Imagine, if you will, a financial instrument so popular that it has attracted nearly $69 billion in assets. That’s more money than some small countries have in their annual GDPs-though, admittedly, I’m not sure which ones because I didn’t look it up. This particular marvel is the Schwab U.S. Dividend Equity ETF, or SCHD for short. It’s the kind of thing people talk about at cocktail parties with an air of smug satisfaction, as though they’ve discovered the secret to happiness itself.

But let’s pause here and ask the contrarian question: Why on earth would anyone get excited about something everyone else seems to adore? Well, dear reader, the answer lies not in blind enthusiasm but in the peculiarities of its construction-a bit like admiring a cathedral not for its stained glass windows but for how ingeniously the stones were laid.

What Does This ETF Actually Do?

At first glance, the Schwab U.S. Dividend Equity ETF appears to be just another index-tracking fund, dutifully mimicking whatever its underlying index does. And what index might that be? The Dow Jones Dividend 100, thank you very much. Now, before your eyes glaze over, consider this: the Dow Jones Dividend 100 isn’t just any old collection of stocks; it’s a curated selection designed to weed out the riffraff. Think of it as inviting only those guests to a dinner party who promise not to spill red wine on the carpet.

To qualify, companies must have increased their dividends every year for at least a decade (real estate investment trusts need not apply). This requirement alone ensures two things: stability and growth. After all, a company can’t increase payouts unless it’s doing reasonably well financially-and by “reasonably well,” I mean better than my attempts at assembling IKEA furniture.

Compare this approach to one of SCHD’s rivals, the Vanguard Dividend Appreciation ETF. While Vanguard also tracks a dividend-focused index, it adds an extra wrinkle: chopping off the top 25% of high-yielders from its pool. This skews its portfolio toward growth, leaving value-oriented investors feeling slightly left out, like being handed celery sticks when everyone else gets cake.

But wait! The Dow Jones Dividend 100 doesn’t stop there. Oh no, it goes further, creating a composite score for each eligible stock based on metrics such as cash flow to total debt, return on equity, dividend yield, and five-year dividend growth rates. Cash flow to total debt speaks to financial resilience-a topic even more thrilling than watching paint dry, yet undeniably important. Return on equity hints at quality management, while dividend yield provides income-minded investors with something tangible to hold onto. Finally, the five-year dividend growth rate gives us a glimpse into future potential-or so we hope.

Growth or Value? Why Not Both?

Here’s where our tale takes a curious turn. You see, most funds pick sides-they’re either Team Growth or Team Value. But SCHD plays Switzerland, refusing to take a firm stance. Instead, it blends both philosophies into a sort of financial smoothie. For contrarians like myself, this raises an intriguing possibility: perhaps the best investments aren’t found at the extremes but somewhere comfortably in between.

Of course, purists may scoff at this middle-ground approach. To them, SCHD might seem neither fish nor fowl-a jack-of-all-trades but master of none. Yet, for those willing to embrace ambiguity, the ETF offers a compelling compromise. Its current dividend yield hovers around 3.8%, higher than the broader market but lower than some competitors. In other words, it won’t make you rich overnight, but it might keep you comfortable while you wait.

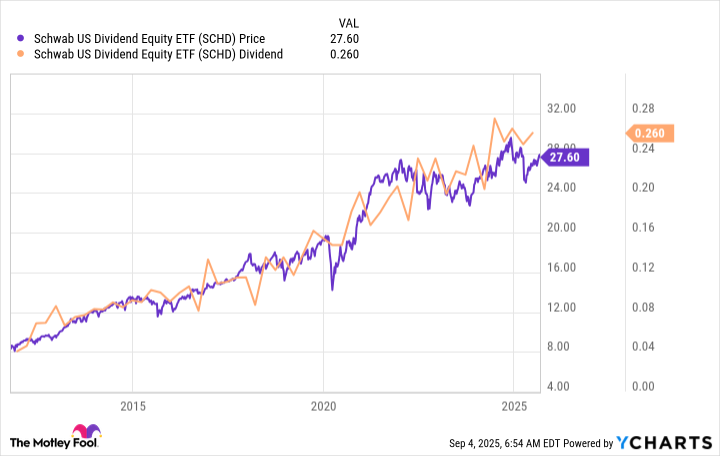

Ultimately, the Schwab U.S. Dividend Equity ETF strikes me as the perfect option for those who don’t want to choose-a bit like ordering the sampler platter at a restaurant instead of committing to a single dish. Over time, it has delivered steady share price appreciation alongside growing dividends, proving that sometimes the safest path isn’t avoiding risk altogether but spreading it thin enough to sleep soundly at night. 🧩

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-09 17:37