It is a peculiar habit of humankind to anticipate calamity, yet simultaneously to live as if it were eternally deferred. We construct elaborate fortresses of expectation, only to find ourselves surprised when the inevitable breaches occur. Thus, it is not merely prudent, but a necessity born of experience, to contemplate the possibility of market correction – a reckoning, if you will – and to prepare oneself, not with frantic speculation, but with a measured understanding of where true value may reside when the illusory edifice of inflated prices begins to crumble.

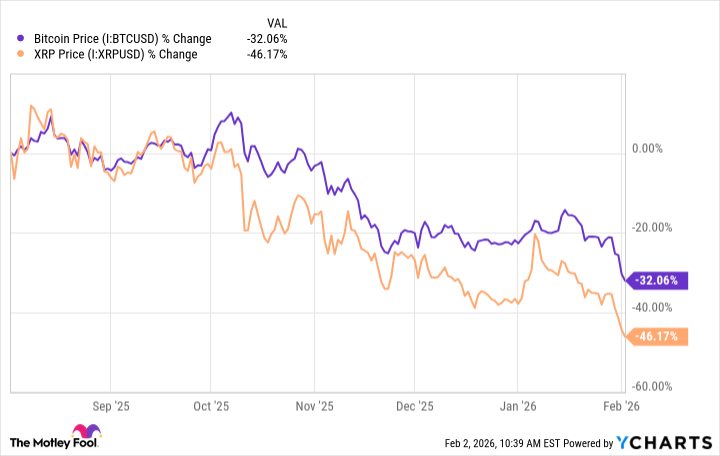

The question before us is not whether a downturn will arrive – history offers ample evidence of their cyclical nature – but which digital assets, born of this new era of financial architecture, might retain a semblance of worth when the tide recedes. Specifically, we consider Bitcoin and XRP, two contenders in a landscape littered with ephemeral promises and the wreckage of failed ventures. The choice is not a simple one, for it demands a sober assessment of inherent resilience, and a willingness to discern substance from shadow.

Let us recall the events of October 10th, 2025 – a date now etched in the collective memory of those who participated in the digital asset markets. A trillion dollars of notional value vanished, a stark demonstration of the fragility inherent in these nascent systems. It was a brutal lesson, and one that should not be forgotten. From the ruins of that collapse, certain patterns emerged, revealing the underlying strengths – and weaknesses – of various contenders.

Bitcoin, it appears, possesses a structural advantage. It is, at its core, a remarkably simple construct – a decentralized ledger, secured by cryptographic principles, and governed by a predictable issuance schedule. This simplicity, far from being a limitation, is its strength. It is the digital equivalent of a well-forged ingot – durable, resistant to corrosion, and possessing intrinsic value. The long-term holders – those who have weathered previous storms – understand this, and their continued faith serves as a ballast against the prevailing winds of speculation. It has demonstrated, time and again, the capacity to recover from precipitous declines – even those exceeding seventy percent – and to emerge stronger, setting new peaks in the process. This is not a guarantee, of course, but a testament to its underlying resilience.

The halving schedule, a deliberate reduction in the rate of new coin creation, further reinforces this scarcity. It is a mechanism designed to counter inflationary pressures and to preserve the long-term value of the network. To accumulate Bitcoin during periods of market distress – to purchase it in small, regular tranches – is not merely a speculative gamble, but a calculated act of preservation – a recognition that true wealth is not measured in fleeting gains, but in the enduring power of sound money.

XRP, however, presents a more complex picture. It, too, has experienced periods of recovery, but its fate is inextricably linked to the fortunes of Ripple, the company that champions its adoption. Ripple markets XRP as a solution for faster cross-border payments and the tokenization of real-world assets. This ambition, while laudable, introduces a layer of dependence – a reliance on the execution of a single entity, and the vagaries of institutional acceptance. The XRP Ledger, while maintained by a broader community, remains fundamentally tethered to Ripple’s vision. This is not necessarily a fatal flaw, but it introduces a vulnerability that Bitcoin, with its decentralized architecture, does not share.

Therefore, in the event of a significant market correction – particularly one triggered by fundamental economic realities – XRP is likely to suffer a more pronounced decline, and its recovery will be hampered by the constraints of institutional adoption and the inherent risks associated with centralized control. To invest in XRP is to place one’s faith in the competence of a single entity – a precarious position in a world governed by uncertainty. If one seeks an asset whose investment thesis requires the fewest external dependencies, Bitcoin, with its inherent scarcity and decentralized architecture, remains the more prudent choice. It is not a panacea, but a bulwark against the inevitable storms that will buffet the financial landscape.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-02-07 13:02