Author: Denis Avetisyan

New research reveals how leading platform companies prioritize overall ecosystem strength over short-term profits in individual markets.

This paper develops a dynamic theory explaining cross-market subsidization and the resulting stable, yet dynamically inefficient, equilibrium in platform economics.

Dominant firms often defy conventional wisdom by maintaining below-cost pricing even with substantial market share. This paper, ‘Ecosystem Competition and Cross-Market Subsidization: A Dynamic Theory of Platform Pricing’, resolves this paradox by modeling firms as ecosystem optimizers, prioritizing overall user value over single-market profits. We demonstrate that when user activity generates spillover benefits across adjacent markets-what we term ecosystem complementarity-perpetual below-cost pricing can emerge as a stable equilibrium, distinct from predatory behavior. This dynamic, however, leads to capital flowing into subsidy wars rather than innovation, raising the question of how antitrust intervention can effectively address cross-market capital flows to promote long-term welfare.

The Razor’s Edge: Competition and Margin Compression

The competitive landscape for Chinese platform firms is notably intense, particularly within the food delivery sector, where razor-thin profit margins are the norm. This environment fosters relentless rivalry as companies vie for market dominance, forcing them to prioritize scale and user acquisition over immediate profitability. Unlike markets where established players can maintain comfortable margins, these firms operate under constant pressure to undercut competitors, leading to a dynamic where even small gains in market share are fiercely contested. The food delivery market serves as a microcosm of this broader trend, demonstrating how platform companies often engage in aggressive expansion strategies, accepting temporary losses in pursuit of long-term control and network effects.

The competitive landscape for Chinese platform firms often devolves into intense price wars, fueled by strategies of deliberately undercutting costs and substantial subsidies intended to attract and retain customers. This isn’t a broad market struggle, however; the top two companies routinely command a combined 95% of the market share, creating a highly concentrated environment where these aggressive pricing tactics become particularly pronounced. Such maneuvers aren’t necessarily indicative of failing businesses, but rather represent a calculated, if costly, battle for dominance – a means of leveraging scale and securing long-term market control even at the expense of short-term profitability.

The aggressive pricing and substantial subsidies employed by leading Chinese platform firms aren’t solely indicative of a damaging price war, but rather a sophisticated, albeit costly, battle for market dominance. Over a mere six months, three major companies collectively expended RMB 100 billion in subsidies, a figure that underscores the intensity of competition and the strategic investments being made to capture market share. This expenditure suggests a calculated effort to build network effects, establish brand loyalty, and ultimately, achieve a sustainable competitive advantage – even if it necessitates short-term financial sacrifices. While appearing destructive on the surface, these strategies demonstrate a complex interplay of market dynamics where significant investment is viewed as a pathway to long-term control and profitability.

Escalation and the Logic of Subsidies

The entrance of JD.com into the food delivery sector demonstrably increased competitive subsidies within the market. Prior to JD.com’s entry, existing platforms were already engaged in promotional pricing; however, the addition of another major competitor forced a significant escalation of these incentives. This resulted in increased consumer discounts, lowered delivery fees, and expanded promotional offers across all platforms as each attempted to gain market share. The intensified subsidy war compressed margins for all participants, creating a highly competitive landscape where sustained profitability relied on factors beyond immediate transaction revenue.

