Behold, gentle investors, a spectacle most curious! Two titans of Detroit, Ford and General Motors, engage in a contest not of engineering prowess, but of returning coin to those who have entrusted them with their fortunes. ‘Tis a comedy, I assure you, though one where the stakes are measured not in laughter, but in dividends and share repurchases. Observe, if you will, how these manufacturers, having mastered the art of assembling metal behemoths, now turn their hand to the equally intricate craft of appearing generous.

Ford, that venerable house, doth favor the direct approach. A dividend, you see, is a most visible demonstration of prosperity, a regular dole to appease the shareholders. They offer a yield of some consequence, exceeding that paltry sum dispensed by the broader market. ‘Tis as if to say, “Here, take this token of our success, and be content!” A modest ratio of price to earnings, coupled with this stream of income, doth suggest a company content with steady, if unspectacular, advancement. And, a most intriguing detail: the Ford family, those scions of industry, hold shares that grant them not only dividends but also a voice in the company’s direction. A convenient arrangement, wouldn’t you agree? One might suspect their enthusiasm for these payouts is… substantial.

They pledge to return a considerable portion of their free cash flow – forty to fifty percent, if you please – to their investors. A noble gesture, certainly, though one wonders if it is born of genuine philanthropy or a shrewd calculation to maintain contentment amongst those who hold the purse strings. Should their ventures into the electric realm prove fruitful – and that, my friends, remains a question for the ages – even greater sums might flow forth. A prospect to gladden the heart of any shareholder, and, undoubtedly, the Ford family itself.

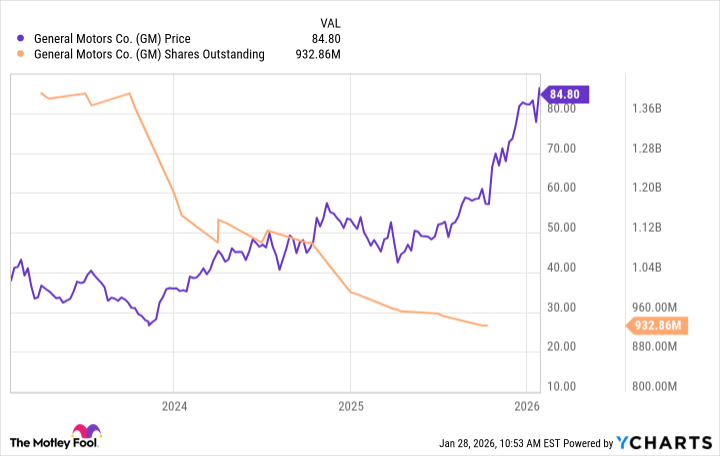

General Motors, however, prefers a more subtle game. Rather than showering shareholders with direct payments, they engage in the art of share buybacks. ‘Tis a maneuver most ingenious, designed to inflate the value of the remaining shares. A bit like removing chairs from a crowded room – those who remain find themselves with a bit more space, and a correspondingly inflated sense of importance. They have, in recent times, authorized billions for this purpose, retiring a multitude of shares and, naturally, elevating the price. A clever illusion, wouldn’t you say? A way to appear generous without actually diminishing the company’s coffers.

They have recently surpassed expectations, announcing an increase to their dividend – a small concession to the direct approach – and a further authorization for share repurchases. ‘Tis a pattern, you see, a consistent dedication to returning value, albeit through a method less obvious than a simple cash payment.

So, what are we to make of this spectacle? Both Ford and General Motors, it seems, are committed to rewarding their shareholders. Whether through dividends or share buybacks, the intention is clear: to demonstrate confidence in their current investments and to maintain a strong balance sheet. ‘Tis a comedy, indeed, this dance of capital, but one played with serious consequences. For in the final act, it is the shareholders who reap the rewards – or, should fortune frown, bear the losses. A cautionary tale, perhaps, that even the most generous of gestures may be motivated by self-preservation. And that, my friends, is a truth as old as the theatre itself.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-02 03:03