Michael Burry, that most peculiar of financial alchemists, whose notoriety as a mortgage-market Cassandra was immortalized in The Big Short, now turns his attention to the realm of athletic wear. Scion Asset Management, his modest yet formidable enterprise, commands $600 million with the dispassionate precision of a man who once bet against a global catastrophe. His portfolio, a surgical collection of stocks and options, now includes a curious specimen: Lululemon Athletica.

One might reasonably inquire what draws this contrarian to a brand that, in recent seasons, has stumbled through a gauntlet of misfortunes-tariffs, inventory shortages, and the relentless tide of competition. Yet here we are, in the peculiar theater of capital markets, where even the most implausible bets find their stage.

The Erosion of a Once-Revolutionary Brand

Lululemon, once the undisputed monarch of athleisure, ascended to prominence by transforming gym wear into a sartorial necessity. Its reign coincided with the pandemic’s forced exile from offices, a circumstance that proved both fortuitous and fragile. Now, as the world returns to desks and dress codes, the brand’s former dominance appears to have curdled into a litany of missteps: missed seasonal color trends, tariff-induced price hikes, and an overstocked inventory of its most coveted items.

Its affluent clientele, accustomed to coddling, now finds itself courted by newer rivals. Return-to-office mandates, those modern-day harbingers of sartorial normalcy, have only deepened the unease. The stock, once a paragon of growth, now languishes 60% below its zenith-a decline that reads less like a collapse and more like a prolonged sigh.

Not Merely Yoga Garments

Yet all is not lost. The 2025 fiscal first quarter revealed a glimmer of resilience. Revenue rose 7%, gross profit 8%, and China-a market as enigmatic as it is lucrative-witnessed a 22% sales surge. CEO Calvin McDonald, ever the optimist, attributes this to “intentional buying behavior” among U.S. consumers. One imagines a populace meticulously budgeting for $150 leggings amid inflationary chaos.

China, that great economic enigma, remains Lululemon’s sanctuary. With plans to open 40-45 new stores this year, the brand clings to its status as a premium purveyor in a land where luxury often masquerades as necessity. Even as U.S. competitors multiply like dandelions in a windstorm, the Canadian-born label persists, its global ambitions undeterred.

The Calculus of Contrarianism

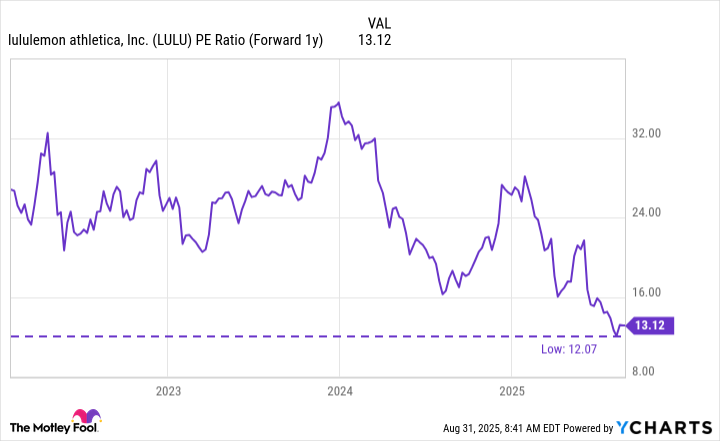

Burry’s interest is not mere whimsy. His purchase of call options-a bet that the stock will rise-suggests a conviction that Lululemon’s nadir is nearing. At a forward P/E of 13, the valuation smacks of bargain-hunting, though whether this is a prudent investment or a quirk of market psychology remains to be seen. The company’s recent product launches-lines such as Daydrift and Shake It Out-hint at an attempt to rekindle the magic, though one wonders if novelty alone can stave off the inevitable.

As the market awaits second-quarter results, the stage is set for either vindication or further ridicule. For now, we are left to ponder the paradox of a brand that, despite its flaws, still commands loyalty-and a hedge fund manager who sees opportunity where others see folly. 🤝

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-09-02 17:33