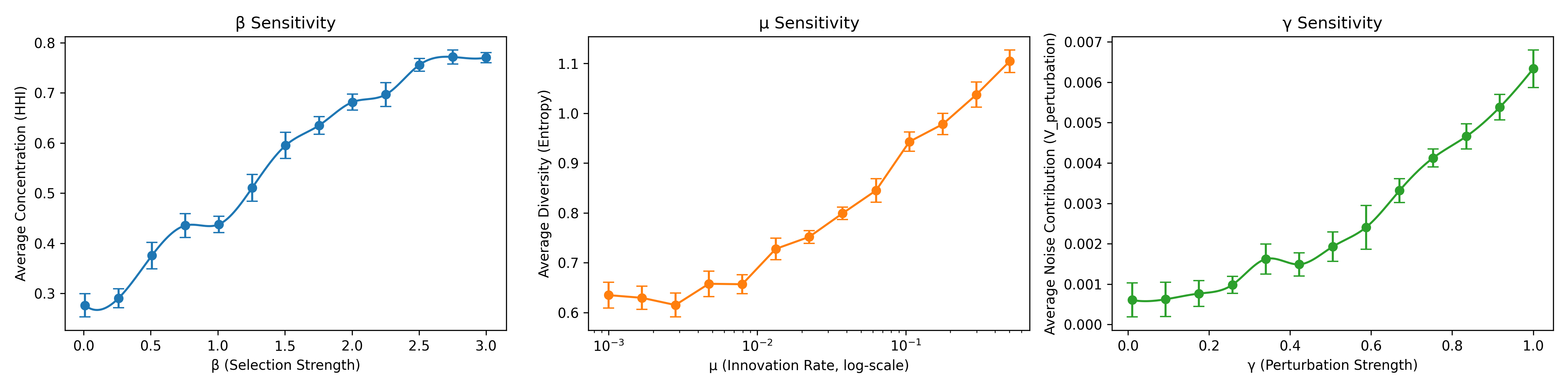

Conventional financial strategy evaluation struggles to capture the dynamic interplay of agents within evolving markets. Addressing this, we present ‘FinEvo: From Isolated Backtests to Ecological Market Games for Multi-Agent Financial Strategy Evolution’, a novel framework modeling financial ecosystems where heterogeneous, machine learning-driven agents adapt and compete. This approach reveals emergent dynamics-coalitions, collapses, and context-dependent outcomes-invisible to static backtests, driven by mechanisms of selection, innovation, and environmental perturbation. Could this ecological game formalism offer a principled means to explore the impact of macroeconomic policies and systemic risk on price evolution and market equilibrium?

The Market as a Living System

Conventional financial models frequently operate under the constraint of static assumptions – treating market participants as homogenous entities with fixed behaviors and relationships. This simplification neglects the crucial reality of dynamic interplay, where agents constantly adapt, learn, and evolve in response to each other and changing conditions. These models often struggle to anticipate emergent phenomena – unpredictable shifts and systemic risks – because they fail to account for the feedback loops, network effects, and competitive pressures that characterize real-world financial landscapes. The inherent limitations of these static approaches become particularly apparent during periods of heightened volatility or crisis, where the interconnectedness and adaptive behaviors of market participants drive outcomes that are poorly predicted by traditional methods. Consequently, a more nuanced understanding of financial markets requires acknowledging the dynamic, evolving nature of the interactions between its constituent agents.

FinEvo departs from conventional financial modeling by conceptualizing markets not as equilibrium-seeking systems, but as dynamic ecosystems mirroring biological evolution. This approach draws parallels between the interactions of financial actors and the competitive pressures shaping species within an ecosystem – where strategies adapt, proliferate, or fail based on their ‘fitness’ in the prevailing environment. By applying principles like mutation, selection, and speciation to agent-based models, FinEvo simulates the emergence of systemic risk not as a sudden shock, but as a gradual consequence of evolving market structures. This innovative framework allows researchers to explore how seemingly rational individual behaviors can collectively generate complex, and potentially unstable, system-wide effects, offering a foundational step toward more robust and realistic risk assessment.

