Artificial intelligence became Wall Street’s favorite parlor trick in 2022. Suddenly, companies could slap an “AI” sticker on their product and watch their stock prices levitate. Nvidia, the semiconductor sorcerer, grew twelvefold. The “Magnificent Seven” tech titans feasted. Even Palantir, that shadowy data-mining outfit, turned into a darling of Fortune 500 boardrooms. Such is life when investors mistake a buzzword for a business model.

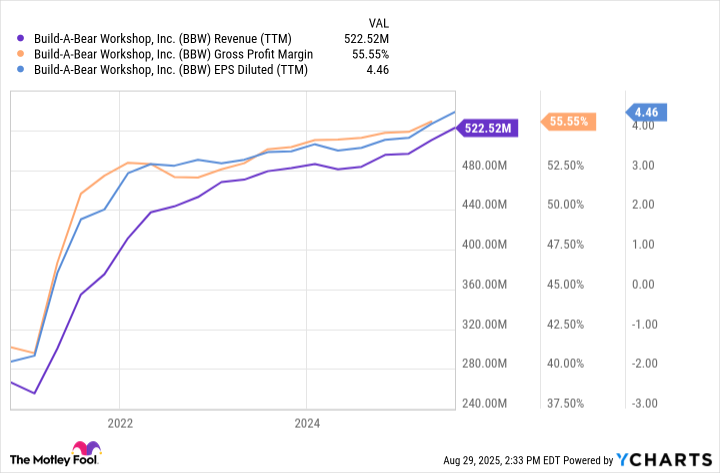

But while the world fixated on circuits and algorithms, a different kind of magic happened in the toy aisle. Build-A-Bear Workshop-yes, the place where children stuff synthetic guts into plush animals-delivered a 2,390% return over five years. That’s not a typo. The company outperformed every AI darling, all while selling products that cannot generate quarterly reports or mine cryptocurrency. So it goes.

A bear in need of mending

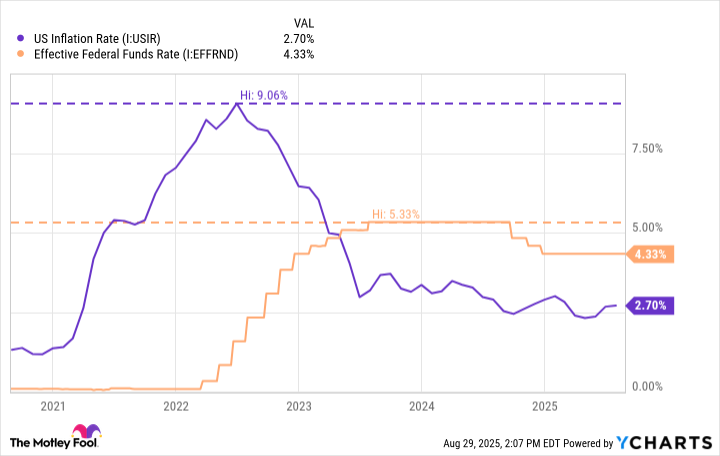

Let us consider the odds. The retail apocalypse had already vaporized Sears, JCPenney, and countless others. E-commerce giants loomed like kaiju over Main Street. Then came inflation, interest rates, and a global pandemic that emptied malls faster than a fire drill. Build-A-Bear’s core demographic-parents with disposable income and children who still enjoy touching stuff-seemed doomed. And yet.

The resurrection of Mr. Squiggles

Build-A-Bear didn’t reinvent capitalism. It remembered a forgotten truth: people will pay for experiences that make them feel briefly alive. The company transformed stores into Disneyland for the Cabbage Patch generation. Families who couldn’t afford Disney World could still spend $50 to assemble a teddy bear while feeling like participants in a wholesome American tradition. Nostalgia, it turns out, is recession-resistant.

Licensing deals with Disney and the NFL followed. Suddenly, Build-A-Bear wasn’t just selling toys-it was trafficking in cultural relics. Adults began collecting limited-edition bears dressed as Mickey Mouse or Tom Brady. The store became a pilgrimage site for those who miss the 1990s. Repeat customers returned like clockwork, lured by new character drops. The cash registers chimed. The shareholders smiled. Such is life.

Cheap, if you can find one

Today, Build-A-Bear trades at a forward P/E of 18. The S&P 500, bloated by tech unicorns playing dress-up as public companies, sits at 23. This means investors collectively believe the market’s froth will outlast a bear that stitches itself anew every quarter. Perhaps they’re right. Then again, value investing has always been the art of disagreeing with crowds, preferably while they’re panicking.

Here lies the paradox: Build-A-Bear’s resurgence seems both miraculous and mundane. Its stores won’t disrupt banking or cure diseases. But it feeds a hunger no AI can replicate-the desire to touch, to create, to own something that doesn’t require a software update. In a world of intangible assets and speculative frenzies, that might qualify as durable competitive advantage. Or maybe we’re just getting sentimental in our old age.

At current prices, the bears are still hungry. They won’t bite. They might just keep stuffing their way upward. Investors would do well to remember: plush toys don’t send quarterly guidance, but they do make excellent companions during market crashes. 🐻📉

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 03:58