Author: Denis Avetisyan

New research suggests that the rapid pace of technological innovation and its spread through networks can create unstable cycles, potentially leading to periods of stagnation in artificial intelligence.

Dynamical modeling reveals how high investment and diffusion rates in technological innovation can lead to chaotic boom-bust cycles, mirroring historical ‘AI winters’.

Despite ongoing advances, technological progress isn’t always linear, often exhibiting patterns of unsustainable growth followed by abrupt decline. This is explored in ‘Toward a new AI winter? How diffusion of technological innovation on networks leads to chaotic boom-bust cycles’, a study developing interconnected dynamical models to explain these cycles. The research demonstrates that high investment and rapid diffusion within networks of related technologies can generate chaotic boom-bust patterns, mirroring observed trends in markets like NFTs. Could these dynamics foreshadow a renewed ‘AI winter’, and how can we better anticipate-or mitigate-such disruptions in the future?

Forecasting the Diffusion of Intelligence: Beyond Linear Projections

Accurately forecasting the spread of artificial intelligence is paramount, yet conventional predictive models consistently struggle to capture its true pace and impact. These models typically rely on linear projections and historical data from previous technological shifts, failing to account for the unique characteristics of AI – namely, its capacity for exponential growth and self-improvement. The technology’s complexity stems not only from intricate algorithms but also from the interplay of numerous, rapidly evolving factors – including research breakthroughs, data availability, computational power, and shifting economic incentives. Consequently, simplistic analyses often underestimate the potential for rapid, disruptive change, hindering effective strategic planning for both businesses and governments.

Conventional diffusion models, frequently employed to forecast the spread of new technologies, often miscalculate the trajectory of artificial intelligence due to a critical oversight: the interwoven feedback loops driving its development. Unlike simpler innovations, AI’s progress isn’t merely a function of initial demand; rather, increased investment spurred by early adoption directly fuels further supply – more powerful algorithms, larger datasets, and specialized hardware. This, in turn, creates new applications and expands demand, initiating a self-reinforcing cycle. Consequently, a basic model projecting adoption based solely on initial market signals fails to capture the accelerating, and potentially exponential, growth characteristic of AI, overlooking how supply actively shapes demand, and investment responds to both. This dynamic interplay requires a more sophisticated analytical approach to accurately predict the long-term impact of artificial intelligence.

Accurate forecasting of artificial intelligence development requires a deep appreciation for the interplay between financial investment, technological advancement, and evolving market demands. Investors navigating this landscape must recognize that AI’s growth isn’t simply a matter of increasing adoption rates; it’s a complex system where capital influx fuels innovation, which in turn shapes future investment strategies and user expectations. Similarly, policymakers crafting regulatory frameworks or funding initiatives benefit from acknowledging these feedback loops, allowing for interventions that stimulate responsible growth and address potential disruptions. Ignoring these interconnected dynamics risks misallocating resources, hindering innovation, or creating policies that are quickly rendered obsolete by the technology’s rapid evolution. A holistic perspective, therefore, is not merely beneficial but crucial for both maximizing returns and fostering sustainable progress in the field of artificial intelligence.

Predicting the spread of artificial intelligence requires a shift from simplistic, linear forecasting to comprehensive system-level modeling. Traditional diffusion models often treat AI adoption as a straightforward process, failing to capture the intricate interplay between technological supply, market demand, and crucial investment cycles. A systems approach acknowledges that advances in AI not only respond to demand, but also actively shape it by creating new possibilities and altering existing needs. This creates recursive feedback loops – increased investment fuels innovation, which expands applications, further driving demand and investment – that invalidate linear projections. Effectively understanding AI’s trajectory therefore demands a holistic view, one that considers the technology as an evolving, interconnected system rather than a predictable, step-by-step progression.

Modeling the AI Ecosystem: A System Dynamics Approach

System Dynamics modeling utilizes stock and flow diagrams and differential equations to represent the causal relationships driving AI adoption. This approach explicitly models feedback loops – where the output of a process influences its input – to capture the complex interplay between technological advancements and economic factors. For instance, increased investment in AI research and development ( R & D ) leads to faster technological progress, which in turn affects market demand and subsequently influences further investment. These loops can be reinforcing (positive feedback, accelerating growth) or balancing (negative feedback, stabilizing growth), and their combined effect determines the overall trajectory of AI diffusion. By quantifying these relationships, System Dynamics allows for the analysis of how changes in one variable propagate through the system, impacting other variables and ultimately influencing the rate and extent of AI adoption.

