The Bitcoin Empire Strikes Back: Altcoin Season’s Demise

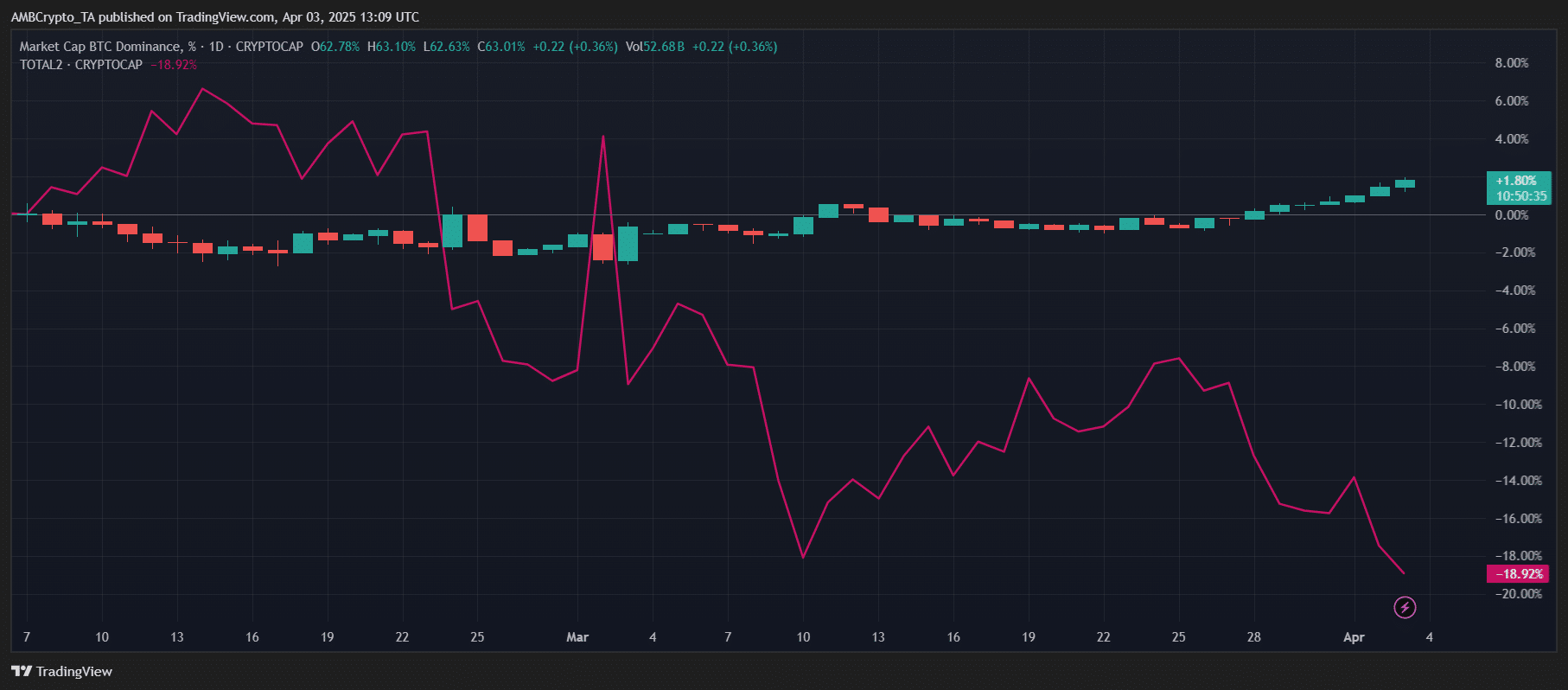

- Bitcoin’s dominance has reached a staggering 63%, a bearish sign for altcoins across all metrics

- Stablecoin flows suggest a risk-off phase, delaying any major altcoin breakout

It would seem that Bitcoin [BTC] has tightened its grip on the wider crypto market, leaving altcoins to wither away like a bouquet of wilted flowers 🌼.

With its dominance now over 63%, the latest market structure might be hinting at deep struggles for altcoins. It’s as if they’re trapped in a never-ending cycle of despair 🌪️.

This shift was highlighted by Alphractal CEO Joao Wedson in a tweet contrasting Bitcoin’s price with an Altcoin Season Index. It’s a stark reminder that altcoin seasons are as rare as a unicorn sighting 🦄.

At the time of writing, fewer than 25% of altcoins seemed to be outperforming Bitcoin — A textbook Bitcoin Season. The writing is on the wall, my friends: Bitcoin is the king, and altcoins are just peasants 🤴.