The Engine of Market Behavior: Heterogeneity Unleashed

FinEvo simulates market dynamics through the interaction of a population of ‘Heterogeneous Agents’. These agents are not modeled as a uniform entity, but rather as individual units each possessing unique trading strategies and access to differing information sets. This heterogeneity is a core design principle, allowing for the representation of varied market participant behaviors – from simple rule-following to complex, information-driven decision-making. The diverse range of agents contributes to emergent market behaviors that are difficult to predict using models based on rational actors with complete information, and provides a platform for studying how varying agent characteristics impact overall market stability and efficiency.

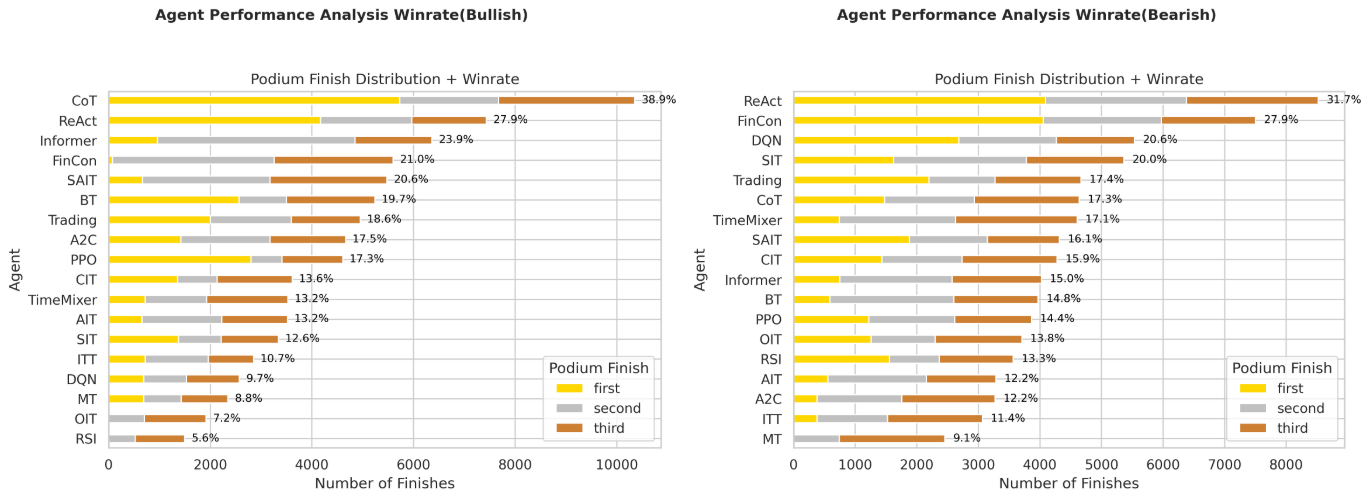

The FinEvo simulation incorporates multiple agent types to model market participation. Rule-Based Agents execute predefined technical analysis strategies, reacting to price and volume indicators. Informed Traders possess privileged, non-public information that influences their trading decisions, creating informational asymmetry within the market. Deep Learning Agents employ neural networks to identify complex patterns in historical data and predict future price movements, allowing for more sophisticated, data-driven trading behavior. These agent types, operating concurrently, contribute to the emergent complexity observed in the simulated market dynamics.

The integration of Reinforcement Learning (RL) Agents and Large Language Model (LLM)-Based Agents into the FinEvo simulation environment introduces a capacity for dynamic behavioral adaptation. RL agents learn optimal trading strategies through trial and error, maximizing rewards based on market conditions, while LLM-Based Agents leverage natural language processing to interpret news, sentiment, and other textual data, translating these insights into trading decisions. This combination allows agents to move beyond pre-programmed rules, evolving their strategies over time in response to changing market dynamics and potentially identifying novel patterns not captured by traditional technical or fundamental analysis. The adaptive nature of these agents contributes to more realistic and complex market behavior within the simulation.