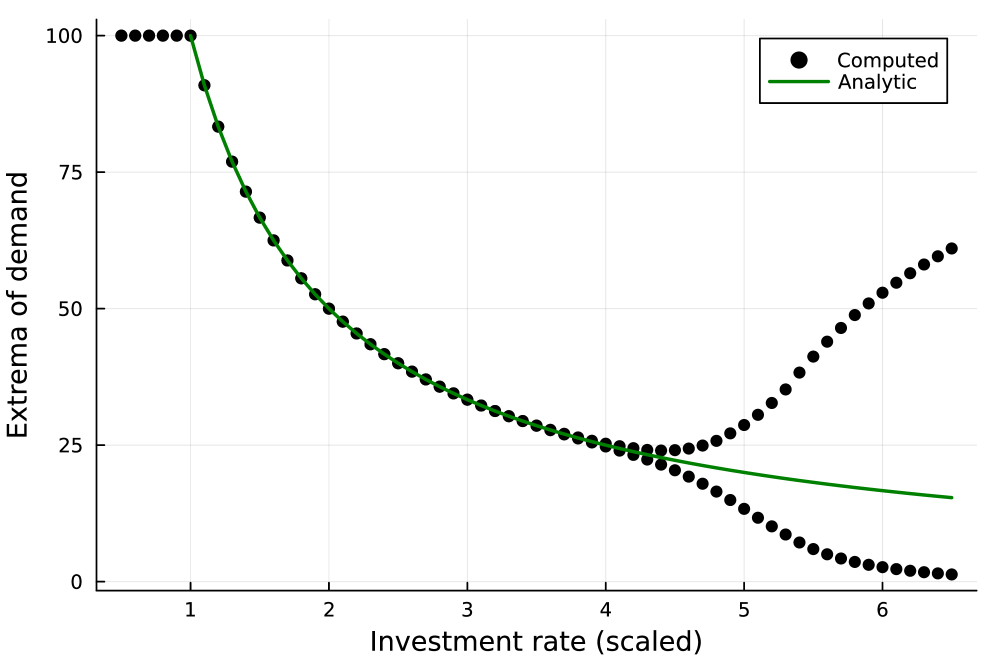

The system dynamics model utilizes quantifiable variables to represent the AI ecosystem. Market capacity is defined as the total potential demand for AI solutions, influenced by factors such as data availability and computational resources. Investment rates, encompassing both public and private funding directed towards AI research, development, and deployment, directly affect the pace of innovation and adoption. Critically, the model also incorporates the impact of open standards – standardized APIs, data formats, and protocols – which reduce integration costs and accelerate AI diffusion by facilitating interoperability and broader market participation. These variables are interconnected within feedback loops to simulate the dynamic behavior of AI adoption over time.

System dynamics modeling allows for the examination of causal relationships within the AI ecosystem through simulation. By adjusting input variables – such as levels of venture capital investment, the rate of algorithmic improvement, or the prevalence of data privacy regulations – the model demonstrates how these changes propagate through interconnected feedback loops. This ripple effect impacts key output variables, including overall AI adoption rates, the concentration of market share among leading AI providers, and the resulting economic growth attributable to AI technologies. The simulations quantify these impacts, providing insights into potential unintended consequences and allowing for the assessment of various policy interventions designed to guide AI’s development and deployment.

Traditional analyses of technology adoption often rely on static models, providing a single snapshot of a system at a specific point in time. System Dynamics modeling, conversely, offers a dynamic perspective by explicitly representing the feedback loops and time delays inherent in AI diffusion. This allows for the observation of how variables interact over time, influencing each other and ultimately shaping the overall trajectory of AI adoption. Rather than predicting a fixed outcome, the dynamic approach simulates the system’s behavior under varying conditions, revealing potential unintended consequences and emergent patterns that would be missed by static analyses. This capability is crucial for understanding the long-term impacts of AI and informing strategic decision-making.

