Can You Believe This Stock ETF Fell 82% in 2025? You Won’t Believe Why! 😱

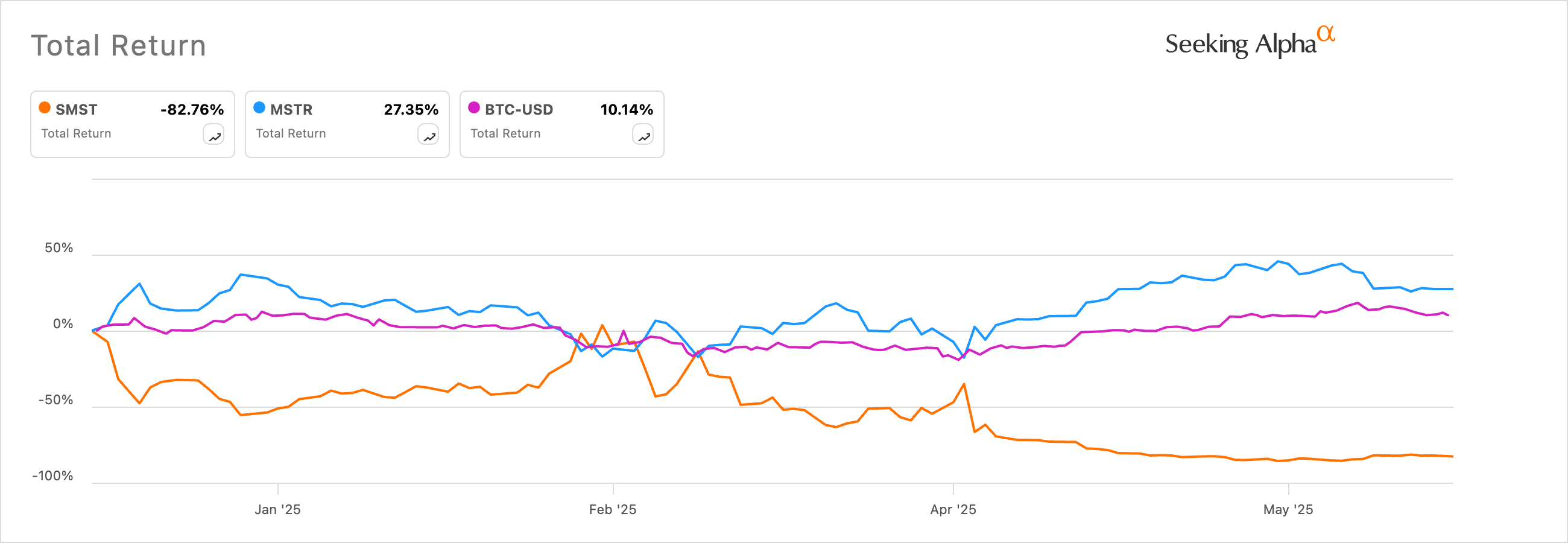

In the grand theatrical spectacle of 2025, Strategy stock took a joyous leap of 27%, outpacing Bitcoin’s modest 12% hop—clearly, folks are piling into stocks like there’s no tomorrow, or perhaps just for a laugh. 🎢

Meanwhile, a diminutive but ambitious ETF, the Defiance Daily Target 2x Short MSTR ETF (affectionately dubbed SMST), decided to take a nosedive of a staggering 82%, settling at a paltry $29—no doubt a record low and a crying shame, considering it held over $42 million in assets. Poor thing, it was probably expecting a gold mine, but got the shaft instead.

This spectacular mishap is all down to SMST’s cunning design: it is structured to seek a -2x return of Strategy stock’s daily change. Yes, you read right—this little fellow rises when the stock falls, and flops when the stock ascends. It’s as if it’s playing a game of reverse hide-and-seek, only it keeps losing. 😅

For instance, on Monday, June 2, while dear old MSTR stocks inched up by 1.30%, our daring ETF SMST took a plunge of 2.50%. Talk about flipping the bird to conventional logic! 🦅

Other leveraged MSTR ETFs haven’t fared much better. The Defiance Daily Target 2x Long MSTR ETF slipped by 4.5%, and the T-Rex 2X Long MSTR Daily Target ETF followed suit with a 6.4% slide. All this while Strategy stock was down over 12% from its high-water mark, sparking a fair amount of hand-wringing among investors—and fools.

Inverse leveraged ETFs like SMST: The Gamble of the Gods

Historically, these inverse ETFs are about as reliable as a paper umbrella in a hurricane. To illustrate, the ProShares UltraPro Short QQQ (SQQQ) crashed 97% over five years—talk about a spectacular fall from grace—while the TQQQ, the bullish counterpart, soared a dizzying 242%. Such is the lunacy of leverage, my dear reader.

Now, barring a miracle, SMST looks headed for more trouble, especially as all signs point to Bitcoin’s inevitable ascent. Ark Invest boldly predicts Bitcoin will soar to $2.4 million by 2030, and BlackRock isn’t far behind with a modest estimate of $700,000. 🤑

Should these forecasts hold water, Strategy stock is poised to climb, as it owns nearly 600,000 Bitcoins—an ever-growing digital hoard, practically a treasure chest for the modern age.

And just to rub salt in the wound, SMST carries an expense ratio of 1.29%, which makes the $3 annual fee of a typical Vanguard S&P 500 fund look downright frugal. Investing $10,000 in SMST will cost you a hefty $129 per year, a princely sum for a gamble that’s about as reliable as a weather vane in a tornado. 🌪️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-02 20:42