From Theory to Simulation: The FinEvo Framework

The FinEvo framework utilizes the ‘FinEvo SDE’ – a stochastic differential equation – to model population dynamics of agents within a financial market. This equation describes the continuous change in the number of agents employing a particular strategy, driven by both deterministic factors representing strategy profitability and stochastic noise reflecting inherent market uncertainty. Formally, the FinEvo SDE can be represented as dX_i(t) = \mu_i(t)X_i(t)dt + \sigma_i(t)X_i(t)dW(t) , where X_i(t) represents the population of agents using strategy i at time t, \mu_i(t) is the drift term representing the rate of population change due to strategy performance, \sigma_i(t) is the diffusion term accounting for random fluctuations, and dW(t) is a Wiener process representing Brownian motion. The SDE’s continuous-time nature allows for precise modeling of agent population evolution, providing a foundation for understanding complex market behaviors.

The continuous-time \text{FinEvo SDE} is not directly solvable for practical market simulations; therefore, a discrete-time approximation is employed. This discretization process involves dividing the continuous time horizon into a series of discrete time steps, \Delta t, and approximating the solution of the SDE at each time step using numerical methods such as Euler-Maruyama or Milstein schemes. This allows the evolution of agent populations to be modeled as a series of iterative updates, significantly reducing computational demands compared to attempting a continuous solution. The size of the time step, \Delta t, represents a trade-off between accuracy and computational efficiency; smaller values increase accuracy but also increase the number of iterations required, while larger values reduce computational cost but may introduce greater discretization error.

