The matter of Intuitive Surgical (ISRG +2.55%), as with most ventures predicated on the extension of human capability, presents a curious paradox. It is not, strictly speaking, a bargain. The current valuation—a price-to-earnings ratio hovering near sixty—suggests an optimism that, to a dispassionate observer, verges on the fantastical. The index of the S&P 500, a more prosaic reflection of collective sentiment, maintains a ratio of twenty-eight, a figure grounded, perhaps, in a more realistic appraisal of earthly limitations. Yet, to dismiss Intuitive Surgical outright would be to succumb to the allure of simple categorization—a temptation to which even the most learned scholars are occasionally prone.

The Labyrinth of Precision

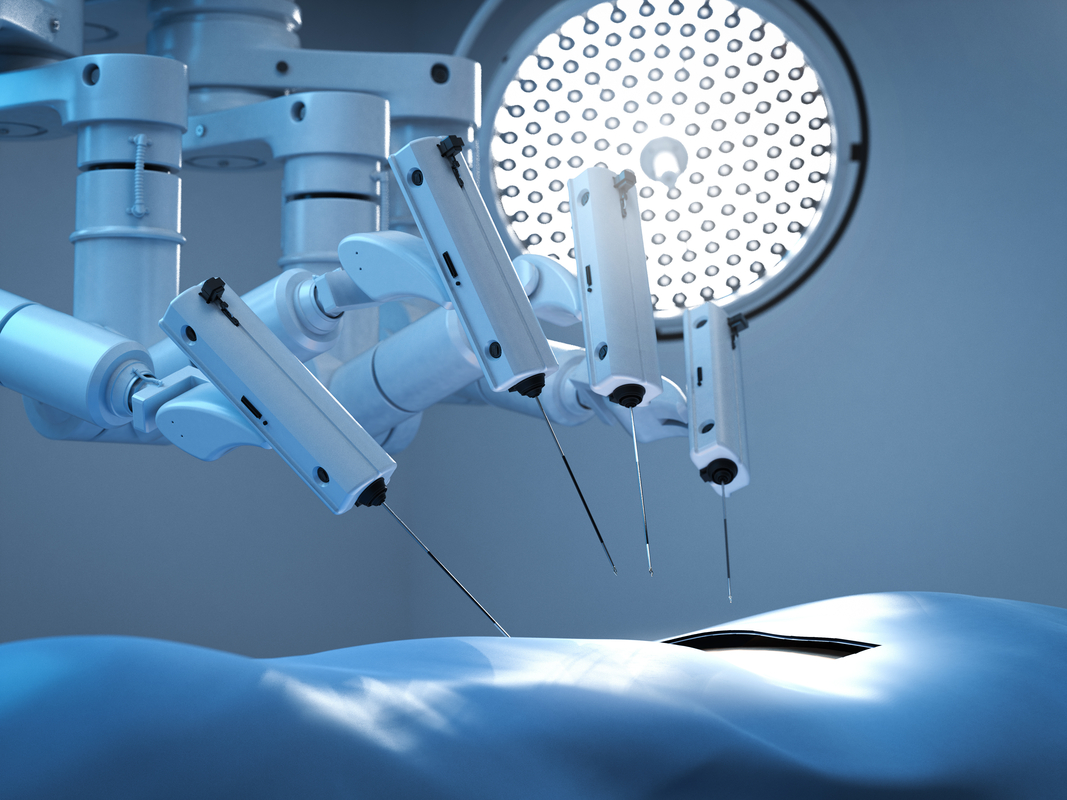

The company’s principal creation, the da Vinci surgical system, is, at its core, an attempt to impose order upon the inherent chaos of the human body. As of the end of 2025, eleven thousand one hundred and six such systems were in operation globally—a number that, while substantial, feels strangely…incomplete. Each system, a metallic simulacrum of human dexterity, performs an ever-increasing number of procedures. In 2025, the volume of surgeries increased by eighteen percent, a rate that suggests a growing acceptance—or perhaps, a growing dependence—upon this mechanical intervention. The company projects a further increase of up to fifteen percent in 2026, a prediction that assumes, of course, the continuation of this current trajectory—a dangerous assumption in any endeavor governed by the unpredictable currents of human desire and technological advancement.

It is worth noting that the true revenue stream is not derived from the sale of these complex machines, but from the consumables—the instruments, accessories, and the ongoing service agreements. This, in effect, transforms Intuitive Surgical into a purveyor of a perpetually renewing cycle, a mechanical analogue to the mythical ouroboros, consuming its own tail to sustain itself. The initial investment in the machine merely secures a future stream of revenue—a subtle but crucial distinction.

The confluence of artificial intelligence and robotic surgery, while frequently touted as a harbinger of a medical renaissance, is, in truth, a continuation of a long-standing human impulse—the desire to transcend our biological limitations. Whether this ambition will ultimately lead to genuine progress or merely to a more elaborate form of self-deception remains, as always, an open question.

A Fleeting Symmetry

The market, that capricious and often irrational entity, has recently subjected Intuitive Surgical to a minor correction—a temporary dip in valuation. This, however, should not be interpreted as a sign of fundamental weakness. Growth stocks, by their very nature, are prone to these periodic fluctuations—brief moments of equilibrium amidst a larger, more chaotic pattern. The current price-to-earnings ratio of sixty, while not insignificant, is below the five-year average of seventy-one—a subtle but noteworthy divergence. The stock is currently nineteen percent below its 2026 peak and twenty-one percent below its all-time high, reached in late 2025—a fleeting symmetry, perhaps, before the inevitable ascent continues.

History is replete with examples of such temporary setbacks—drawdowns of twenty-five to thirty percent, or even more. For the long-term investor, possessing a certain degree of philosophical detachment, these fluctuations may present an opportunity—a chance to acquire a stake in a company that, despite its inherent complexities and inflated valuation, appears poised to benefit from the ongoing evolution of medical technology. To demand absolute certainty, however, is to misunderstand the fundamental nature of the market—a realm governed by probability, not prediction. It is often better to be approximately correct in one’s timing than to be paralyzed by the pursuit of perfect precision.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-07 19:04