On a day when the indexes dipped, a peculiar sense of déjà vu seemed to hang in the air-like the tired refrain of an opera that never truly ends. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq have been soaring, fueled by an unyielding belief that companies will somehow dodge the bullets fired by President Donald Trump’s tariff escapades. And not just dodge them-oh no-these companies are poised to prosper. Somewhere in the distance, artificial intelligence (AI) looms large like some omnipotent deity waiting to deliver riches. The AI giant Nvidia predicts a future where AI infrastructure spending could touch a staggering $4 trillion by decade’s end. If this prophetic vision holds, a great many investors, whether deserving or not, might find themselves basking in fortune’s glow.

Indeed, the market has been so buoyant of late that even the S&P 500 has set record after record, marching steadily towards its third consecutive annual gain. And here, amidst this fervent optimism, stands Warren Buffett-the very embodiment of market wisdom, or so they say. The head of Berkshire Hathaway has, over nearly six decades, navigated the financial landscape with such dexterity that his performance in bull markets, bear markets, and catastrophic crashes has become the stuff of legend. Yet, now, as the indexes surge, the question hangs in the air like an unspoken curse: Is the Oracle of Omaha, a man whose very name carries the weight of hundreds of billions, casting a gaze upon a future that the rest of us are blind to?

Buffett’s Strategy: A Journey Through Time and Fortune

To understand the movements of this enigmatic investor, one must first delve into the intricate workings of his mind-his methods, his obsessions. Buffett has not built his empire through the fickle, erratic dance of day-trading, nor by riding the feverish highs of emerging technologies that swell with the promise of explosive growth, only to plummet just as quickly. No, his path has been steadier, though no less treacherous. He invests in industries he understands-financials, consumer goods, and energy-holding them close like prized artifacts of a long-forgotten era. With a patient hand, he waits for the right moment to scoop up undervalued gems, those enterprises hidden from the gaze of the average investor, awaiting the day when the world will finally recognize their worth.

And what of dividends, those humble rewards that most investors dismiss as mundane? Buffett, however, is no ordinary investor. His enduring love affair with companies like Coca-Cola has allowed him to amass a fortune in passive income, a fortune that swells with every quarterly check. But, perhaps most remarkable of all, is Buffett’s commitment to never straying from his guiding principles, regardless of the market’s manic fluctuations. While the rest of the world dances to the rhythms of irrational exuberance, Buffett’s steps remain calculated, deliberate.

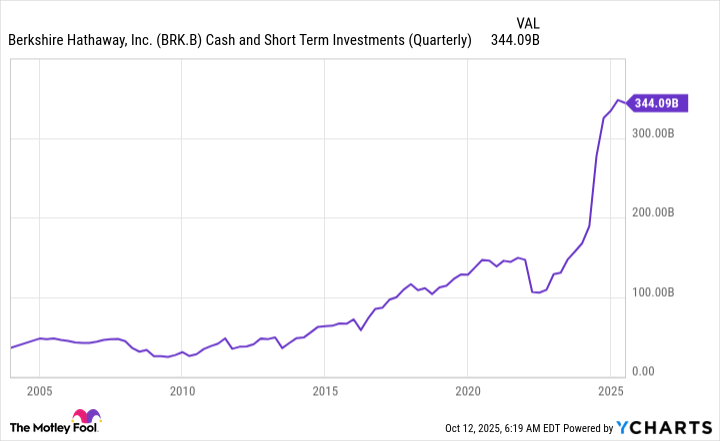

And yet, here we stand, on the precipice of a new chapter in the saga of Buffett’s investments. A chapter that is not written in soaring stock prices, but in the quiet, almost imperceptible movements of a master who knows when to hold and when to withdraw. For in the second quarter of this year, Warren Buffett did something utterly out of character for an investor of his stature: he sold more stocks than he purchased. This marks the 11th consecutive quarter of net stock sales, a statistic that would send a shiver down the spine of any Wall Street enthusiast. As a result, Berkshire Hathaway has amassed a war chest-a cash position that has ballooned to a record $344 billion.

Buffett’s Gaze: The Calm Before the Storm?

But what is Buffett’s secret? What does he see that others cannot? The truth, dear reader, is that Buffett’s caution is not a sign of weakness but rather a reflection of his eternal obsession with value. While some stocks may indeed represent opportunities-UnitedHealth Group and Pool Corp, for instance-he will not buy simply because a stock is trending. No, Buffett is a value investor, and no amount of market euphoria can sway him from his belief that the price must reflect the inherent worth of the company.

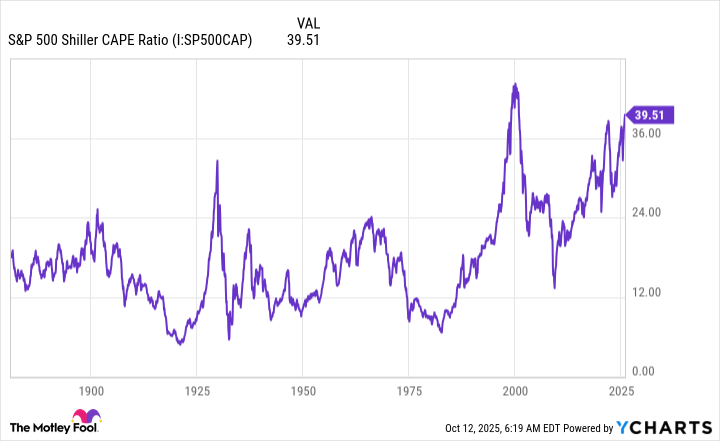

It is likely that, in his silence, Buffett is keenly aware of the S&P 500 Shiller CAPE ratio-a haunting metric that measures the price of earnings over the course of a decade. The number is staggering, and its implications are clear: the market is overvalued. This ratio has reached heights that have only been seen on two prior occasions in history, and each of those moments was followed by catastrophic market events. Could Buffett, in his quiet manner, be preparing for the inevitable correction?

What, then, does this mean for the average investor? Should you sell off your holdings, lock your doors, and retreat into a world of cash? Absolutely not. Instead, like Buffett, look for opportunities. Even in a market as overheated as today’s, there are bargains to be found. But-most importantly-set aside some capital for future opportunities, those that will surely arise when the storm clouds roll in. In the end, when the market corrects itself, those who have prepared will be able to seize the moment, to hold fast, and to emerge victorious when the dust settles.

For, as Buffett knows all too well, the market is a patient beast, and those who do not succumb to its maddening rhythm may find themselves with the last laugh in the end. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2025-10-13 15:22