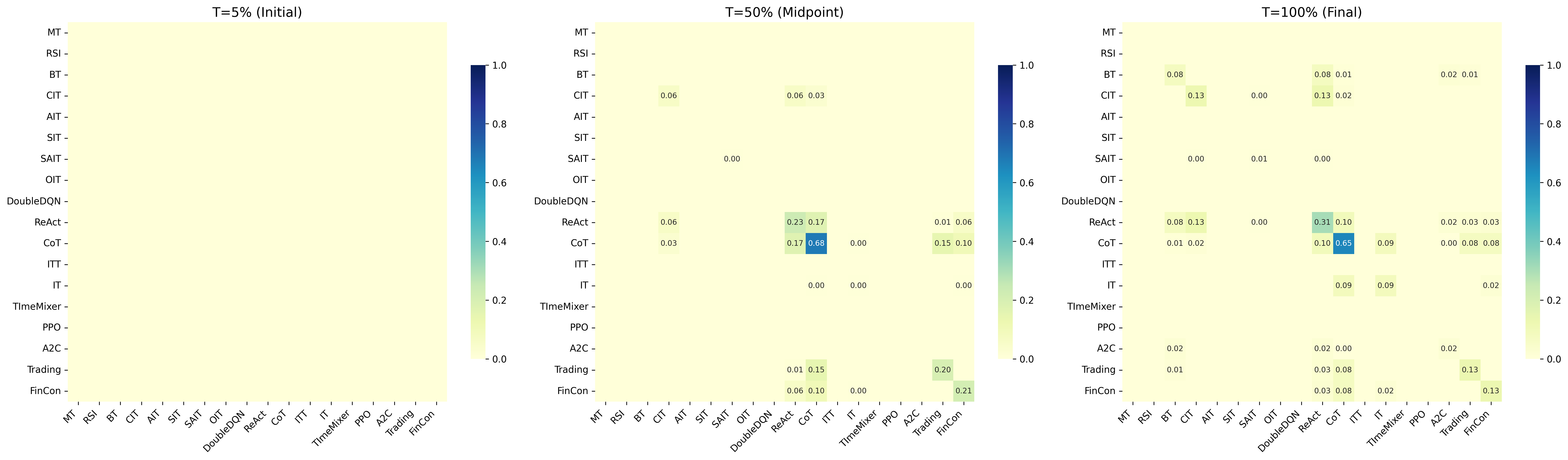

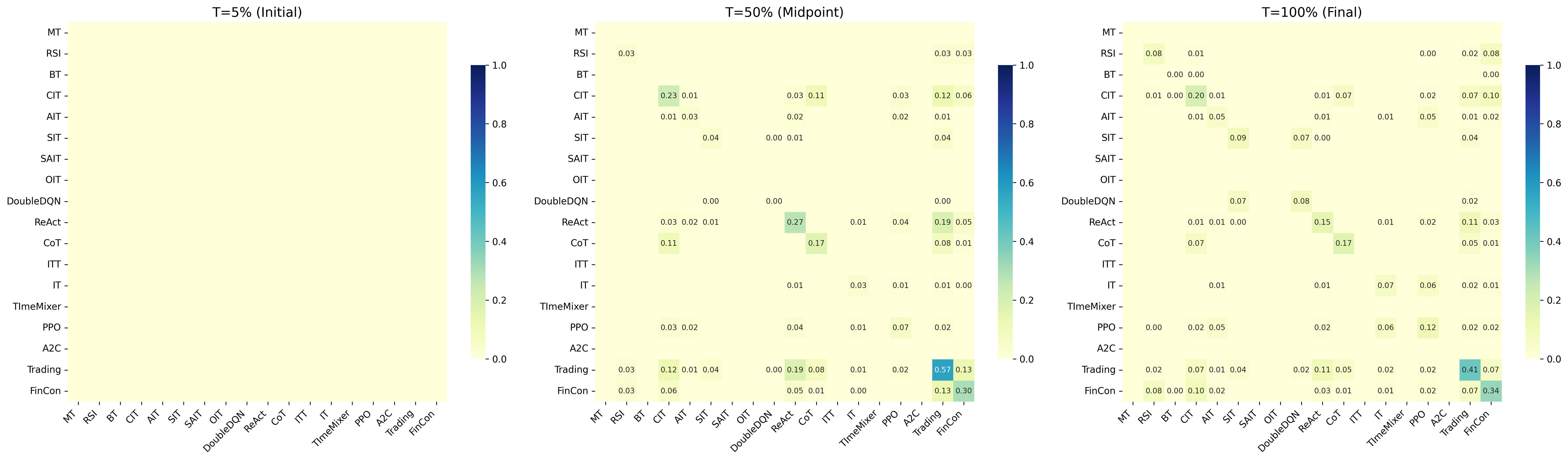

The FinEvo framework allows for the observation of evolutionary dynamics by modeling the lifecycle of trading strategies within a simulated market. Strategies are subject to selection pressures based on their performance; more profitable strategies increase in population size, while less profitable strategies decline. This process mimics natural selection, allowing researchers to quantify adaptation rates, competitive interactions, and long-term survival probabilities of different algorithmic approaches. Analysis of these dynamics reveals emergent patterns of market behavior and provides insights into the factors driving the evolution of successful trading strategies, ultimately informing the development of more robust and adaptive algorithms. The framework tracks population changes and performance metrics over time, offering a quantitative basis for understanding how strategies evolve in response to changing market conditions.

The Ripple Effect: Emergent Dynamics and Systemic Resilience

Within the FinEvo simulations, complex market behaviors arise not from explicit programming, but from the interactions of individual agents. These ‘emergent dynamics’ consistently reveal a tendency towards concentration of market share, where a small number of entities accumulate a disproportionate level of control. Simultaneously, the framework also models a diversification of strategies, as agents explore various approaches to compete and survive. Critically, this interplay doesn’t necessarily guarantee stability; the simulations frequently demonstrate the potential for systemic risk, where localized failures can cascade through the network, impacting the entire system – a phenomenon directly linked to the interconnectedness of agents and the feedback loops inherent in the model.