Cyclical Dynamics and the Specter of AI Winters

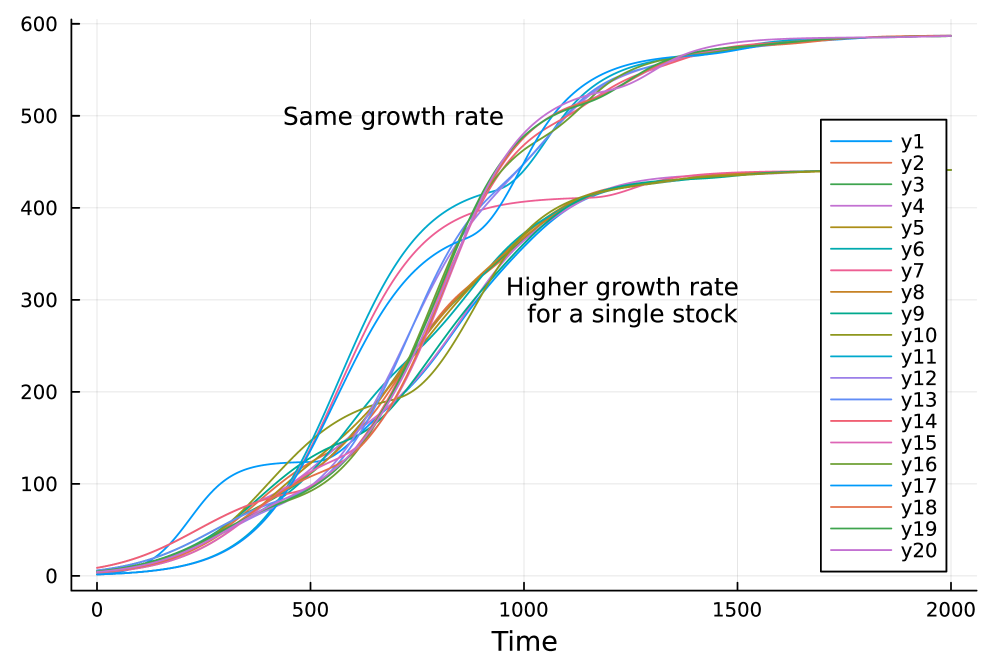

Simulations of AI technology diffusion demonstrate non-linear progression, exhibiting cyclical patterns analogous to those observed in the historical development of other technologies. This means periods of rapid advancement and widespread adoption are predictably followed by periods of stagnation or decline. These cycles aren’t necessarily indicative of fundamental limitations, but rather reflect fluctuations in investment, public interest, and the availability of enabling resources. The observed cyclical behavior suggests that sustained, linear growth in AI is not the default expectation, and that forecasting future progress requires acknowledging the potential for recurring periods of diminished returns and reduced momentum.

