In the grand opera of corporate theater, where the curtain rises on another act of calculated absurdity, Alphabet and Meta Platforms took their bows on Friday, their stocks pirouetting upward as if guided by the ghost of J.P. Morgan’s ledger. The Federal Reserve’s hint of a rate cut served as the overture, but the true libretto was a $10 billion cloud deal-a Faustian bargain inked between rivals, each trading a fragment of their soul for a sliver of the future. One imagines the Devil himself, perched on a boardroom chair, sipping espresso and scribbling footnotes in the margins.

Alphabet, that modern-day Icarus with a penchant for flinging itself into the sun of innovation, now finds itself tethered to Meta, a fellow mortal who once danced with the same fire. The deal, a six-year contract to supply Google Cloud’s infrastructure to Meta’s insatiable AI ambitions, is less a partnership and more a masquerade ball where adversaries don silk masks to outwit the true antagonist: the market’s fickle heart. For Alphabet, it is a balm for its wounded pride, a salve for the festering wound of declining ad revenue. Yet, as with all such remedies, one wonders if the potion is more poison.

Terms of the partnership

Meta, that digital titan with a revenue stream as vast as the Siberian tundra, will pay Alphabet $10 billion over six years to access Google Cloud’s labyrinthine network of servers, storage, and networking services. A sum, one must note, that pales beside the $49 billion Google Cloud raked in over the past year. Yet, in the realm of corporate accounting, even a pebble can become a mountain if polished with the right rhetoric. This is not a transaction but a ritual-a sacred rite where numbers are exorcised into symbols of power.

Meta’s prior reliance on Amazon’s AWS and Microsoft’s Azure was akin to a poet’s devotion to iambic pentameter. Yet now, like a scribe abandoning quill for typewriter, it diversifies its dependencies. Alphabet, meanwhile, is Meta’s largest competitor in digital advertising, a field where both companies bleed the same ink of monetized attention. Their alliance, then, is a marriage of convenience, a truce brokered not by love but by the shared fear of obsolescence. One might imagine them clasping hands across a chasm, each wondering when the other will step back.