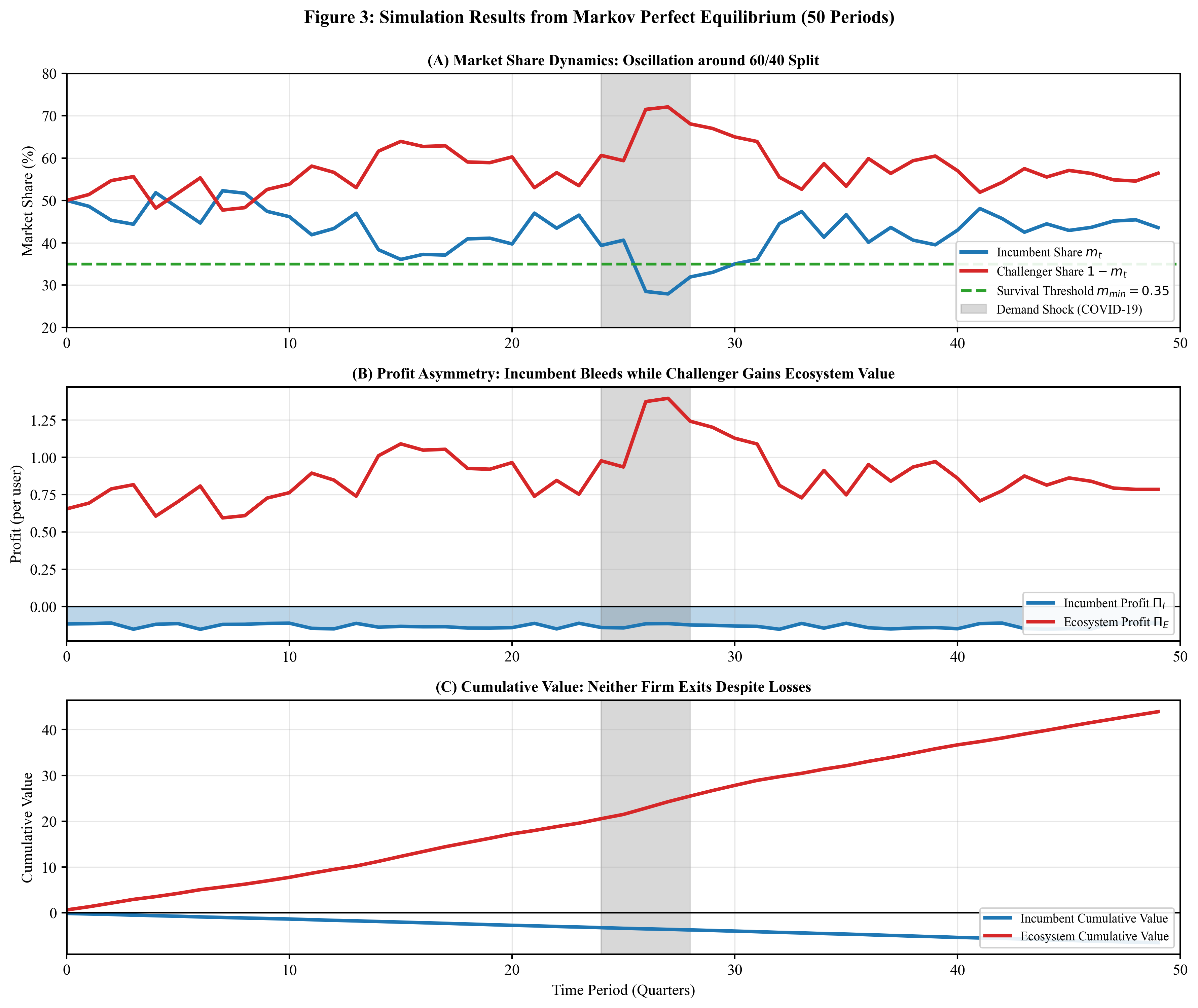

Game-theoretic modeling, specifically employing the concept of Markov Perfect Equilibrium (MPE), provides a framework for analyzing the strategic interactions driving subsidy wars in competitive markets. MPE assumes players rationally anticipate future outcomes and optimize their current actions accordingly, considering all possible future states of the game. Applying MPE to subsidy competition allows researchers to identify conditions – such as the number of competitors, consumer price sensitivity, and the cost structure of firms – under which sustained subsidy levels are logically consistent with rational behavior. This analysis moves beyond simple price competition by explicitly modeling the dynamic, multi-period nature of these subsidy wars and can predict the likelihood of escalation, accommodation, or eventual exit from the market by certain players. The model’s output helps determine if observed subsidy levels represent a stable equilibrium or a temporary, unsustainable tactic.