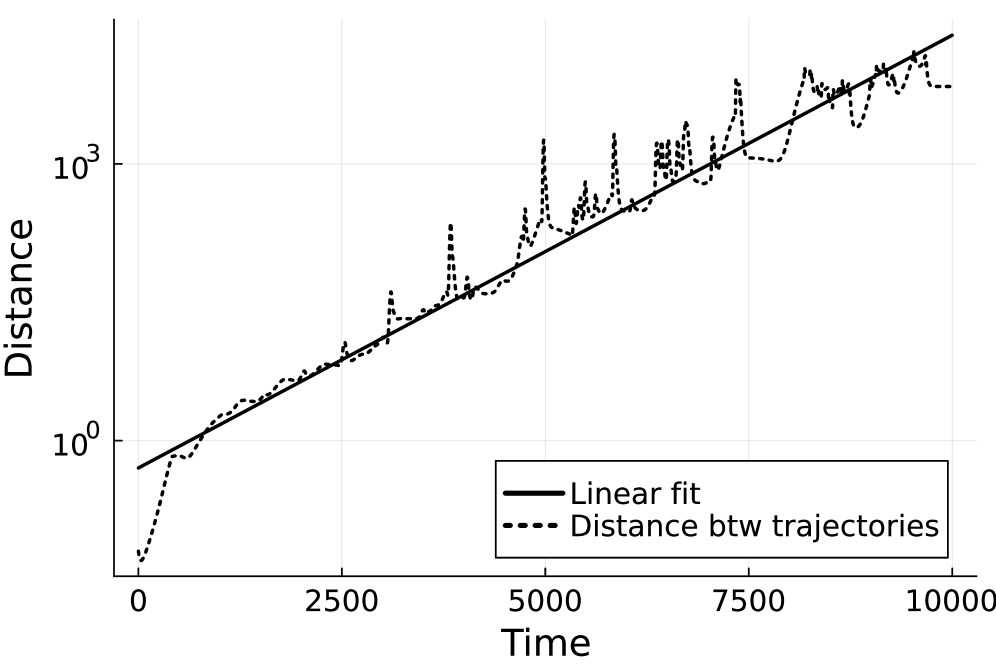

The AI diffusion model, incorporating principles of Chaotic Dynamics, demonstrates sensitivity to initial conditions. This means minor variations in factors such as funding levels, public perception, or algorithmic breakthroughs can result in significantly divergent outcomes in AI progress. This sensitivity is quantitatively indicated by a positive Lyapunov Exponent, measured at 10-3, confirming the system’s chaotic nature. A positive exponent signifies that nearby trajectories in the system’s state space diverge exponentially over time, making long-term prediction difficult and increasing the probability of abrupt shifts, including periods of stalled advancement – commonly referred to as AI winters.

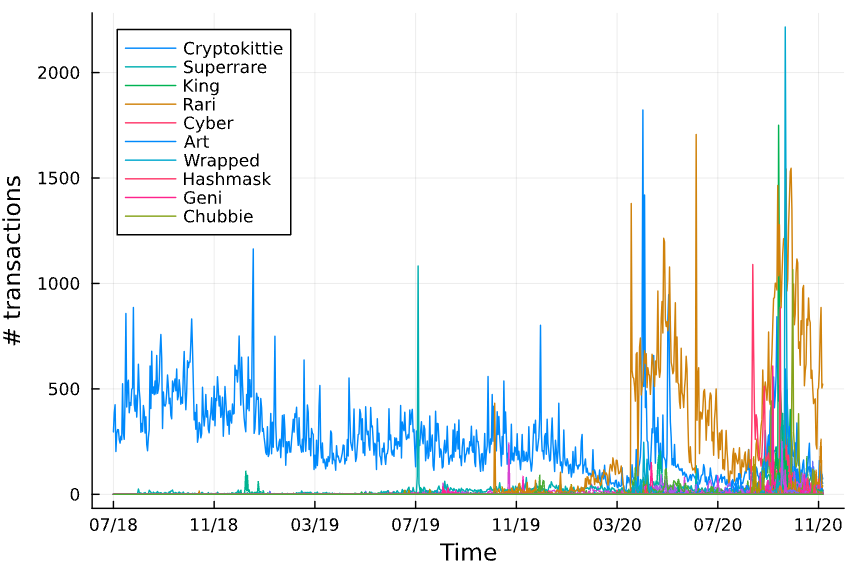

The Non-Fungible Token (NFT) market provides a recent example of rapid technological hype followed by substantial value correction. Initial market capitalization reached approximately $22 billion in January 2022, driven by speculative investment and media attention. However, by December 2022, trading volume had decreased by over 95%, and average sale prices experienced significant declines. This deflationary trend demonstrates the inherent volatility associated with emerging technologies reliant on speculative demand and limited intrinsic value, illustrating how quickly investor sentiment can shift and deflate overhyped asset bubbles.

Given the demonstrated cyclical patterns and sensitivity to initial conditions in AI development, proactive interventions are essential to prevent periods of stalled progress, commonly referred to as AI winters. These interventions should focus on stabilizing research funding, fostering collaboration between academic and industrial sectors, and prioritizing the development of robust, generalizable AI techniques over narrow, hype-driven applications. Specifically, maintaining consistent investment during periods of perceived diminished returns, and strategically diversifying research efforts can buffer against the deflationary pressures observed in rapidly evolving technological domains like the NFT market. Failure to implement such measures risks a return to prolonged periods of reduced funding and diminished public interest, hindering long-term advancements in artificial intelligence.

Sustaining Growth: Counter-Cyclical Strategies for AI Advancement

System dynamics modeling reveals that strategic, counter-cyclical funding is crucial for sustaining artificial intelligence development through economic fluctuations. The research demonstrates that AI progress isn’t linear; downturns can trigger significant reductions in investment, leading to prolonged “AI winters” characterized by stalled innovation and diminished expertise. However, the model shows that proactively increasing funding during these economic dips-essentially, swimming against the tide-can effectively buffer the AI sector, maintaining momentum and preventing the erosion of critical research capabilities. This approach isn’t simply about preventing losses; it’s about capitalizing on opportunities that arise when other sectors are retracting, allowing AI to emerge from downturns stronger and more rapidly advancing. The simulations highlight that such a strategy yields a significantly more stable and ultimately more productive AI ecosystem, ensuring a continuous return on investment and fostering long-term growth.

