As the dying embers of 2025 wane, the market hums with the hollow echo of progress. The S&P 500 (^GSPC +0.19%) and Nasdaq Composite (^IXIC +0.31%) inch forward, gains cloaked in illusion-16% and 21% respectively, but at what cost? Nothing here hints at real human effort, only the sterile dance of numbers and speculation, like shadows on a factory wall.

Among these shadows, artificial intelligence stocks have seized the spotlight-an unchecked fever. Nvidia, Alphabet, giants whose names echo in the corridors of power; they surge ahead while the working man, the ordinary investor, watches from the sidelines, overwhelmed and dazed by the glow of their triumphs. Apple, Meta, Microsoft-these corporations toss their day-old bread to the crowds as their stock prices balloon, yet behind this spectacle, the common laborer’s lot remains unchanged.

In this circus of progress, giant tech firms perform stock splits-not for the benefit of the many, but as a ritual, a mark of their inflated prestige. They split, they multiply, but the core remains static: a fortress built on illusions, where value is spun out of thin air, and workers are left to grasp at the shadow of wealth while the rulers laugh from their towers.

What are stock splits and how do they work?

When a stock begins to rise and pulse like a dying patient’s last heartbeat, investors panic. They consider the price too high-a barrier to entry, a symbol of the distant, unattainable. Yet, the true worth of a company lies not in the number on the ticker but in the sweat, the toil behind the façade. A stock split, none other than a magician’s trick, cuts the price in half, doubles the quantity, giving the illusion of accessibility.

Corporate masters understand this psychology-they see the slowing volume, the hesitation in the eyes of smaller investors. So, they split their shares, not to better the company, but to FASHIONABLY appear more approachable, more “democratic.” Microsoft, current price: $490, and a staggering 7.4 billion shares-an empire built on countless tiny pieces.

Perform a 5-for-1 split, and suddenly, Microsoft shares appear to dip-$98 each-though the true value, the market cap, remains untouched. The number of shares balloons, but the illusion persists: what was once expensive becomes merely “affordable” to those who are gullible enough to believe in such magic. Beneath this spectacle, the real interest is in manipulating perception, not creating genuine opportunity.

Perhaps unwittingly, stock splits serve as a form of marketing-whispered propaganda in financial news, parrots repeating the mantra of “growth” and “accessibility.” In the end, it affects little but the illusion, blinding the masses to the reality that their corner of the market remains a struggle, a fight for crumbs in a palace of shadows.

The recent history of stock splits among tech giants

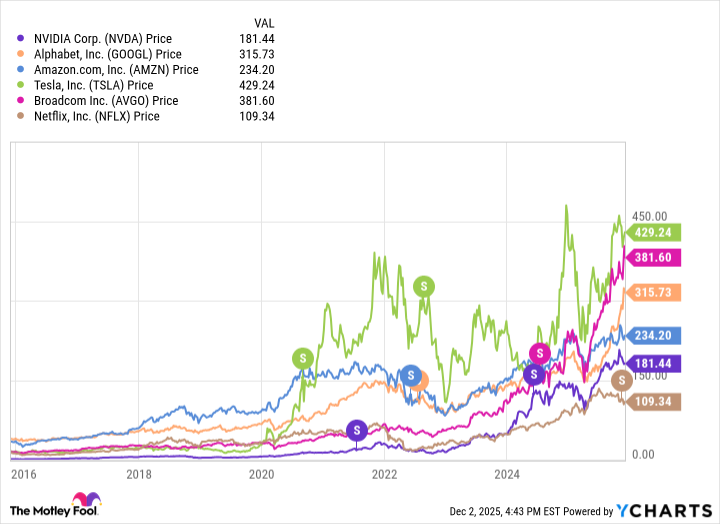

Over recent years, the so-called “Magnificent Seven”-Nvidia, Alphabet, Amazon, Tesla-have all bowed to the ritual. They split their shares, sent their whispers into the wind, signs of their inflated valuations, as if rebirth were guaranteed. Even giants like Broadcom and Netflix fell into the same trap, splitting amidst their soaring prices, masking the truth that their rise was less a victory than a mirage.

The chart tells a story-these companies surged long before they split, their stock prices climbing defiantly, only to deepen the illusion of growth. A spectacle of ascent for the masses, a momentary reviving of hope that soon dissolves beneath the weight of reality.

Why Microsoft may dare to split again in 2026

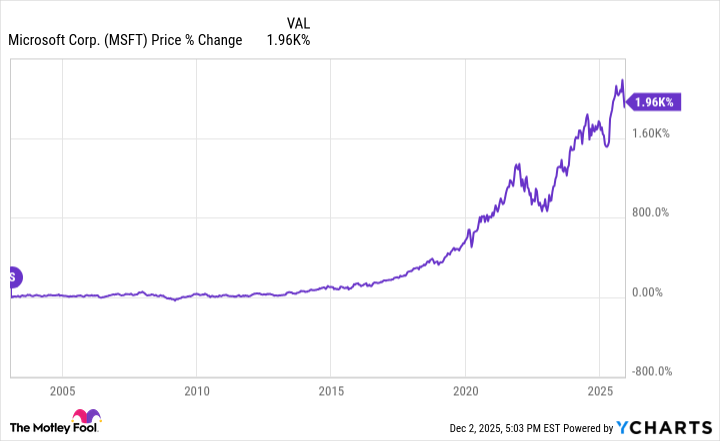

Microsoft, a behemoth, has gained 92% amidst the AI uprising-yet it lags behind the relentless Nasdaq. Its last split was in February 2003, a long, silent decade of stagnation that saw its stock linger as if cursed, reanimated only by the recent AI fever. Since then, Microsoft’s shares have swelled nearly 2,000%, a testament to resilience, or perhaps just the market’s capacity to inflate everything until it bursts.

For ten years, Microsoft floated in a fog-once a titan, now dismissed as a relic. The early days were marked by inertia, as if the company’s heart was stilled, its innovation stifled by comfort and complacency. Today, Azure is its proud shield in the AI battlefield, yet a distant second to Amazon Web Services-more a tale of slow decline than a rising star.

Moreover, Microsoft’s venture into custom chips, a move seen as a step toward independence, remains minimal-an echo of old ambitions, unrealized and fading. Nvidia’s dominance is firm, and Alphabet’s challenge grows louder. Microsoft lingers, clinging to past glories, a shadow of its former self-perceived as archaic, out of tune with the modern symphony.

My contrarian view? All these recent splits, the renewals of their images, are only masks-dressed-up tricks to revive fading enthusiasm. Yet beneath lies the same stubborn truth: Microsoft’s core is built on decades of stagnation. A stock split in 2026? Perhaps a last desperate push to fool the sheeple into believing that the giant has awakened, that the old dog is still worth a chase. But I see through the illusion-it’s a game of prolonging the inevitable decline.

As a seasoned observer, I remain skeptical. The company’s true value is buried under layers of hype and nostalgia. Microsoft’s future is not in reinventing itself but in convincing fools that it’s still relevant. For the wise, the real opportunity lies in the wreckage of this grand spectacle, where the common worker’s hopes and dreams are sacrificed for the shiny illusions of stock splits and fleeting glory. And so, I watch and wait-for this game of illusions will not last forever. 🔥

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-07 08:32