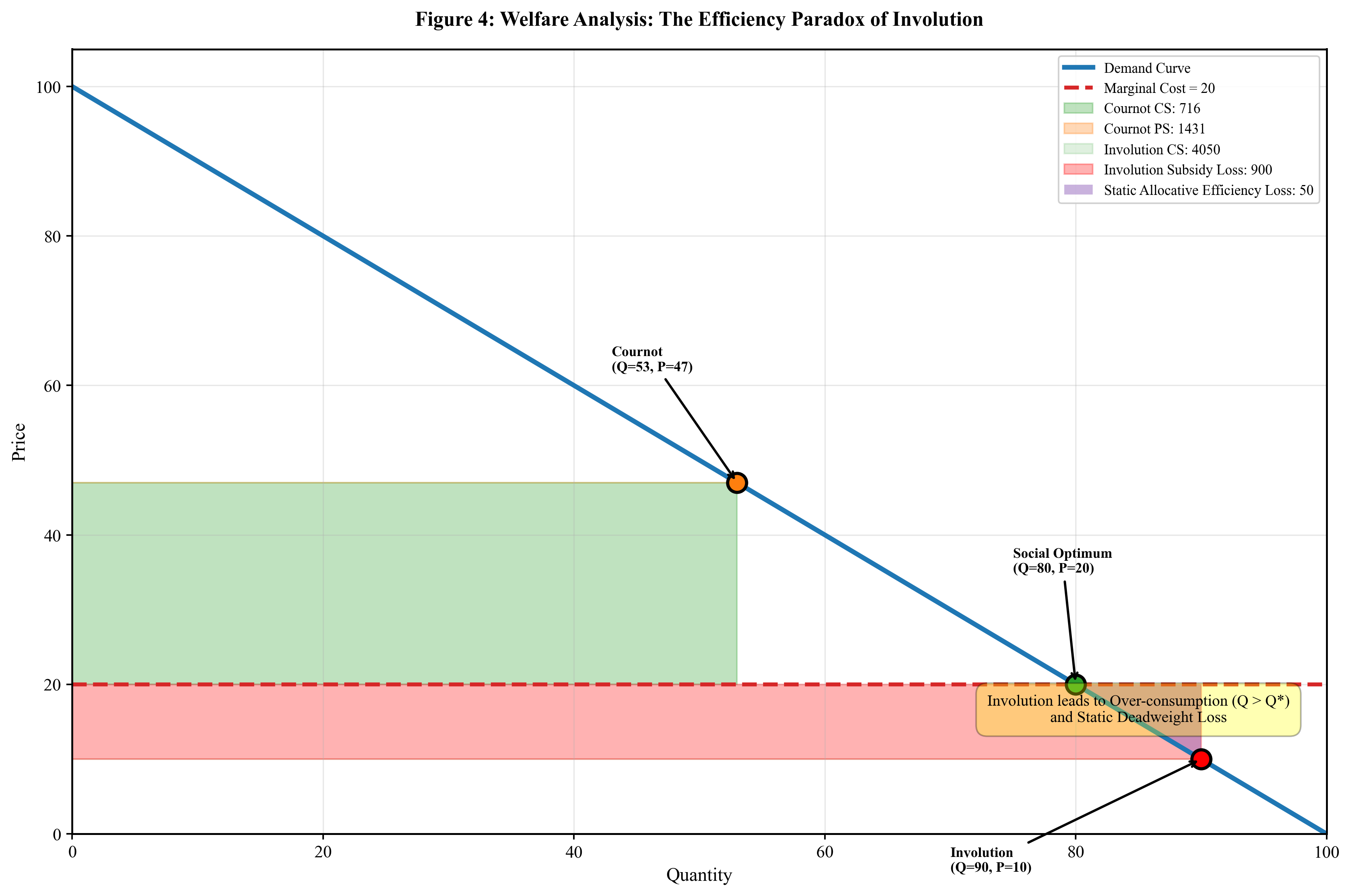

Analysis of subsidy-driven competition must consider the potential for predatory pricing, where firms temporarily operate at a loss to drive out competitors. This strategy hinges on recoupment logic – the expectation of raising prices to supra-competitive levels in the future to recover initial losses and achieve long-term profitability. Despite significantly compressed margins during periods of intense competition, leading firms in these markets frequently maintain operating margins between 10-15% through cross-market synergies, allowing them to absorb short-term losses and facilitate eventual price recoupment.