The Few, the Brave, the Forgotten

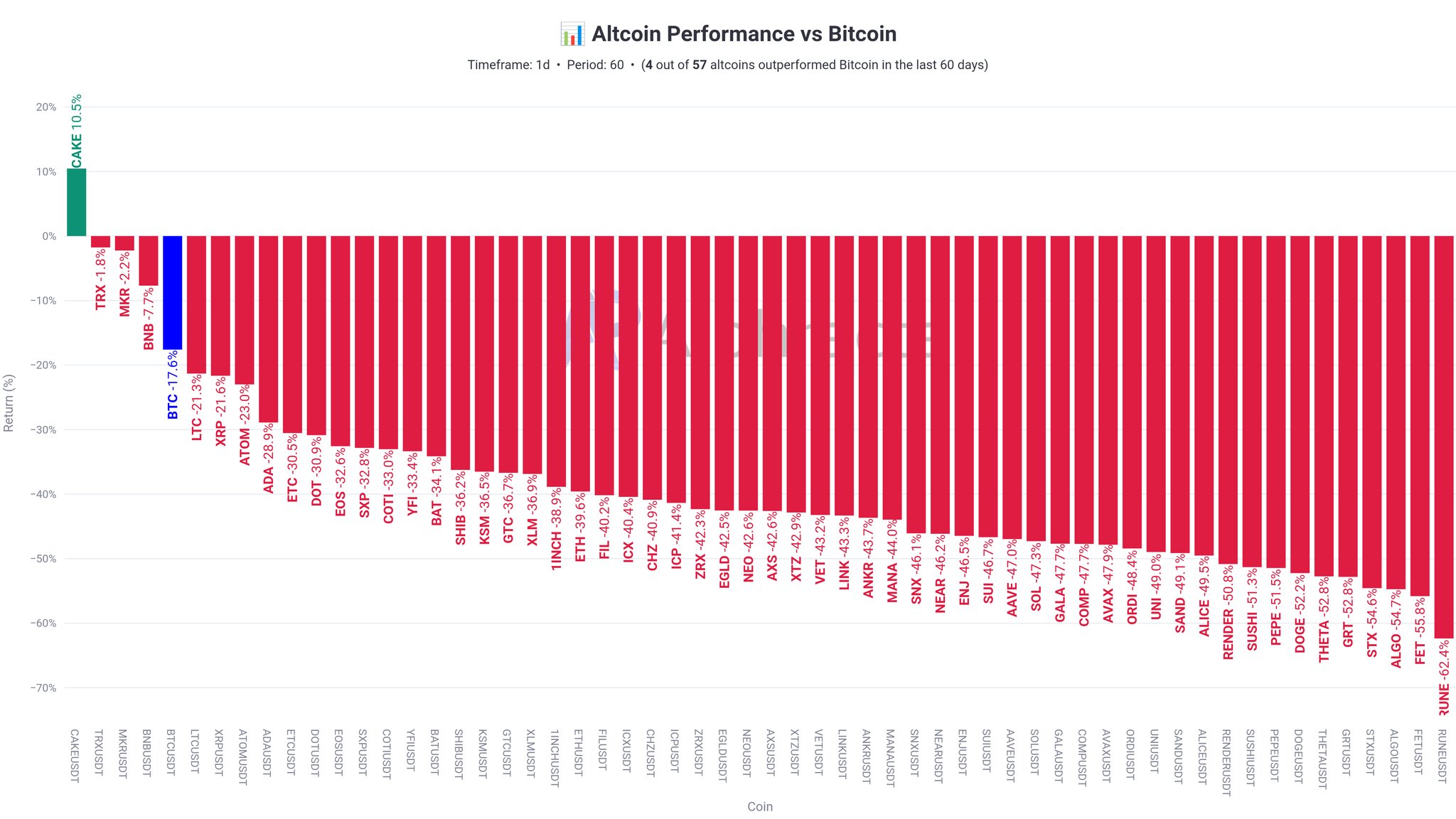

According to Alphractal, just 4 out of 57 altcoins have outperformed Bitcoin, which itself dropped by -17.6% on the charts. Among the few outperformers, PancakeSwap [CAKE] posted the only positive returns with figures of +10.5%. A small victory, but a victory nonetheless 🏆.

To put it simply, the underperformance is stark. Most altcoins returned between -20% and -72%, with JUNE leading losses at -72.4%. Bitcoin, despite its own drop on the charts, still remains a relative safe haven. It’s like a warm hug on a cold winter’s night 🧸.