A robust and adaptable artificial intelligence landscape hinges on the prioritization of open standards. By encouraging interoperability and diminishing dependence on closed, proprietary systems, these standards facilitate broader participation and innovation within the AI community. This approach not only lowers barriers to entry for researchers and developers, fostering a more diverse range of contributions, but also mitigates the risks associated with vendor lock-in and the potential obsolescence of specific technologies. The resulting ecosystem, built on shared protocols and accessible frameworks, exhibits greater resilience against disruption and allows for more rapid advancements, ensuring that the benefits of AI are widely disseminated and sustainably maintained through collaborative development and continuous improvement.

Successfully navigating the future of artificial intelligence requires a shift beyond short-term gains and reactive policies; a deep comprehension of technological paradigms is paramount. History reveals that impactful technologies don’t progress linearly, but unfold in predictable phases – emergence, rapid growth, maturity, and eventual disruption – a pattern observed across innovations from railways to the internet. Recognizing these cyclical patterns allows for proactive investment strategies, mitigating risks during downturns and capitalizing on opportunities during periods of acceleration. Policy decisions, informed by this long-term perspective, can foster sustained innovation by prioritizing foundational research, encouraging open standards, and building resilient infrastructure. Ultimately, understanding that AI is not merely a technological advancement, but a fundamental shift in how systems operate, enables stakeholders to guide its development towards beneficial and lasting outcomes.

System dynamics modeling offers a powerful framework for anticipating and mitigating challenges to sustained AI advancement, moving beyond reactive responses to proactive strategies. This approach doesn’t simply forecast; it maps the complex interplay of factors – funding cycles, talent availability, computational resources, and public perception – revealing potential feedback loops and unintended consequences. By simulating these interactions, researchers and policymakers can test the effectiveness of interventions before implementation, identifying policies that stabilize development during economic fluctuations and prevent the stagnation of ‘AI winters’. Crucially, such modeling highlights the importance of long-term investment horizons and the need to address systemic vulnerabilities, ultimately unlocking AI’s full potential to deliver broad societal benefits and ensuring its trajectory remains positive even amidst external disruptions.

The study illuminates how readily innovation diffuses across networks, yet also reveals the inherent instabilities within such systems. This mirrors a fundamental principle articulated by Albert Einstein: “The definition of insanity is doing the same thing over and over and expecting different results.” The models demonstrate that unchecked investment and rapid diffusion, while initially appearing successful, can quickly lead to unsustainable cycles – a repeating pattern of boom and bust. Just as a complex organism requires careful balance, so too does technological advancement; neglecting systemic vulnerabilities ensures a return to prior states – the very ‘AI winter’ the research seeks to understand and potentially mitigate through nuanced system dynamics.

The Looming Pattern

The models presented here suggest a disquieting truth: accelerating innovation isn’t necessarily synonymous with sustained progress. The very mechanisms driving rapid diffusion – network effects, positive feedback – appear intrinsically linked to the potential for systemic instability. One cannot simply inject capital into the system and expect linear growth; the architecture of innovation, like a circulatory system, demands a holistic understanding. A blockage in one area inevitably impacts the whole.

Future work must move beyond isolated case studies and embrace the complexity of interconnected systems. The current focus on maximizing diffusion rates, while superficially appealing, ignores the underlying dynamics that govern long-term sustainability. Exploration of dampening mechanisms – perhaps analogous to regulatory processes in biological systems – is crucial. Simply put, one must consider not only how innovation spreads, but when and under what conditions it should be slowed, guided, or even pruned.

The specter of ‘AI winters’ isn’t a failure of technology, but a predictable consequence of ignoring the inherent limitations of complex adaptive systems. To avoid repeating past cycles, the field requires a shift in perspective: from chasing exponential growth to cultivating resilient, self-regulating innovation ecosystems. The pursuit of novelty, untethered from an understanding of systemic consequences, is a path not to progress, but to recurring disillusionment.

Original article: https://arxiv.org/pdf/2602.03620.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2026-02-04 06:58