Ecosystems and the Pursuit of Synergies

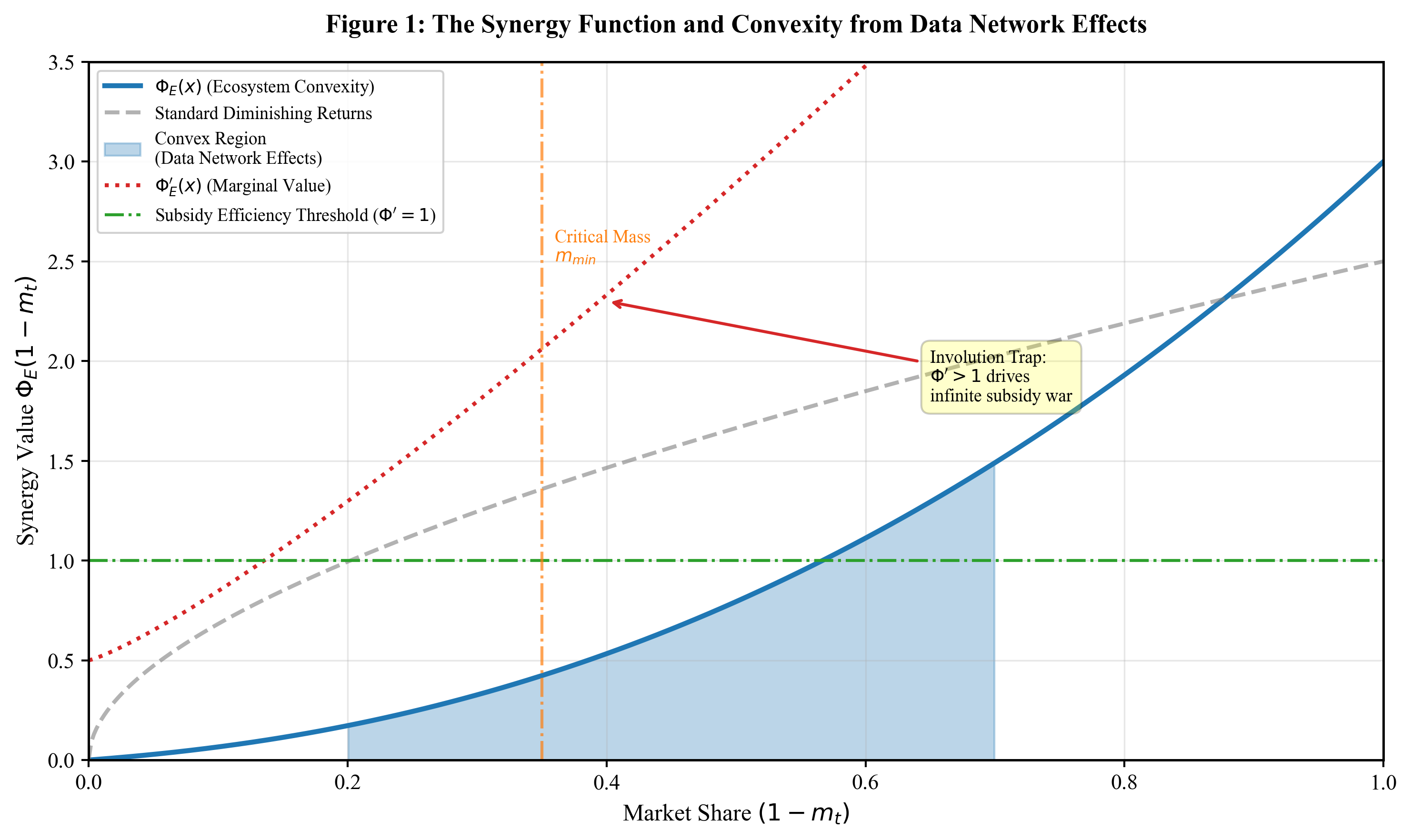

Platforms such as Meituan and Ele.me demonstrate ecosystem complementarity by strategically expanding service offerings beyond their core food delivery business. This expansion encompasses adjacent markets including local services, travel booking, and financial products. By integrating these diverse services within a single platform, these firms increase user engagement and frequency of use. This approach enables cross-selling opportunities and leverages a shared user base, ultimately driving revenue growth and increasing the overall lifetime value of each customer. The result is a diversified revenue stream less reliant on a single market segment and a strengthened competitive position through increased user lock-in.

Data externalities and traffic diversion are key mechanisms for platform value creation. Data externalities occur when data generated within one service improves the functionality or personalization of another; for example, purchase history from a food delivery app informing product recommendations within an e-commerce section. Traffic diversion involves directing users from one service to another within the same platform; a ride-hailing app user might receive promotions for local restaurants, driving traffic to the firm’s food delivery service. These practices enable platforms to leverage data assets across multiple offerings, increasing user engagement and reducing customer acquisition costs, ultimately contributing to synergistic growth beyond the scope of any single service.

