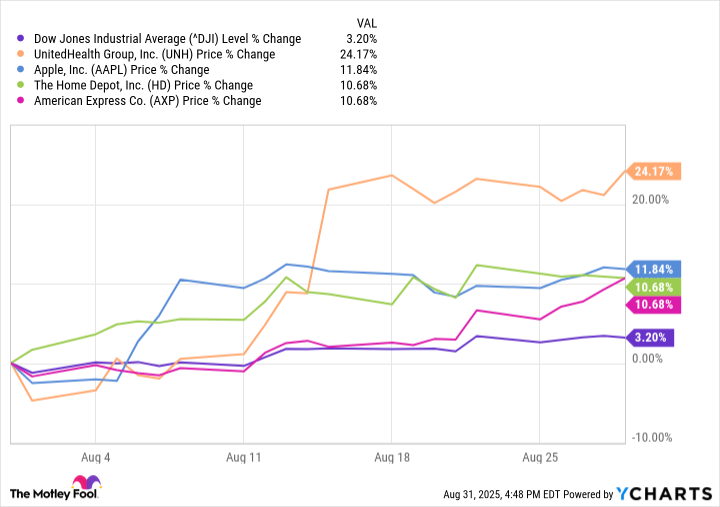

In the vast and intricate theater of human enterprise, where fortunes rise and fall like tides upon an endless shore, the month of August 2025 bore witness to a peculiar drama within the hallowed confines of the Dow Jones Industrial Average (^DJI). With its modest ascent of 3.2%, the index outpaced many of its peers, yet this victory was not the work of collective effort but rather the labor of a few chosen champions-stocks whose fates intertwined with the ambitions, fears, and calculations of men who wield capital as though it were destiny itself.

Foremost among these heroes stood UnitedHealth Group (UNH), its shares soaring by 24% in a month that seemed almost providential. Yet what force propelled such a meteoric rise? Not the hand of UnitedHealth’s stewards, for they had done little to distinguish themselves during this time. No, the architect of this transformation was none other than Warren Buffett, that sage of Omaha, whose Berkshire Hathaway (BRK.A) (BRK.B) announced a bold acquisition of five million shares in the beleaguered insurer. The stock, once battered and bruised-a casualty of spiraling reimbursement costs and slashed profit forecasts-had plummeted more than 60% from its April zenith. And yet, in the eyes of Buffett and his lieutenants, the market’s despair revealed opportunity. To them, the sellers had overreached in their panic, leaving behind treasure amidst the wreckage. It is here we glimpse the eternal paradox of markets: that value lies not merely in numbers but in the hearts of those who interpret them.

Not far behind came Apple (AAPL), advancing nearly 12% in a performance both steady and deliberate. Its journey began with solid fiscal results unveiled at the end of July, which set the stage for further triumphs. But it was not earnings alone that carried Apple aloft; rather, it was a proclamation of immense ambition-an additional $100 billion pledged toward American manufacturing capacity. This investment, bringing the total to $600 billion, sought not only to shield its iPhones from import tariffs but also to assert dominion over the very means of production. Herein lies a question worthy of contemplation: does such mastery over supply chains represent progress for humanity, or does it serve chiefly to consolidate power into fewer hands? As always, history will judge.

Lastly, tied in their ascent like twin stars in the firmament, stood Home Depot (HD) and American Express (AXP), each climbing 10.7%. For Home Depot, the path was fraught with contradictions. Its second-quarter earnings fell short of expectations, yet investors discerned hope in the embers of same-store sales growth, however meager, and in the steadfast reaffirmation of annual guidance. Was this optimism born of reason or faith? Perhaps both, for belief often precedes evidence in matters of commerce. Meanwhile, American Express drifted quietly upward, buoyed less by specific events than by the broad currents of bullish sentiment sweeping through the markets. Its robust second-quarter figures, announced earlier in July, provided sufficient ballast against any tempestuous winds.

And so, dear reader, we find ourselves contemplating the nature of these gains-not merely as numbers on a ledger but as reflections of human striving, folly, and aspiration. Each stock tells a story, each movement a testament to the interplay of forces both seen and unseen. Yet let us not forget that beneath the veneer of triumph lies risk, uncertainty, and the ever-present specter of reversal. Let the prudent investor heed this truth, lest they mistake fleeting fortune for enduring prosperity. 🌟

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of First Steps

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-02 20:09