“The Bitcoin Bear: Will the Price Plummet to $72,000?”

It seems the bitcoin party is over, at least for now. Despite the long-term optimism, the short-term outlook is looking rather… gloomy.

Investors, it seems, have lost their mojo. The market is in a state of utter confusion, and the price is paying the price. Or should I say, the price is paying the penalty for the investors’ lack of enthusiasm? 🤑

Bitcoin Needs Investors’ Backing (and a Shot of Espresso)

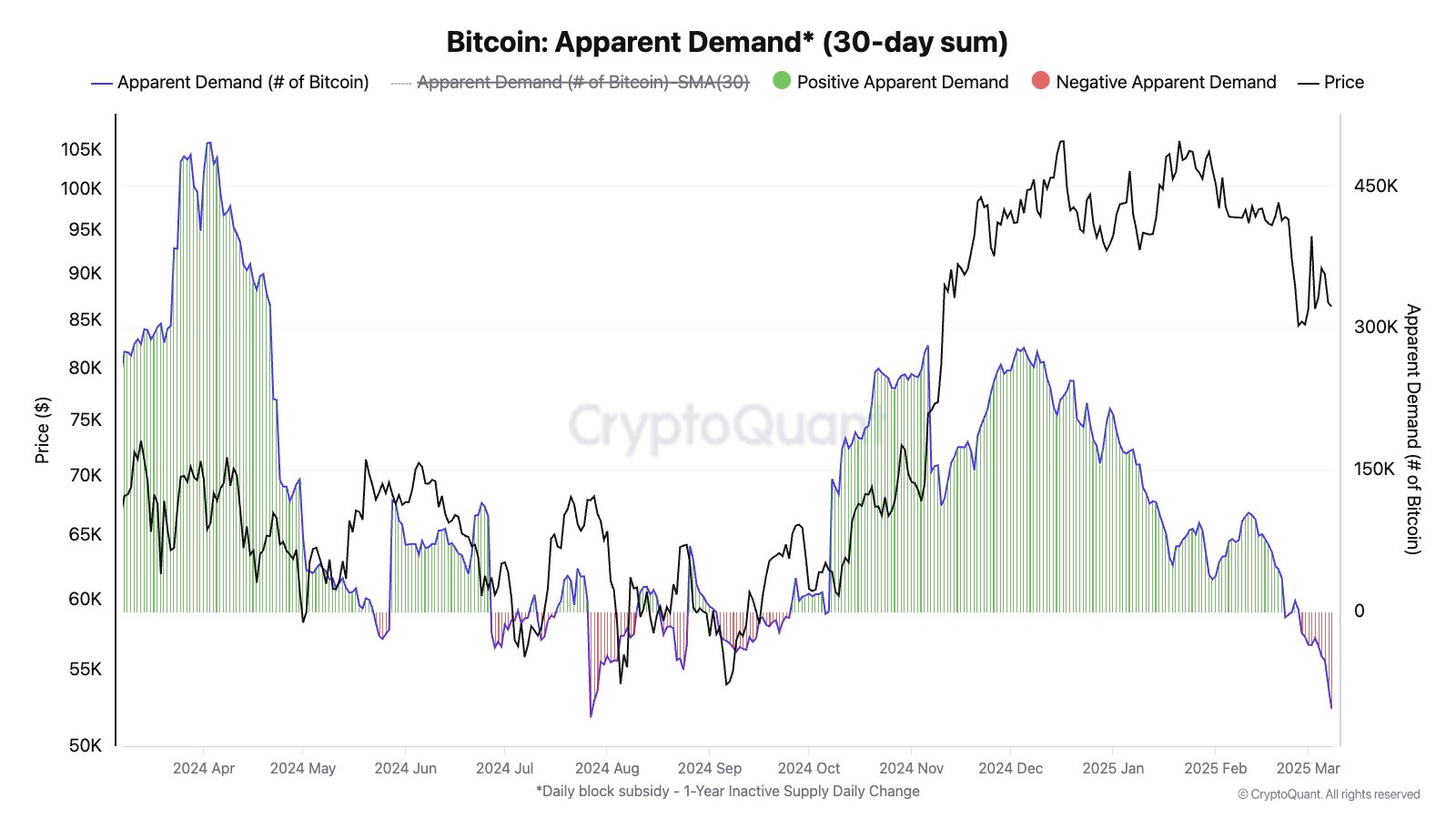

It appears the demand for bitcoin has taken a nosedive, with spot demand contracting sharply in recent days. This is the biggest decline since July 2024, and it’s the first time in over four months. It’s as if investors have lost faith in the crypto king. 😔

A shrinking demand suggests that market participants are hesitant to enter new positions. If demand doesn’t recover soon, bitcoin could struggle to sustain its current price levels, increasing the risk of further drawdowns. It’s like a game of musical chairs, but with bitcoin and a lot of uncertainty. 🎶

