August arrived like a soggy Monday, and Bitcoin decided to take a nosedive, tumbling down to $114,337. A fiery mix of Trump’s tariff tantrums and market jitters stirred the pot, making everyone clutch their digital pearls.

But hold onto your hats-something interesting is afoot. The panic that once gripped investors seems to be easing. Bitcoin’s moves are less about screaming fear and more about the strange dance of market conditions-like a drunkard staggering home, trying to find the door.

Bitcoin’s Selling Spree Slows to a Snail’s Pace

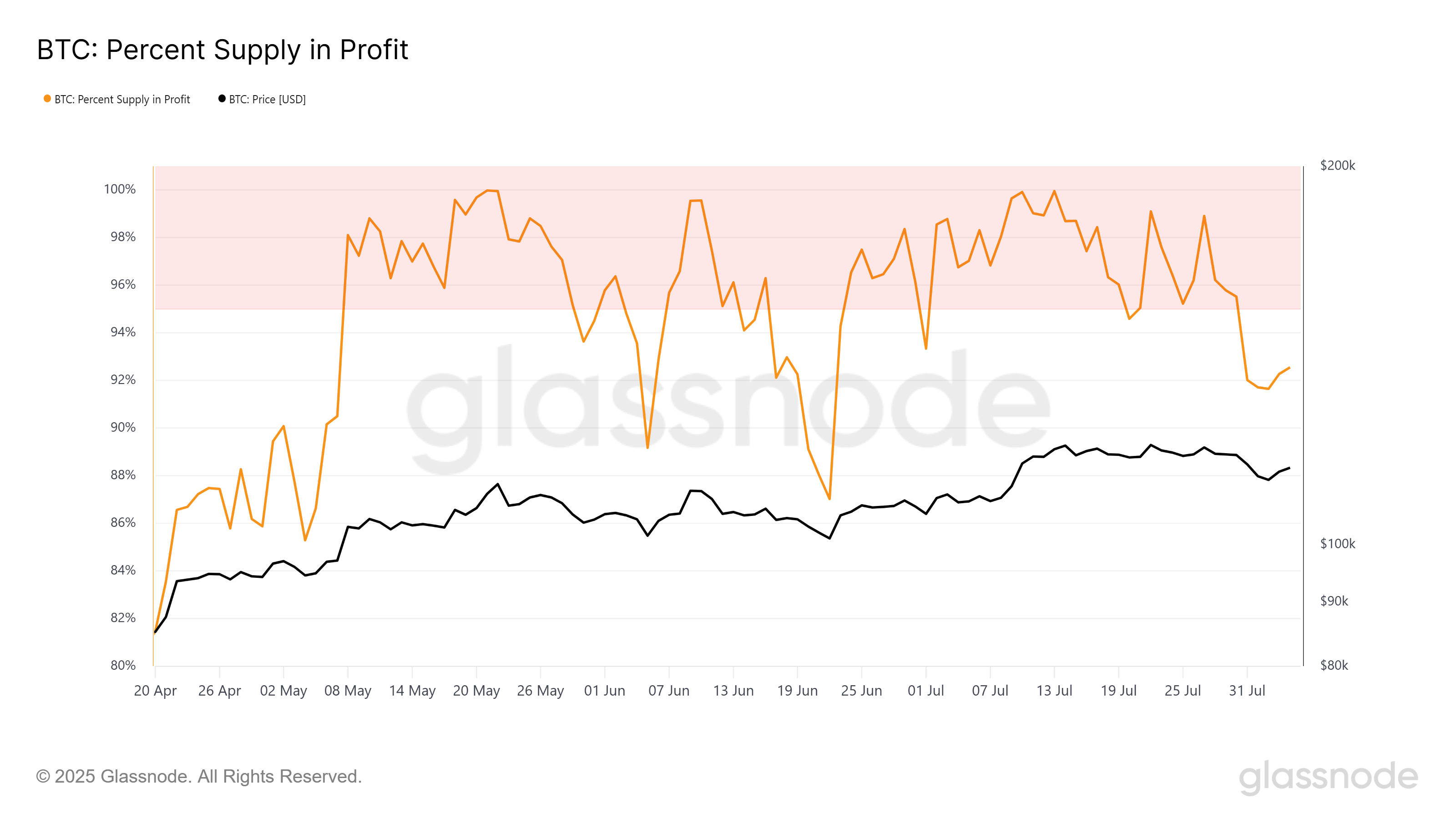

This week, Bitcoin’s profit-holders cooled their jets, dropping below a 95% profit share. Turns out, the market’s been riding high on a bubble of overconfidence, like a balloon about to pop. After a month of bullish bounces and dollar signs, the profit ratio dips to 92.5%, soothing some of that sell-off swagger.

It’s like the market finally yawned, saw the time, and decided maybe, just maybe, the sky isn’t falling-yet. This subtle shift hints at a calmer, maybe even sunnier outlook, provided nobody pulls the rug from under it.

The big pink elephant in the room: exchange balances are climbing to a four-month high, like a caffeinated squirrel hoarding acorns. This usually means folks are selling, tired of the bullish hype, and secretly hoping for a do-over. But for now, the frenzy might be losing its steam, thanks to the looming shadow of trade wars and tariff dramas.

With all this hoopla dying down, Bitcoin might find a cozy corner to sit and breathe, possibly even gaining some ground as the market takes a breather. Good news, maybe, if you like a slow climb and less chaos.

The Price Hanging By a Thread

Bitcoin is stubbornly sticking around the $114,337 mark, looking nervously over its shoulder. The Parabolic SAR is giving a warning sign-kind of like your grandma’s static hair-hovering above the candles. But the 50-day EMA is acting like that dark horse friend who never gives up, holding strong as support. So, Bitcoin’s likely to just hang out between $110K and $115K, waiting for something to happen.

If it manages to cross $115,000 and make it stick, a small rally to about $117,261 might happen-like a dog chasing its tail, hopeful but unlikely to catch anything big soon. Running past $120,000? Nah, that’s probably just wishful thinking, like expecting a unicorn at the county fair.

But beware-the external villains, like tariffs and trade wars, could stir up more trouble. If Bitcoin drops below $111,187, it might tumble down to $109,476-like a child falling off a bicycle, surprising but probably not the worst. If it slips under $110,000, the whole “bullish” illusion might evaporate faster than a snow cone in July.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-05 14:01