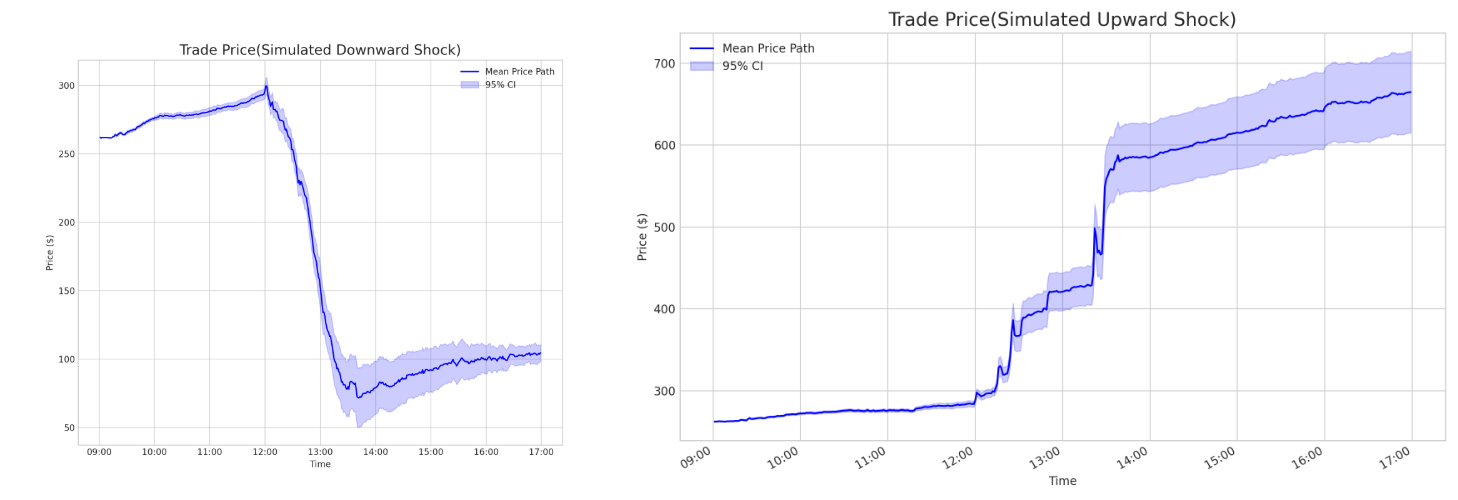

FinEvo, the computational framework detailed in this study, consistently demonstrates a remarkable capacity to maintain stable dynamics even when subjected to significant alterations in its underlying parameters and prevailing market conditions. Researchers found that variations in agent behaviors – such as investment strategies, risk aversion, or information processing – did not lead to catastrophic system failures. This robustness stems from the inherent redundancy and adaptive capabilities built into the model’s agent-based structure, allowing the system to absorb shocks and reorganize without collapsing. The observed resilience suggests that complex financial systems may possess an intrinsic capacity for self-correction, though the limits of this capacity remain an important area for further investigation, and understanding these limits is crucial for effective regulatory design.

FinEvo establishes a robust analytical environment for dissecting systemic risk and evaluating prospective policy interventions within complex economic systems. This computational framework moves beyond traditional modeling approaches by simulating the interactions of numerous heterogeneous agents, allowing researchers to observe emergent patterns and assess the cascading effects of shocks. The platform’s capacity to model diverse agent behaviors and market structures facilitates a nuanced understanding of how interventions – such as altered capital requirements or trading regulations – propagate through the system and ultimately impact overall stability. By offering a controlled environment for ‘what-if’ analyses, FinEvo empowers investigators to proactively identify vulnerabilities and design more effective policies aimed at bolstering market resilience, as evidenced by the novel methodological approach detailed within this work.

