The question “Where will UPS be in 3 years?” isn’t just a question-it’s a riddle wrapped in a mystery inside an enigma. The sort of thing that might keep you up at night, tapping your finger to your chin while gazing out of the window, pondering the fates of giants like UPS. You see, UPS is embarking on a journey into a rather uncertain future, and the various possible destinations are as varied as they are intriguing. What’s certain, of course, is that the decisions made by the company’s management will be a guiding compass. Let’s take a moment to unpack this delightful conundrum and try to make sense of it all.

UPS’ Strategic Blueprint

At its investor day last year, UPS’ leadership unveiled an ambitious roadmap to 2026. In a nutshell, they’re betting big on past successes-specifically in markets like small and medium-sized businesses (SMBs) and healthcare. But that’s not all. They’re also pouring vast sums into productivity-enhancing technologies, like automation and smart facilities, to create what they affectionately call their “network of the future.” The idea here is not just to stay relevant, but to build a system that can weather the storm of growing demand while keeping costs as low as possible. It’s a bit like investing in a highly sophisticated bicycle to race against the wind-except the wind is the ever-expanding demands of global commerce.

The logic behind these investments is twofold. For starters, modernizing the network allows UPS to improve productivity, thus lowering the cost per package. It also means they can shut down inefficient facilities, consolidating their resources into the newly optimized ones. Think of it as pruning an overgrown hedge-you cut away the parts that aren’t helping the plant grow and focus on the healthy bits. And there’s more: UPS hopes that the oversupply in the U.S. small-package market, which bloomed during the lockdown years, will eventually fade as demand recovers and the excess capacity shrinks.

On top of that, 2025 brings with it some bold moves. UPS plans to reduce its deliveries to Amazon by 50%-because let’s face it, those deliveries aren’t exactly cash cows-and take back the last-mile delivery for its SurePost service from the Postal Service. It’s a rather savvy way to squeeze out better margins and focus on higher-productivity deliveries.

UPS’ Trouble Spots

But-oh yes, there’s always a “but”-UPS isn’t exactly sailing smoothly through these choppy waters. The ongoing trade tensions, especially with China, are like an inconvenient cloud hanging over the company. As CEO Carol Tomé mentioned in April, “China to U.S. trade lines are our most profitable trade lines.” So, when these trade routes are disrupted, it’s not just a little inconvenience-it’s a real problem. And it gets worse: Many of UPS’ SMB customers are heavily reliant on China for their supplies. The ongoing trade uncertainty is casting a long shadow, and the SMB market, which UPS has bet on for growth, is feeling the heat.

As a result, UPS has been reluctant to offer its usual optimistic forecast for the year. The trade tensions are just the beginning. The company was hoping that the imbalance in the small-package market would sort itself out naturally over the next few years. Instead, it’s facing the very real possibility of long-term disruption in its most important market.

Wall Street’s Two Cents

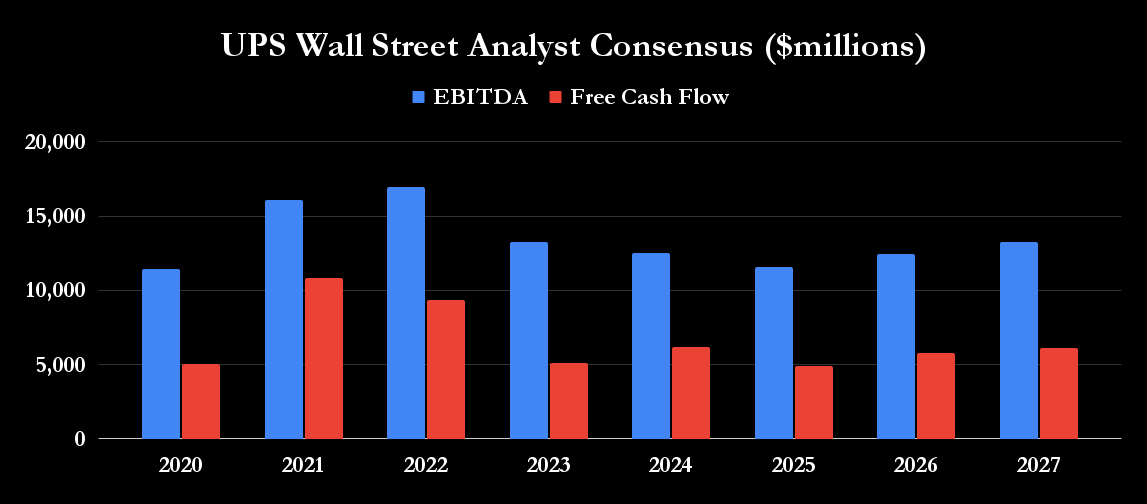

Now, let’s turn our attention to the opinions of the soothsayers of the stock market-Wall Street analysts. Their view on UPS seems to oscillate between cautious optimism and outright skepticism. Their main focus is on UPS’ EBITDA (earnings before interest, taxation, depreciation, and amortization) and free cash flow (FCF). But here’s the rub: UPS is doling out a substantial $5.5 billion in dividends. Wall Street estimates that by 2027, the company will be using over 90% of its free cash flow just to keep those dividends flowing. Which, let’s be honest, doesn’t leave much room for error.

Three Possible Futures for UPS

What will the next few years hold for UPS? Let’s entertain a few possibilities. In the optimistic scenario, UPS manages to weather the storm. The small businesses adjust to the shifting tariffs, healthcare revenue continues to rise, and management executes a flawless strategy, reducing costs and enhancing productivity. The company emerges from its turbulent phase stronger and more profitable.

Then there’s the pessimistic scenario, where the trade conflicts drag on, and the SMB market continues to suffer. This could lead to a significant reset of expectations, potentially forcing UPS to cut its dividend-a bitter pill for many investors. The company might even face a structural decline in its key markets.

But here’s the most likely scenario: a hybrid of both. UPS will likely face a rough patch in the short term. The trade situation will probably keep things precarious, and the company will have to make some tough decisions-perhaps slashing dividends to reinvest in the business, especially its transition to higher-margin, technology-driven solutions. It won’t be an easy ride, but it might set the company up for greater long-term success. For now, though, investors may have to brace themselves for a bit of volatility. The road ahead may get rockier before it gets smoother.

So, there you have it. UPS is at a crossroads, with several potential futures stretching out before it. Whether it flourishes or falters will depend largely on how well it navigates the storms ahead. And, much like a savvy investor watching the tides of the market, we’ll just have to wait and see what happens next. 🤔

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 15:47