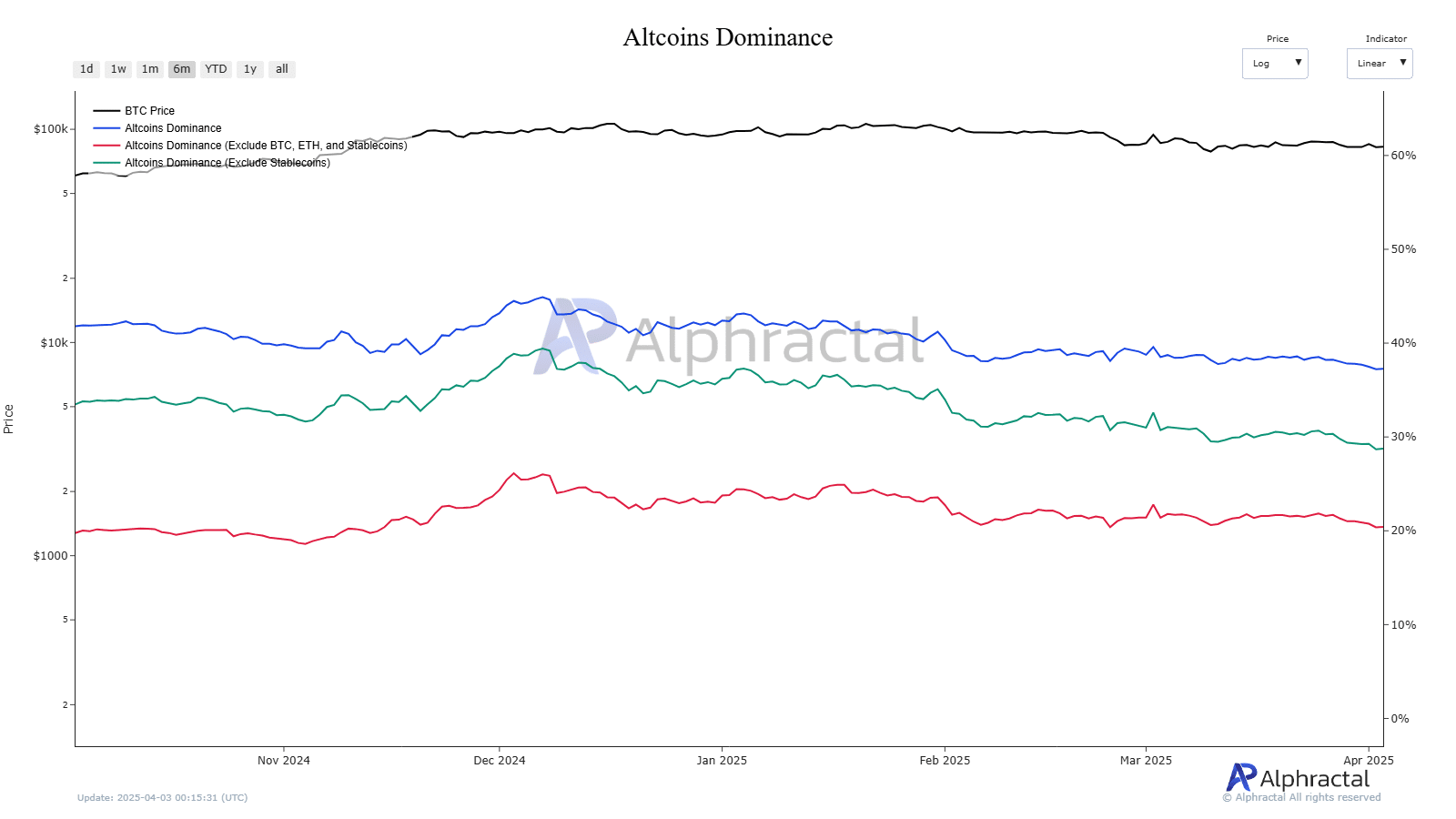

On the contrary, altcoin “dominance” tells us the same story. Since November, the altcoin market’s share has dropped from 41% to 37%. Excluding stablecoins, it actually slipped from 35% to 28%. It’s as if altcoins are slowly disappearing into thin air 🌫️.

The Vanishing Act of Altcoin Credibility

Filtering out Bitcoin, Ethereum, and stablecoins paints an even bleaker picture, with shares for the same falling from 23% to 20%. Given everything that has been happening, the aforementioned decline simply confirms a lack of investor conviction in non-Bitcoin assets. It’s a sad, sad tale 🌧️.

