Enter, if you dare, the grand stage of modern commerce, where the players wear silicon crowns and speak in the tongues of electrons. At center stage stands Taiwan Semiconductor Manufacturing Company, or TSMC—a name whispered with reverence among those who seek to harvest dividends from the fertile fields of artificial intelligence. This titan of transistors has once again dazzled the market with its Q2 performance, as though it were a miser counting coins under candlelight.

Behold the cast of characters: Broadcom, Marvell, Nvidia, AMD, Intel, Qualcomm, and even the illustrious Apple. All flock to TSMC’s foundries like courtiers to a king, for none can match the alchemy of its process nodes. And yet, what is this but a masquerade of dependency? Each company dons its mask of innovation while secretly leaning upon TSMC’s shoulders—a farce worthy of the stage.

But let us not dismiss this spectacle too hastily. For beneath the veneer of greed lies an undeniable truth: TSMC’s dominance is no mere sleight of hand. Its 68% share of the global semiconductor foundry market towers over rivals like a colossus, leaving Samsung—a distant second with less than 8%—to play the role of a forgotten understudy. Ah, how vanity dances when one holds such power!

Act II: The Miser’s Hoard Grows Ever Larger

In the latest act of this drama, TSMC reported a 44% year-over-year surge in Q2 revenue, amassing $30.1 billion—a treasure trove that exceeded even its own lofty expectations. Yet, dear reader, observe the miser’s delight: adjusted earnings per share leapt by 61%, a testament to pricing power so potent it could make Midas weep. Such wealth accumulation would be admirable were it not accompanied by the faint odor of hubris.

And now, the prophecy: TSMC foresees its full-year revenue growing by 30% in 2025, revised upward from earlier estimates of mid-20%. Tariffs? Pah! They are but whispers in the wind compared to the gale force of AI demand. Indeed, the company’s guidance suggests a crescendo of growth, driven by end-markers poised to swell into a $3 trillion juggernaut by 2030, according to McKinsey.

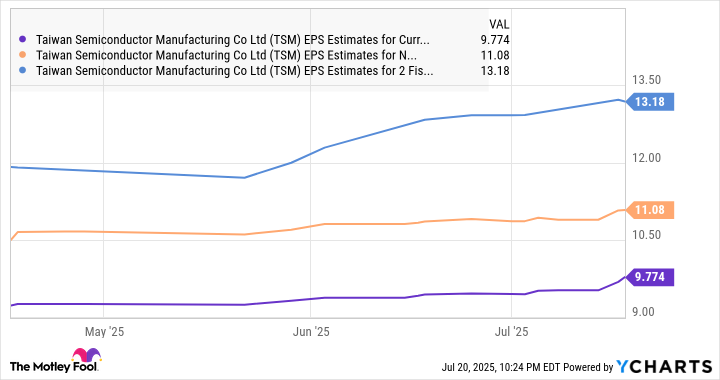

Analysts, ever eager to join the chorus, have raised their forecasts through 2027. One might almost pity them—an ensemble cast perpetually chasing the star performer, hoping to catch a glimpse of its script.

Act III: The Stock Ascends Amidst Laughter

Mark well, ye seekers of dividends, for here lies opportunity cloaked in irony. Despite a 59% ascent in just three months, TSMC trades at 28 times trailing earnings—a modest valuation when set against the Nasdaq 100’s exuberant multiple of 32. Even more enticing is the forward earnings ratio of 24, a siren song for those who crave sustainable returns.

Thus, I say to thee: consider TSMC not merely as a stock but as a character in a comedy of errors. It is both miser and magnate, greedy yet generous, vain yet indispensable. To invest in it is to partake in a farce where fortunes are made amidst folly—and perhaps, to laugh all the way to the bank. 😊

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-07-26 11:07