In the labyrinthine realm of technology stocks, two titans stand: Nvidia (NVDA), the semiconductor colossus, and Palantir Technologies (PLTR), the AI scribe of government and commerce. Their tales are as peculiar as the markets themselves-Nvidia, a beast that once fed on computer graphics, now devours data centers with a ravenous hunger, while Palantir, a ghostly scribe, whispers secrets to bureaucrats and CEOs alike. Both are marvels of modern alchemy, yet which shall reign supreme?

The question hangs like a specter in the chamber of investment, a riddle wrapped in the enigma of numbers. One might say the choice is as simple as selecting a loaf of bread-yet the loaves here are baked in the fires of speculative frenzy.

To unravel this mystery, let us summon the two specters from their lairs.

Nvidia

Nvidia’s GPUs, those tiny gods of silicon, have become the crucible of the digital age. Once mere curiosities for gamers, they now fuel the engines of artificial intelligence, their circuits humming with the weight of human ambition. A single GPU, one might say, is a microcosm of the universe-its electrons dancing to the tune of quantum whims. Nvidia, the alchemist of this realm, holds dominion over 92% of the market, a crown of absurdity in a world of chaos. As data centers swell like overfed titans, Nvidia’s coffers grow fat, its stock a pendulum swinging between euphoria and despair.

The behemoths of tech-Microsoft, Alphabet, Meta Platforms-are now architects of their own ruin, pouring billions into data centers that resemble the lairs of dragons. Nvidia, the sly fox, rides their folly, its earnings reports a ritual of prophecy and panic.

Palantir Technologies

Palantir, born in the shadow of the 21st century, is a creature of paradoxes. It began as a whisper in the halls of government, a tool for those who govern in the dark. Its rise to prominence was no less absurd than a clockwork bird learning to sing. The tale of its role in the capture of Osama bin Laden is a fable for the ages, a parable of data’s power to bend the world. Now, it weaves its web into the very fabric of commerce, its AI platform a labyrinth of algorithms and bureaucratic whims.

Its contracts, a parade of government agencies and corporate titans, are as absurd as they are lucrative. The Federal Aviation Administration, the IRS, and even Walgreens Boots Alliance-each a node in a network of data, each a pawn in a game of digital chess. Palantir’s revenue, a crescendo of growth, is a testament to the madness of modern enterprise.

The Verdict

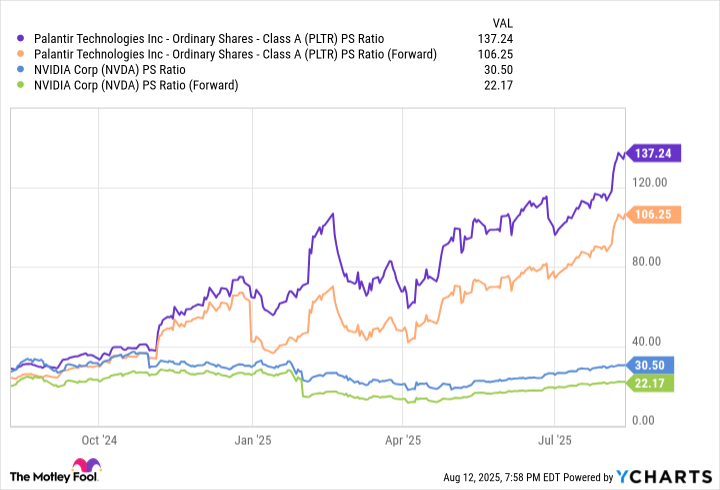

To choose between these two is to stand at the crossroads of a madman’s dream. Both are marvels, both are monsters, yet the scales tip with the weight of valuation. Nvidia, though richly priced, is a beast of reason-its P/E ratio a whisper of sanity in a world of chaos. Palantir, however, is a specter of absurdity, its valuation a riddle that defies logic.

The price-to-sales ratio, that arbiter of sanity, reveals Nvidia’s strength as a colossus in a field of dwarves. Palantir, for all its brilliance, is a ghost in the machine, its value a mirage.

Thus, I declare Nvidia the victor, though not without a pang of sorrow. Both are worthy of a place in the pantheon of modern finance, yet only one may reign. Let the market decide, as it always does-through the whims of a capricious god.

🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-17 08:12