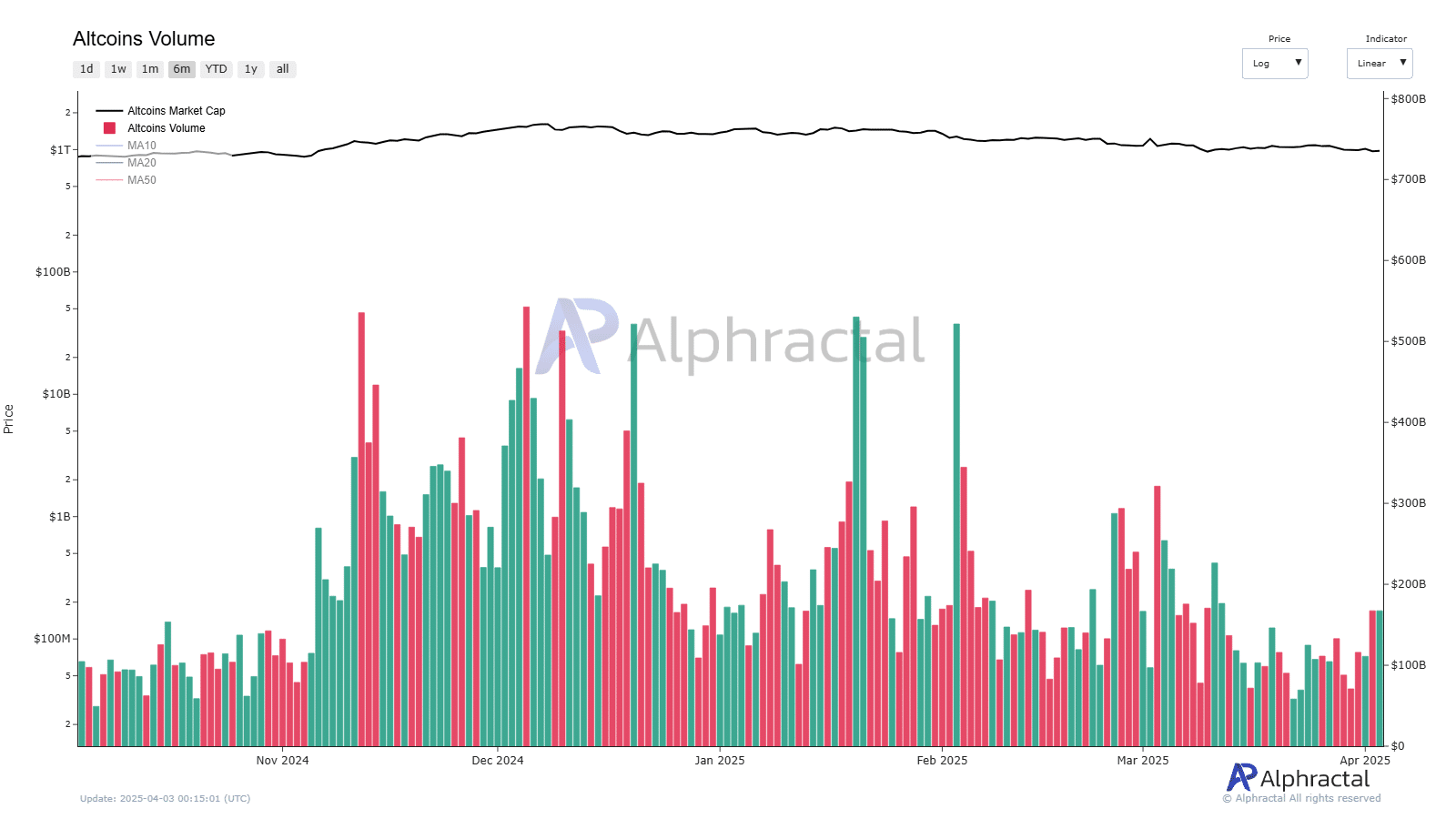

Momentum in trading has also vanished lately. On 05 December, the altcoin market cap peaked at $1.43 trillion, with volume at $542.63 billion. By 03 April, however, those numbers fell to $975.64 billion and $137.31 billion, marking 32% and 296% drops, respectively. It’s like watching a balloon deflate 🎈.

The Peak of Despair

Bitcoin’s rise in dominance also coincided with clear signals from the Stablecoin Supply Ratio (SSR). 23 February stands out as a turning point because both Bitcoin’s price and the SSR peaked simultaneously. It’s a reminder that even the most optimistic of us can fall victim to the cruel whims of the market 🌪️.

Bitcoin peaked at $96,209, alongside a 16.03 SSR. Within three days, however, both reversed sharply. By April, BTC fell to $81,800, and the SSR dropped to 14.21. It’s a stark reminder that even the mighty can fall 🤴.

This alignment can be seen as a sign of how liquidity shifts signal trend exhaustion. Importantly, despite Bitcoin’s own losses, its market dominance rose, not fell. It’s a testament to the power of the Bitcoin empire 💪.

Bitcoin or Bust?

Short-term optimism around altcoins exists. However, data also revealed that without a structural shift in dominance and liquidity, any rallies may remain isolated and brief. It’s a cruel joke, really 🤣.

For now, the smart money appears to be staying parked in Bitcoin, or waiting on the sidelines. It’s a wise decision, really. After all, why take a risk when you can play it safe with the king of cryptos? 🤷♂️

Read More

2025-04-04 11:09