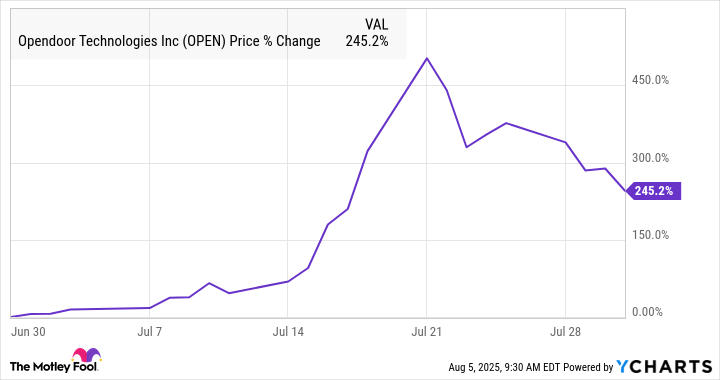

Within the shadowed corridors of Wall Street’s latest carnival, Opendoor Technologies (OPEN) saw its stock inflate by an astonishing 245% in the month of July-an ascent that would make even the most seasoned dividend hunter raise an eyebrow. No doubt, the social media echo chambers-Reddit and X-became the spectacles of the day, fueling what was ostensibly a meme stock frenzy with the kind of fervor that suggests the markets have perhaps lost their taste for sober investment and now delight in spectacle and spectacle alone.

The volume of trading became a veritable conga line of chaos, squeezing shorts mercilessly, while options bought en masse seemed to orchestrate a gamma squeeze-a seductive dance where market makers are compelled to purchase stocks to cover sold call options, thereby fanning the flames of volatility. This theatrical episode reached its zenith on July 21, interrupted by trading halts and a case of mistaken identity-investors auctioned off their rationality, mistaking Open Doors Partners, a firm petitioning for a stock sale, for the real, and increasingly beleaguered, Opendoor.

By month’s end, the company’s nominal gain stood at a staggering 245%, though one suspects that none of this has much to do with the underlying fundamentals of a business that, historically, has been as stable as a house of cards in a windstorm. The chart below-a visual lament of the entire spectacle-serves as a testament to the unpredictability of market sentiment when fueled by meme-like delirium and the collective desire to catch a falling star.

Can Opendoor continue its capricious ascent?

A brief history serves as a reminder that Opendoor’s life has been a series of dramatic episodes-born from a SPAC in late 2020, then soaring with naive optimism, only to plummet as rising interest rates cast a pall over its business model. The enterprise’s attempt to profit from home-flipping relied on a fairy-tale premise: transaction fees and sales margins riding on the housing market’s turbulent fortunes. When rates ascended into the stratosphere, that dream evaporated, leaving behind a stock trading beneath the dollar mark and a company contemplating a reverse split with all the glamour of a bankrupt aristocrat contemplating bankruptcy.

Yet, the meme stock phenomenon appears to have momentarily granted a reprieve, much like a curious benefactor who throws a lifeline amidst the chaos. The narrative here-dubious, perhaps wilfully so-is that lower mortgage rates will revive Opendoor’s prospects, setting it back on the path to profitability. It’s a tempting story; a fairy tale reinforced by hope rather than hard data. But the medieval notion that magical interest rate cuts can resurrect a fundamentally flawed business-especially in an economy showing signs of fatigue-would be laughable if it weren’t so tragic.

What rogue fate awaits Opendoor?

Following a lukewarm jobs report that disappointed the economic overlords, the stock has rekindled its modest ascent, buoyed by hopes-perhaps naïve-that the Federal Reserve’s next move in September might be a cut. Investors, ever hopeful, await the second-quarter results with a cautious optimism that is more aspirational than analytical. Expectations are modest: flat revenue around $1.5 billion, and a slender loss per share that narrows from 4 to 2 cents. Such a report, after all, is less an epiphany than a mere whisper of stability.

The real story lies not in the numbers, but in the rhetoric-what the management chooses to reveal or conceal. If they can craft a narrative of impending revival, the stock might yet dance again, seductive in its illusion. Conversely, another round of tepid results, devoid of optimistic projections, could lead to a stampede of disillusioned shareholders-those who bought in recent weeks and will now vote with their feet. Such is the unpredictable theatre of modern markets, where even a dividend hunter must occasionally marvel at the spectacle of collective delusion, gilded with hope yet founded on fragility. 📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-08-06 06:32