On that fateful day, the 27th of August, the swollen eyes of investors were fixed upon Nvidia, a corporate behemoth basking in the garish limelight of semiconductor prowess. Yet, as their eager anticipation turned to ennui, the figures unveiled by the chip designer, though paltry roses amidst the weeds of expectation, failed to ignite the hearts of those who gamble their fortunes on the ferns of the stock market.

Despite sailing breezily past the criteria scribbled in Wall Street’s ledger, Nvidia found its fortune pegged down, like a feeble butterfly trapped in a jar, by the heavy shackles of anxieties regarding its commerce in the vast, inscrutable expanse of China. Thus, as the morning sun rose on the following day, shares hardly budged, residing in stasis like a statue of a bureaucrat, far removed from the tomb of excitement. Yet lo and behold! Another phantom, darting under the guise of artificial intelligence (AI), erupted forth into the limelight on the self-same day, its stock ascending in the air like a stray balloon released into the sky. A year had passed since this stock took flight, and it now cast a long shadow over Nvidia’s once-charming ascendancy.

Come forth, dear readers! Allow us a moment to dive into this intriguing apparition and ponder why it possesses wings strong enough to ascend even higher.

The Ascendant Specter: Snowflake and the Deceit of Demand

Snowflake (SNOW), alas, does not reside in the frozen tundra of obscurity but operates a cloud-based marvel where data finds its sanctuary, surrendering itself to the sacred rituals of analysis under the watchful eyes of dedicated patrons. Here lies a platform where menfolk securely cradle their delicate information, even as they whisper amongst the clouds of Amazon Web Services, Microsoft Azure, and Google Cloud, each vying for a piece of the ephemeral pie.

With an understanding as profound as an ancient sage, Snowflake has been equipping its patrons with AI tools, enhancing their capabilities and ensuring they bask in the glory of their data’s potential. This strategy, mind you, has not only borne fruit but has produced an overwhelming bouquet, as they recently revealed their fiscal 2026 second-quarter accomplishments (culminating on that fateful day, July 31).

Revenue surged like a tempest, ascending 32% year over year to an impressive $1.1 billion, an almost laughable acceleration from previous periods, as if a jester had enchanted the numbers only to see them dance fabulously before the market’s bewildered eyes. The meteoric adoption of Snowflake’s AI solutions lies at the heart of this splendid growth. A staggering 19% leap in their customer base since a year prior, over half of whom were enchanted enough to be utilizing Snowflake’s mystical AI wares.

Behold! For the company’s platform serves as an Aladdin’s lamp, allowing acolytes to create AI agents that analyze scrolls of documents, deploy fiendish models, and converse with the large language models (LLMs)-those arcane contrivances they deem relevant. As the company’s chief scribe, Sridhar Ramaswamy, stated with fervor, “Today, AI is a core reason why customers are choosing Snowflake,” as if one were to proclaim the importance of bread in a banquet.

Yet, even amid this growth, satisfaction breeds a strange ailment. AI birthed not only new customers but a tempest of spending from those already ensnared in Snowflake’s web, evident in their astonishing net revenue retention rate of 125%. A number exceeding 100% whispers the sweet tales of expansion and more spending unfurling like dreadful petals in bloom.

As new patrons flock to their gates and existing ones splurge extravagantly, Snowflake’s adjusted earnings, almost doubling from last year’s numbers, sit perched at $0.35 per share, like a chubby merchant on a stool, counting gold. This auspicious company, holding within its grasp a robust revenue pipeline, gazes into the horizon where its addressable market beckons like a siren, promising even brighter tomorrows.

A Race Towards Dominance: Snowflake’s Unraveling Success

The shares of Snowflake, one might note, have soared with remarkable audacity, clocking in an eye-watering 108% increase over the past year, while Nvidia, lagging behind wallowing in its meager 40% gains, seems like a drowsy feline at the foot of the throne-the very essence of mediocrity!

Looking into a crystal ball, Snowflake reveals opportunities yet untapped-sizable remnants of revenue unfurling with a 33% leap in remaining performance obligations, amassing to a princely sum of $6.9 billion. And behold, amidst such splendor, the company has raised its expectations for the fiscal 2026 product revenue forecast to $4.4 billion, stimulating visions of a magic carpet ride through bountiful fields.

Should the winds of fortune align favorably, further upward revisions may dance upon the horizon, as AI continues to proliferate like so many spring daffodils, promising a total addressable market (TAM) to surpass a jaw-dropping $355 billion by the year 2029. Such towering aspirations hint that years of extraordinary growth lie ahead.

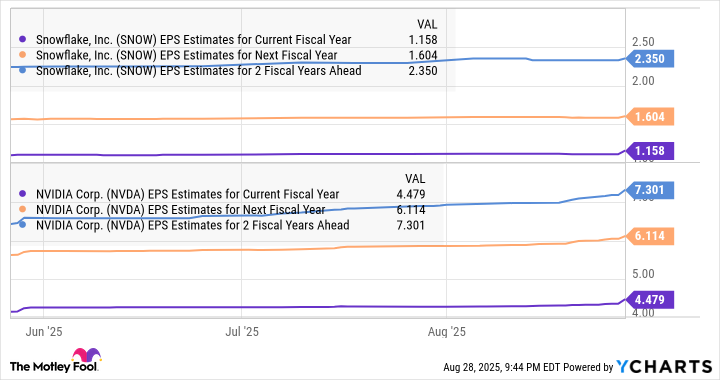

One must not ignore that Snowflake’s progress competes sharply against Nvidia’s incremental ascent, the latter demonstrating a rather modest 54% year-over-year earnings rise. Analysts, ever the optimistic merchants, foresee Snowflake continuing to eclipse Nvidia’s growth trajectory like an artist effortlessly outshining a dull copyist.

In conclusion, dear investors, do not be alarmed if Snowflake, that cheeky sprite of the stock realm, continues to enchant with its whimsical profits in the years to come. And should you find its stock, with a charmingly modest price-to-sales ratio of 19 compared to Nvidia’s inflated 30, a suitable offering for your collection, take heed! Such opportunities rarely dance on the cobblestone street twice. 🕵️♂️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-01 04:22