Network effects, in the context of digital ecosystems, describe the phenomenon where the value of a service increases for each user as the number of other users grows. This occurs both directly, through increased opportunities for interaction, and indirectly, via the creation of complementary services and data. Positive feedback loops are established; a larger user base attracts more third-party developers, enhancing service offerings, which in turn attracts more users. This virtuous cycle reinforces the platform’s competitive position by creating barriers to entry for competitors and enabling sustained growth. The resulting scale advantages further lower customer acquisition costs and improve profitability, solidifying the platform’s dominance.

Cross-market capital flows represent a key strategic advantage for firms operating multi-service platforms. These firms can leverage profitability in one market segment to offset losses or support growth initiatives in others, creating a financially sustainable competitive position. This internal subsidization is enabled by a centralized data infrastructure that identifies and manages risk across diverse product lines. For example, Ant Group utilizes this approach in its financial services, achieving default rates that are 30-50% lower than those of traditional banks due to enhanced risk assessment derived from aggregated user data and the ability to dynamically allocate capital based on cross-market performance.

The Fragility of Efficiency: Systemic Risk and Long-Term Consequences

The persistence of “soft budget constraints” – the implicit or explicit expectation that failing firms will receive assistance – actively hinders long-term economic growth by suppressing genuinely efficient investment. When businesses anticipate bailouts during difficult times, the incentive to minimize risk and maximize productivity diminishes; instead, resources are often allocated to projects with lower returns but reduced downside risk, relying on external support to cover potential losses. This creates a systemic issue where inefficient firms are propped up, crowding out more innovative and productive competitors, and ultimately slowing down the rate of technological advancement and overall economic progress. The expectation of rescue, therefore, acts as a disincentive for responsible financial management and strategic decision-making, leading to a less dynamic and ultimately less resilient economic landscape.