How it helps Alphabet

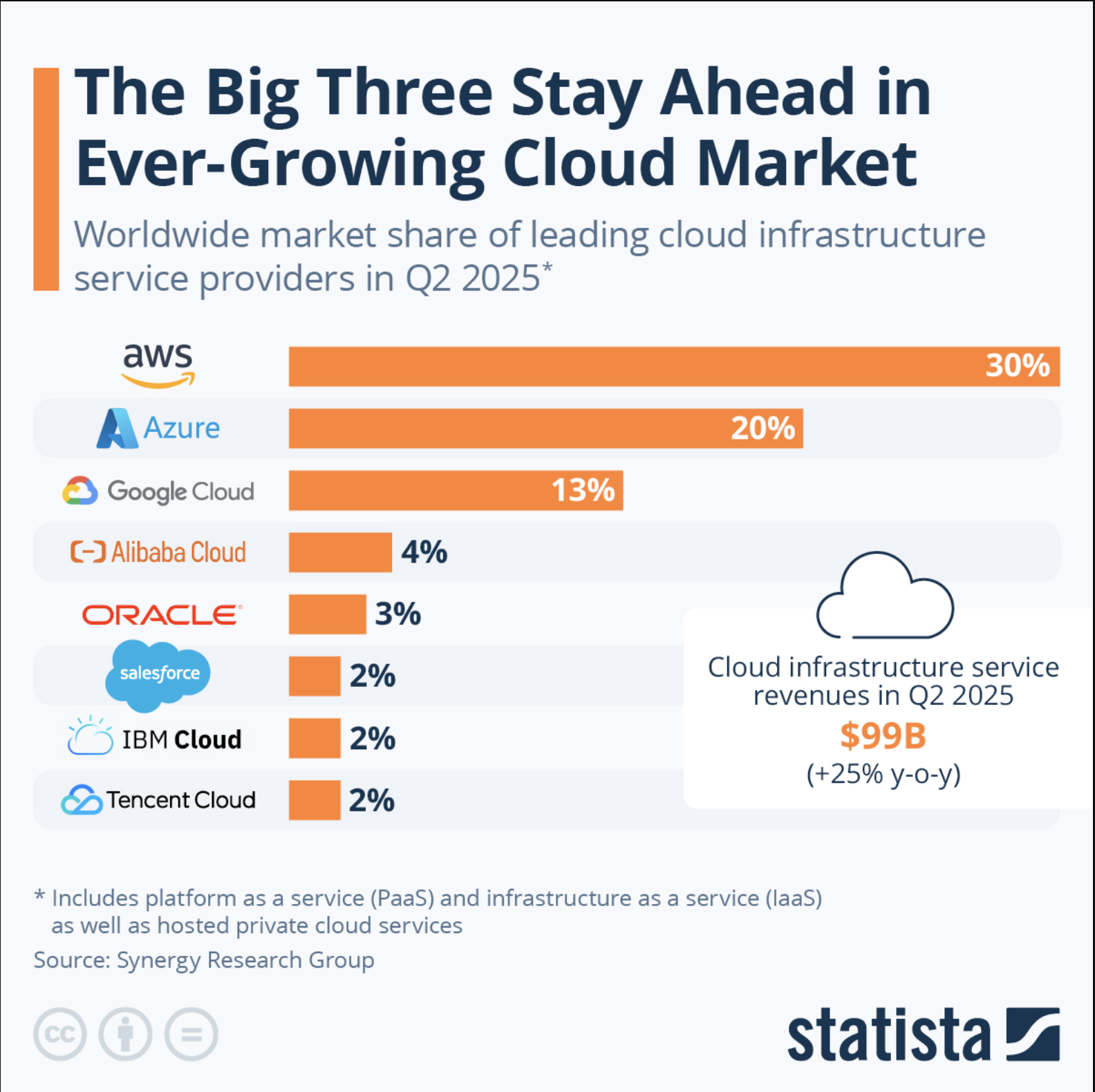

For Alphabet, this deal is a theatrical gesture-a spotlight shone on its struggling cloud division, which trails AWS and Azure like a supplicant begging for crumbs. The 14% of Alphabet’s revenue that now flows through Google Cloud is a drop in the ocean of its $280 billion empire, yet it is the only non-ad revenue stream that dare show its face in the financials. It is the corporate equivalent of a prodigal son who returns home, not with a fatted calf but a spreadsheet.

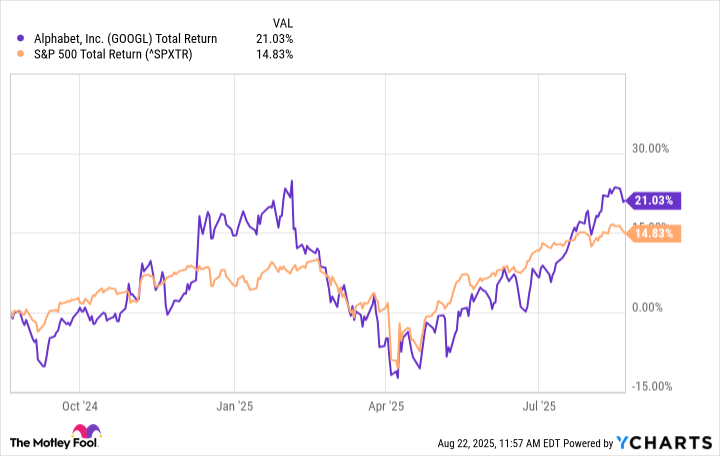

Alphabet’s diversification efforts read like a madman’s diary: a string of acquisitions, each more disjointed than the last, stitched together in the hope of escaping the fate of a one-trick pony. Google Cloud, the lone success among them, is now the subject of this $10 billion love letter from Meta. But love in the corporate world is a currency, and this letter is written in the script of market confidence. Investors, those modern-day alchemists, may now gaze upon Alphabet’s 22 P/E ratio with new eyes, mistaking the reflection for gold rather than glass.

The irony, of course, is that this deal will do little to shift the tectonic plates of the cloud market. AWS and Azure remain the titans, their empires built on bedrock rather than sand. Yet, in the theater of perception, Alphabet has scored a coup. The market, that great collective hallucination, may now whisper that Google Cloud is not dead but merely sleeping. And in the world of stocks, whispers are often mistaken for thunder.

If this deal is a spark, will it ignite a wildfire? Perhaps, but only if other corporations choose to play the game of corporate masquerade. The true test lies not in the $10 billion but in the symbolism: a signal that Alphabet’s cloud is now a player worth courting, even by rivals. Yet, as history teaches, alliances between wolves are never born of trust but of hunger.

The Meta deal and Alphabet stock

In the end, this partnership is a tale of two shadows. Alphabet, the aging maestro of innovation, seeks to prove it still has symphonies left to compose. Meta, the restless prodigy, seeks the tools to build a new cathedral of attention. Together, they dance a waltz of mutual desperation, their feet tracing circles around the grave of relevance. The stock price may rise, but like a candle in a gale, it is the flicker-not the flame-that will be remembered.

Let us not delude ourselves: the $10 billion is but a footnote in the ledger of eternity. Yet, in the absurdity of corporate hierarchies, footnotes become epics. Investors, those modern-day Don Quixotes, will tilt at this windmill of confidence, mistaking the shadow for the sword. And so the machine grinds on, a grotesque ballet where the only certainty is the inevitability of the next scandal, the next pivot, the next Faustian bargain.

After all, in the kingdom of capital, the Devil is not only in the details-he is the CEO. 👹

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-25 05:03