Apple (AAPL) has long stood as a titanic entity within the framework of the U.S. stock market, a soaring monument to innovation and commercial prowess. Yet, in the recent chapters of its corporate saga, shadows have begun to seep into the limelight, as the meteoric ascendancy of artificial intelligence (AI) has illuminated the fortunes of other tech behemoths. In this shadowy struggle, Apple appears to have retreated, its luster dulled amidst the brilliance of competitors.

Over the last triennium, Apple’s stock has eked out a mere 30% increase, rendering it a near pariah among the “Magnificent Seven” – a tragedy more pronounced when one notes it merely trails the erratic Tesla. Meanwhile, the S&P 500 has outpaced it, guiding the battered investor’s psyche through unfamiliar misgivings. Such disconcerting realities are hardly typical for a company once revered for its indefatigable ascent.

Yet, amid the gusts of uncertainty, flickers of revival breath warmth into the chilling air, hinting at a renaissance anew for this iconic titan.

A much-needed rebound for the iPhone and Mac products

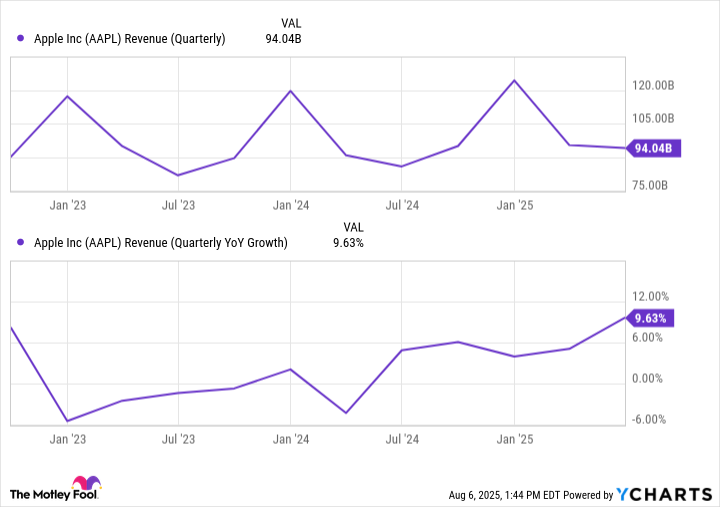

The fiscal third-quarter earnings – the period culminating on June 28 – arrived as a unexpected harbinger of optimism for many observers. Apple’s revenue surged nearly 10% year over year to an exalted $94 billion, a record for the June quarter amidst the cacophony of rising competition. The beloved iPhone, that erstwhile cultural icon, accounted for $44.6 billion, bolstered by the reception of the iPhone 16 series, a beacon of vibrant demand.

In parallel, revenues from the Mac peripherals – encompassing the delightful spectrum of MacBook Pro, Air, iMac, and Mac Studio – surged 15% year over year, totaling $8 billion. However, the tale darkens when considering the plight of the iPad and the concomitant wearables; their sales plummeted by 8% and 9%, respectively, underscoring the harsh reality that even the mightiest giants are not impervious to decline.

In this tempest, Apple’s hardware revenue triumphed, growing by 8% year over year, constituting almost 71% of the company’s total revenue for the quarter. Still, while its services fraternity reached dizzying heights, amassing $27.4 billion, it is the hardware that continues to wield dominion, steadfast in its reign.

This fiscal year-over-year growth in revenue represents the pinnacle of performance witnessed in the past three years, the kind of resurgence that can invigorate a company adrift.

Is Apple finally getting serious about AI?

Yet hanging ominously over Apple’s fortunes has been the specter of AI – or as it has so notably termed it, “Apple Intelligence.” This has been juxtaposed starkly against the vibrant, pulsating urgency exhibited by rivals such as Alphabet and Microsoft in this domain. However, a shifting tectonic plate may be upon us, as whispers of renewed vigor emanate from the Cupertino halls.

Apple’s profound advantage lies in its intimate integration into the lives of millions, ensconced in pockets, homes, and workplaces. The aspiration to entwine AI within its diverse hardware promises to deepen this loyalty, cultivating an even stronger avowal of customer preference. However, this plan has lumbered forward, beset by unanticipated delays.

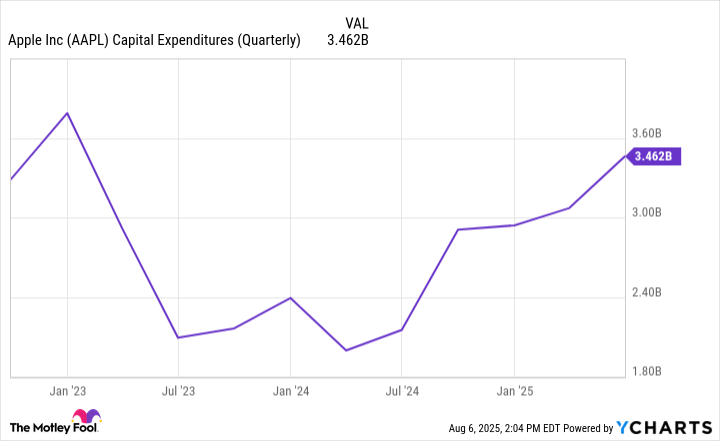

Surely, tides are beginning to turn, as Apple’s management recently proclaimed on their latest earnings discussion the commitment to “significantly increase [its] investment in AI,” encompassing both infrastructural development and human capital. In the latest tranche of fiscal expenditure, Apple allocated nearly $3.5 billion for capital expenditures, its most significant outlay since that fateful fiscal quarter concluded in January 2023.

Apple’s history of cautious exploration cannot be understated. Such intentions of infiltration into AI speak more of a calculated recognition spurred by necessity than an overdue awakening to opportunity – a creeping realization, catalyzed in part by a stock price that reflects not their intrinsic value but a fleeting historical aura.

Apple’s stock looks like a good entry point for investors

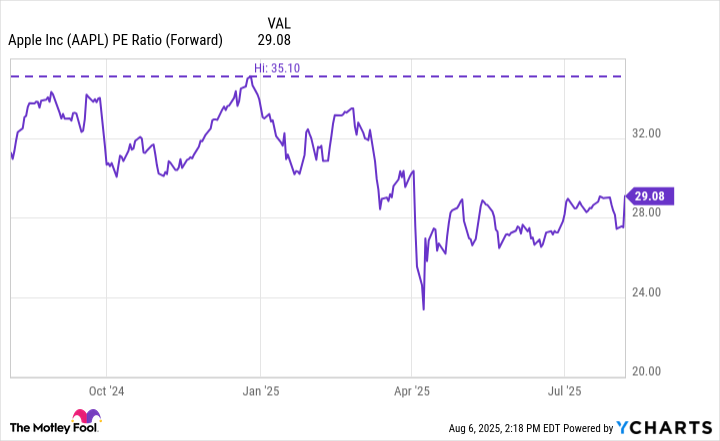

As I pen these thoughts, Apple is trading at 29 times its projected earnings for the coming year, noticeably the second-lowest valuation within the “Magnificent Seven” cohort, a stark contrast to the 35 it held at the year’s inception.

This valuation alone does not necessarily warrant a buying spree; yet it undeniably signals a potential for upward mobility in its investment future. This is especially relevant should its newly forged path in AI unfold in the manner envisioned by management. Armed with $133 billion in cash and liquid assets, Apple possesses ample resources to jockey for position in the fierce race towards AI advancement.

For the discerning investor, there lies opportunity amid changed tides and durable aspirations. 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- USD PHP PREDICTION

2025-08-09 21:01