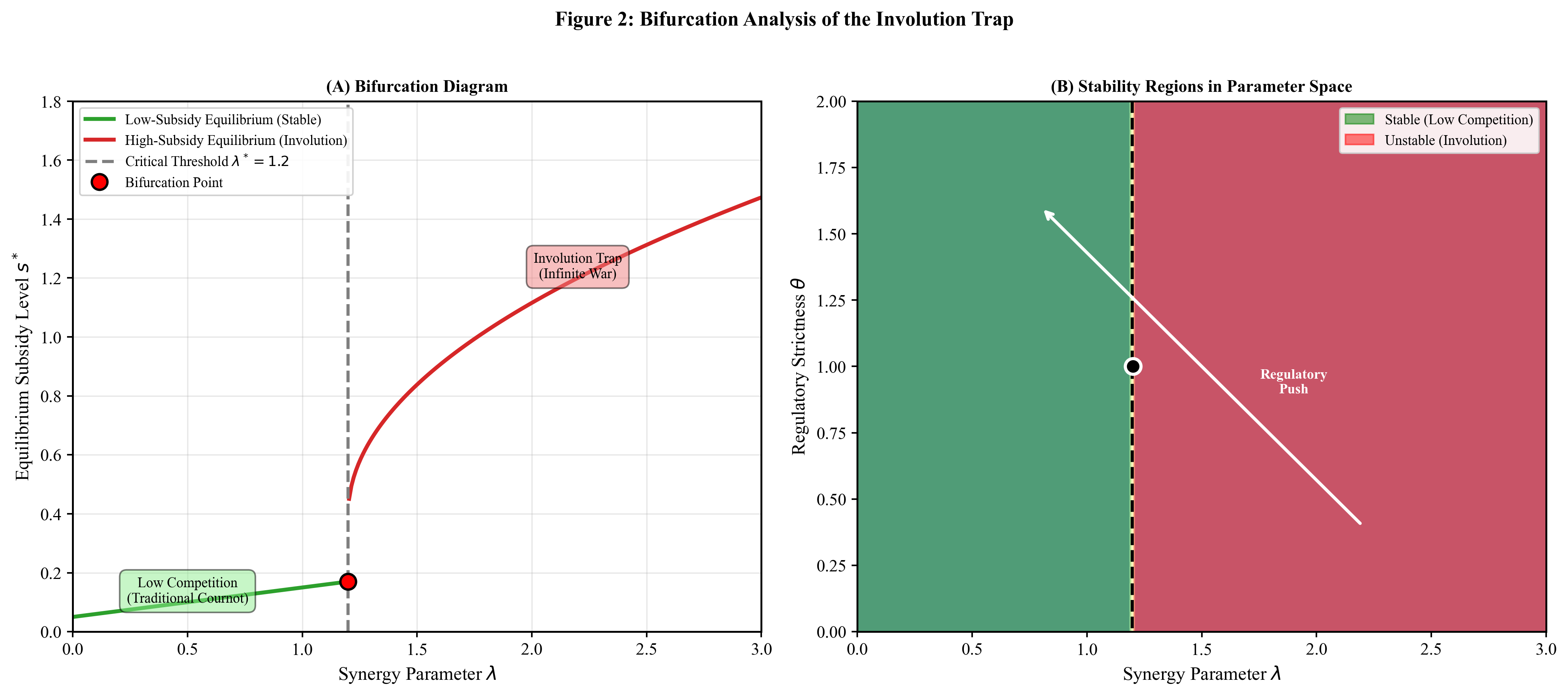

Market dynamics, when coupled with pervasive ‘soft budget constraints’ and strategic subsidies, can unexpectedly trigger a \text{Saddle-Node Bifurcation}. This isn’t merely a theoretical quirk; it represents a fundamental shift in how a market operates, moving from relative stability to a point of critical instability. Initially, the system appears to function normally, but as subsidies escalate and expectations of bailouts solidify, the market reaches a tipping point. Beyond this point, even minor shocks can cause dramatic, often unpredictable swings in behavior-firms may suddenly fail, investment can plummet, or entirely new market structures can emerge. This bifurcation isn’t a gradual drift, but a qualitative change, illustrating how seemingly rational actions-subsidies intended to foster growth-can inadvertently create a fragile system prone to sudden and disruptive collapse.

The persistence of subsidy competition, frequently dismissed as short-term political maneuvering, is revealed to be a surprisingly stable characteristic of modern competitive landscapes. This research demonstrates that these “subsidy wars” aren’t isolated incidents, but rather a predictable outcome rooted in the interconnectedness of market actors – a phenomenon termed ecosystem complementarity. The implications extend beyond simple economic inefficiency, challenging the long-term viability of the prevailing competitive model. Without intervention, this inherent instability risks creating a system perpetually reliant on artificial support, ultimately hindering genuine innovation and sustainable growth; regulatory strategies, therefore, become crucial not to stifle competition, but to re-align incentives and foster a healthier, more resilient market ecosystem.

The study illuminates a peculiar dynamic within platform economics: the persistence of below-cost pricing even after establishing market dominance. This isn’t irrationality, but a calculated strategy for ecosystem control-a prioritization of long-term positioning over immediate profit. It echoes Marie Curie’s sentiment: “Nothing in life is to be feared, it is only to be understood.” The paper attempts to understand this counterintuitive behavior, revealing how firms strategically leverage cross-market subsidization to fortify their overall ecosystem. The analysis demonstrates that seemingly inefficient pricing isn’t a mistake, but a deliberate maneuver to maintain a stable, albeit dynamically inefficient, equilibrium, where understanding the uncertainty of market share is paramount. Anything without a confidence interval, as it were, is merely an opinion.

What’s Next?

This work suggests a stable, if somewhat unsettling, picture of platform competition. The insistence on below-cost pricing isn’t necessarily irrational – it’s simply a different rationality, one focused on maintaining ecosystem dominance rather than maximizing immediate profit. However, the model simplifies. Every dataset is just an opinion from reality, and the inherent complexities of multi-sided platforms – the varying elasticity of demand across user groups, the unpredictable evolution of complementary goods – remain largely unexplored. The devil isn’t in the details; he’s in the outliers – the unexpected network effects, the sudden shifts in consumer preference, the regulatory interventions that can dismantle even the most carefully constructed ecosystem.

Future research should prioritize a more granular analysis of these dynamics. The assumption of homogenous users, while simplifying the mathematics, obscures potentially critical behavioral differences. A particularly fruitful avenue lies in examining the interplay between dynamic inefficiency and innovation. Does the pursuit of ecosystem share actively stifle disruptive technologies, or does it, paradoxically, create the conditions for their emergence?

Ultimately, this framework isn’t a prediction, but a provocation. It reminds one that market share, while easily quantifiable, is a remarkably blunt instrument for understanding value creation – or its absence. The true cost of subsidization isn’t measured in accounting ledgers, but in the opportunity cost of alternatives foregone.

Original article: https://arxiv.org/pdf/2601.15303.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-01-26 02:18