Beyond the Horizon: Charting the Future of FinEvo

Future iterations of FinEvo simulations are poised to benefit significantly from the incorporation of high-frequency data, promising a substantially more granular and accurate portrayal of market dynamics. Currently, models often rely on daily or even weekly data, smoothing over critical intraday fluctuations that can reveal crucial information about investor behavior and market microstructure. By leveraging the wealth of information contained within tick-by-tick data – encompassing every trade, quote, and order book event – researchers aim to capture the fleeting patterns and rapid adjustments that drive short-term price movements. This increased fidelity will not only refine the model’s predictive power, but also allow for a more detailed examination of phenomena like flash crashes, order book dynamics, and the impact of algorithmic trading strategies, ultimately leading to a deeper understanding of financial market evolution.

Future iterations of FinEvo will increasingly prioritize the modeling of network effects, acknowledging that financial markets aren’t simply collections of independent actors. These effects arise from the interconnectedness of agents – how the decisions of one participant directly influence others, creating feedback loops and cascading consequences. The framework will simulate these interactions, examining how information diffusion, herding behavior, and systemic risk emerge from agent-to-agent connections. By representing these complex relationships, FinEvo aims to move beyond equilibrium-based models and provide a more realistic depiction of market dynamics, where collective behavior often overrides individual rationality and small initial shocks can propagate into large-scale events. This expanded capability will be crucial for understanding phenomena like asset bubbles, flash crashes, and the spread of financial contagion.

The culmination of these advancements positions FinEvo not merely as a simulation tool, but as a foundational framework for a new generation of financial modeling. By moving beyond traditional, often static, approaches, FinEvo offers a dynamic and evolving landscape for understanding market complexities. This capability allows researchers and analysts to explore a wider range of scenarios and predict potential market behaviors with increased precision. The framework’s adaptability ensures its relevance as financial markets continue to evolve, promising deeper insights into the forces that drive economic activity and ultimately solidifying its role as a leading platform for both academic research and practical application in the financial sector.

The pursuit of predictive accuracy in financial modeling feels increasingly like trying to chart a hurricane’s path with only tea leaves. FinEvo, with its emphasis on agent-based modeling and evolutionary dynamics, acknowledges this inherent chaos. It doesn’t promise to predict the market, but rather to simulate its unfolding, accepting that the systemic risk isn’t a fixed point but a shifting landscape. As Richard Feynman once observed, “The first principle is that you must not fool yourself – and you are the easiest person to fool.” This framework, then, isn’t about building perfect forecasts, but about honestly portraying the complex interplay of heterogeneous agents – a truce between the bug and Excel, if there ever was one. Everything unnormalized is still alive, and FinEvo embraces that vibrant, unpredictable reality.

What Lies Ahead?

The FinEvo framework, in its attempt to conjure a market from the primordial soup of agents, reveals less about prediction and more about the limits of control. It’s a beautifully complex system, but complexity isn’t understanding-it’s just a more elaborate way to be wrong. The real challenge isn’t calibrating the FinEvo stochastic differential equation, but acknowledging that any such calibration is merely a temporary truce with chaos. Metrics offer a fleeting comfort, a self-soothing ritual in the face of inevitable divergence between model and reality.

Future work, predictably, will focus on scaling-more agents, more strategies, more dimensions of heterogeneity. But the true frontier lies in accepting the inherent unknowability. Can FinEvo be used not to predict systemic risk, but to diagnose vulnerabilities-to identify the fault lines before the earthquake? Perhaps the goal shouldn’t be to build a perfect simulation, but a sensitive early warning system-a seismograph for the markets.

Ultimately, this isn’t about discovering laws of finance-it’s about crafting a mythology. Every model is a spell, and FinEvo is a particularly ambitious one. Its success won’t be measured by accuracy, but by its staying power-how long it can persuade the market to behave, before the whispers of chaos overwhelm the incantation.

Original article: https://arxiv.org/pdf/2602.00948.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 10:49