The pronouncements from Ark Investment Management, with their projections of a deca-trillion-dollar horizon for autonomous transport, arrive like missives from a distant, gilded age. They speak of affordability, of seamless movement, but rarely of the underlying currents that shape such transformations. The assertion that self-directed carriages will unlock a new era of access obscures a more fundamental truth: the consolidation of power, the subtle architectures of control that will inevitably accompany this technological advance.

Tesla, with its Cybercab – a vessel named with a peculiar blend of futurism and austerity – has become the visible symbol of this ambition. Yet, to focus solely on the vehicle itself is to succumb to a dangerous simplification. The true contest will not be won by the builder of the most polished machine, but by the entity that commands the network, the one who possesses the indispensable infrastructure and, crucially, the trust – or, more accurately, the acquiescence – of the traveling public.

Uber Technologies, a name that once evoked images of disruption and individual empowerment, now stands as a more sober, and perhaps more accurate, reflection of this reality. It is not a question of superior engineering, but of accumulated advantage. For fifteen years, this organization has been diligently mapping the capillaries of urban movement, collecting data, refining algorithms, and establishing a pervasive presence in the lives of millions. It is a digital panopticon, subtly shaping demand, directing flows, and, increasingly, dictating the terms of engagement.

To suggest that Tesla, burdened with the task of constructing an entire ecosystem from the ground up, can readily challenge this established dominion is, at best, naive. It is akin to proposing that a newly forged artisan can compete with a centuries-old guild. The advantage lies not in innovation alone, but in the weight of accumulated capital, the density of connections, and the sheer inertia of a network already in motion.

The Network’s Embrace: An Advantage Forged in Time

The pursuit of autonomous mobility demands more than simply a vehicle capable of navigating roads. It requires a seamless digital infrastructure, a platform that anticipates needs, and, above all, a network sufficiently robust to meet demand without succumbing to the inefficiencies of scarcity or the perils of oversupply. Uber, through years of relentless expansion, has cultivated precisely this capacity. Nearly two hundred million monthly active users – a number that continues to swell – attest to the convenience, and, perhaps, the inevitability, of its embrace.

Tesla, meanwhile, remains tethered to the production of physical goods, a realm of diminishing returns and increasing complexity. To simultaneously manufacture vehicles and construct a parallel network is a task of Herculean proportions, a logistical nightmare that threatens to consume resources and divert attention from its core competencies. It is a testament to the ambition of its leadership, but also a warning sign of potential overreach.

Uber’s strategy, while not devoid of its own ethical complexities, is predicated on a more pragmatic understanding of the landscape. By forging partnerships with over twenty companies in the autonomous vehicle sector – including Alphabet’s Waymo and Stellantis – it has effectively outsourced the risks and uncertainties of technological development. Waymo, completing over 450,000 autonomous trips weekly, and Stellantis, committing to the production of 5,000 robotaxis specifically for Uber’s network, represent not merely suppliers, but tributaries flowing into a larger, more formidable current. Nvidia’s Drive Hyperion platform, powering these vehicles, further solidifies the interconnectedness of this emerging ecosystem.

Uber, in essence, has positioned itself as the orchestrator, the conductor of a symphony of innovation. It does not need to perfect a single design; it simply needs to ensure that the instruments play in harmony. Tesla, by contrast, is attempting to build the entire orchestra itself, a task that borders on the Sisyphean.

The Illusion of Value: A Discrepancy Demanding Scrutiny

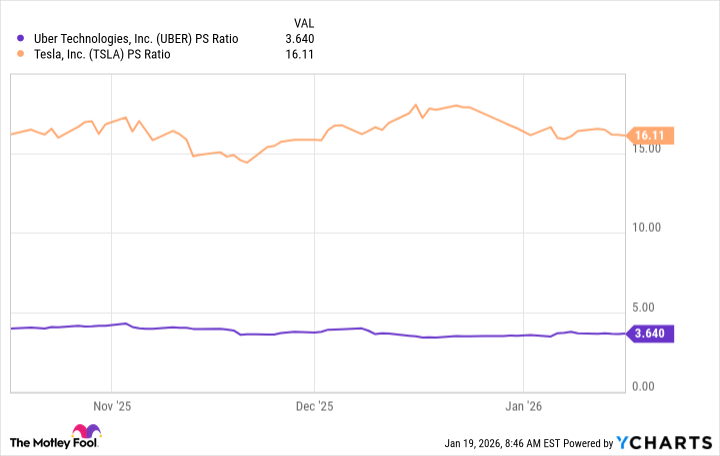

The financial metrics, too, reveal a disturbing asymmetry. While Uber’s revenue has grown by a respectable 17% over the past three quarters, Tesla’s has inexplicably contracted by 3%. Yet, the market continues to reward Tesla with a valuation four times that of Uber, a discrepancy that defies rational explanation. The price-to-sales ratio – a measure of market sentiment relative to revenue – stands at 3.6 for Uber and a staggering 16.1 for Tesla.

The price-to-earnings ratio further exacerbates the imbalance. Tesla trades at an astronomical 292, nine times that of the Nasdaq-100 technology index. This is not merely a matter of market exuberance; it is a testament to the power of narrative, the ability of a charismatic leader to captivate investors and distort perceptions of value.

The potential for autonomous ride-hailing to transform Uber’s financial results is undeniable. During the third quarter of 2025, the company disbursed $22 billion to its 9.4 million drivers – the single largest component of its $49.7 billion in gross bookings. The elimination of this labor cost, through the deployment of self-driving vehicles, would unlock a cascade of profitability, converting a larger proportion of gross bookings into revenue and, ultimately, shareholder value.

If Ark Invest’s projections of a $10 trillion market prove accurate, Uber is poised to capture a significant share of this wealth. Combined with its comparatively modest valuation, this presents a compelling investment opportunity – a rare instance of fundamental value aligning with future potential. To prioritize Tesla, in light of these circumstances, is not merely imprudent; it is a surrender to the seductive allure of hype, a willingness to sacrifice substance on the altar of spectacle.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-21 12:52