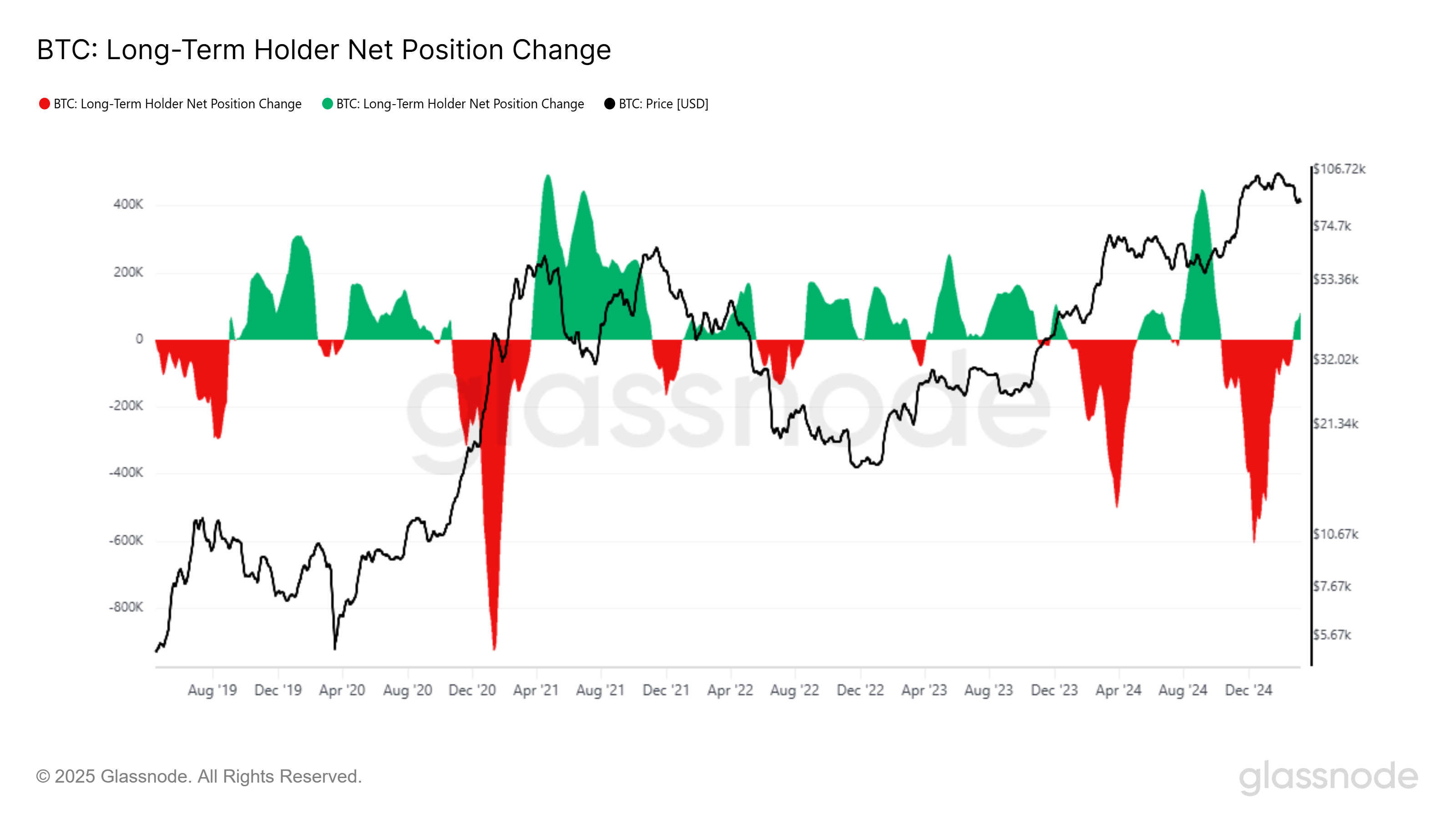

Long-term holders (LTHs) have shifted toward accumulation overselling, as shown by the LTH Net Position Change metric. Over the past 30 days, these investors have accumulated more than 107,413 BTC. Historically, LTH accumulation signals long-term confidence, but in the short term, it has often preceded periods of price weakness. It’s like a double-edged sword – on the one hand, it’s a sign of long-term confidence, but on the other hand, it could lead to short-term volatility. 🤯

LTHs tend to accumulate at lower prices and begin distributing during bull runs. This pattern suggests bitcoin might still face some downside before a meaningful recovery begins. It’s like a rollercoaster ride, but with a lot more uncertainty. 🎠

BTC Price Could Fall Further (and Further, and Further…)

Bitcoin’s price, currently at $82,305, is moving within a broadening descending wedge. While this pattern is historically bullish on a macro scale, in the short term, it indicates a higher likelihood of continued downside. It’s like a seesaw, but with a lot more risk. 🤹♀️

Given the market conditions, the short-term price prediction is that bitcoin could lose the crucial $80,000 support level and fall to test $76,741. If broader macroeconomic factors worsen, the decline could extend further, potentially reaching as low as $72,000. Such a scenario would put additional bearish pressure on the crypto market. It’s like a perfect storm, but with a lot more uncertainty. ⛈️

However, a shift in investor sentiment could change this trajectory. If accumulation increases at the psychological support of $80,000, bitcoin may regain bullish momentum. A move past $82,761 would pave the way for BTC to surpass $85,000, eventually reaching $87,041. Such a development would invalidate the bearish outlook and signal renewed market strength. It’s like a phoenix rising from the ashes, but with a lot more crypto. 🦄

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-10 09:55