In the shadowed corridors of modern finance, where numbers swell like rivers in spring and promises of prosperity echo like hollow hymns, the Nasdaq-100 stands as both a beacon and a specter. For those who seek dividends—those quiet, steadfast returns that speak not of fleeting glory but of enduring sustenance—the allure of growth stocks is undeniable. Yet, to invest in the Nasdaq-100 is to walk a path fraught with contradictions, where the pursuit of wealth collides with the fragility of human ambition.

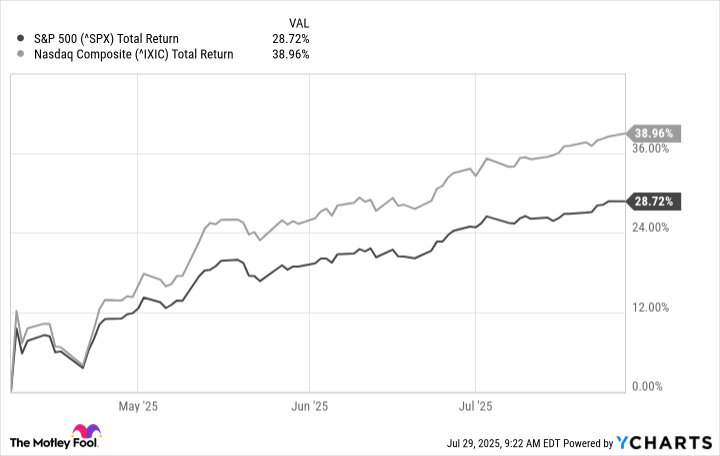

Valuations soar like kites untethered from earth, their strings cut by winds of speculative fervor. The Nasdaq Composite and the S&P 500, those twin towers of market triumph, have scaled heights that would make even the most ardent optimist pause. Is it still wise to entrust one’s capital to an exchange-traded fund (ETF) tracking the Nasdaq-100, or has this ascent become a perilous climb, demanding a retreat into safer havens?

A Paradox of Progress: Why the Nasdaq-100 Beckons the Patient Investor

For the long-term investor—a weary pilgrim on the road to financial redemption—the Invesco QQQ Trust (QQQ) offers a peculiar solace. It is not merely an ETF; it is a vessel carrying the hopes of countless souls seeking refuge in the titans of technology and innovation. Over the past five years, this trust has more than doubled in value, outstripping the broader market with a ferocity that borders on hubris. Its mechanism, though impersonal, is unyielding: it discards the faltering and embraces the ascendant, ensuring that only the strongest remain within its fold.

And yet, what is growth without stability? What is progress without preservation? Safer investments may lack the dazzle of these high-flying equities, but they offer something far rarer in our age of ceaseless motion: peace of mind. Still, for those willing to endure the storms of volatility, the Nasdaq-100 has proven itself a formidable ally. Over the past decade, while the S&P 500 delivered total returns exceeding 260%, the Invesco QQQ Trust surged beyond 450%. Such figures are not mere statistics; they are monuments to the power—and peril—of unchecked ambition.

The Specter of Record Highs: A Warning Amidst Plenty

To gaze upon the markets today is to behold a landscape suffused with both promise and portent. Stocks teeter at record levels, their peaks shrouded in clouds of uncertainty. The Nasdaq and the S&P 500 have danced upward since April, buoyed by the temporary suspension of “reciprocal tariffs.” Yet, beneath this veneer of prosperity lies a chasm of risk. Should fears of renewed trade tensions arise, the markets could plummet as swiftly as they rose.

One cannot dismiss the possibility of decline, for history whispers warnings to those who will listen. Markets, like empires, rise and fall, their cycles dictated by forces often unseen and poorly understood. To ignore such truths is to court disaster, especially when the air is thick with the scent of overheated speculation.

A Question of Time: To Invest or Abstain?

If your horizon stretches beyond five years—if you possess the fortitude to weather the tempests that inevitably batter the ship of growth—then perhaps the Nasdaq-100 remains a worthy companion. Growth stocks, particularly those tethered to technology, carry risks as vast as their potential rewards. Valuations may soar to unsustainable heights, and bad years may test the resolve of even the most steadfast investor. But history teaches us that markets recover, rising again like phoenixes from the ashes.

Yet, if your journey is shorter, if your need for certainty outweighs your appetite for adventure, then safer harbors beckon. Bonds and dividend-paying stocks offer shelter from the storm, preserving capital in times of turmoil. For the long-term investor, however, the Nasdaq-100 retains its allure, a testament to humanity’s relentless drive toward progress, flawed though it may be. 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-04 04:16