Lo and behold, in the year 2025, Bitcoin plummeted into a crimson abyss, yet the valiant mining stocks soared to astronomical heights, as if carried upon the wings of some invisible, economic albatross. Let us embark on a whimsical journey to unravel what transpired when stock prices danced to their chaotic symphonic scores, unveiling the wonder of who truly outshone whom and the importance of temporal precision.

As enigmatic portfolio holders examine the performance of their holdings from the previous year and ponder adjustments for the morrow, a familiar query rises again with the subtlety of an old ghost peering through a dusty windowpane: Ought one retract from the clutches of Bitcoin mining equities to hoard more of Bitcoin in its raw essence?

With the Bitcoin price trudging a few vertiginous steps below its once-lofty pinnacles, this question appears to be of paramount riddle and jest. But do permit us to embark on a quaint review of how Bitcoin and the Bitcoin mining sector fared in the whirlwind year of 2025.

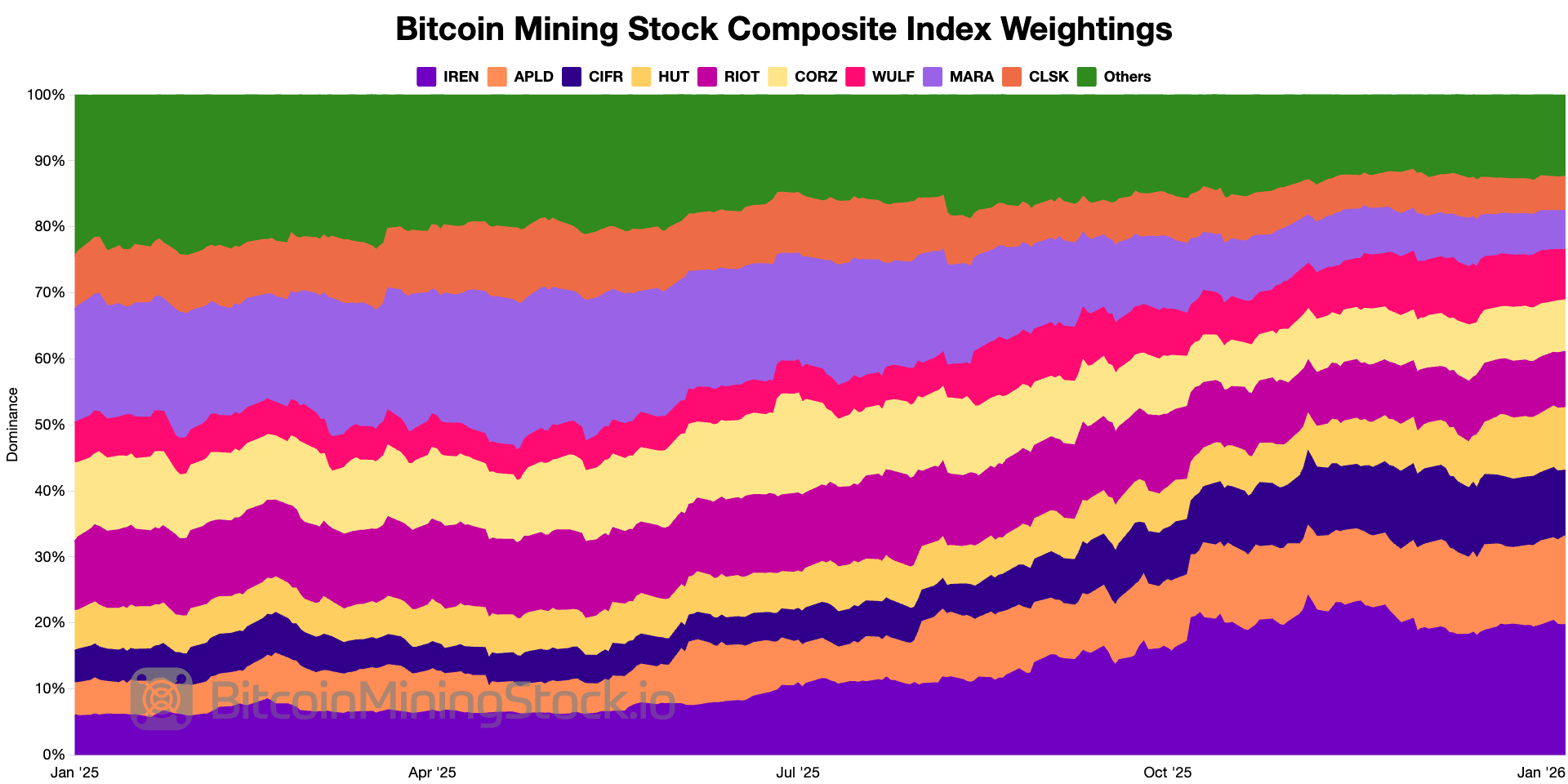

To track the spectacle of the Bitcoin mining bastions, we enlisted the aid of the Bitcoin Mining Stock Composite Index, a performance directory of publicly traded mining companies listed on grand U.S. exchanges, shunning the clandestine whispers of OTC markets. This grand archive encapsulates a stupendous 80% of the sector’s global market stature, providing a resounding caricature of investor mood within the listed mining domain. Merely each firm is weighed by its market cap, conferring greater influence upon those of substantial form.

As wintry twilight of 2025 unfurled, leadership abandoned the venerable banners of MARA, Riot, and CleanSpark, to embrace the dazzling and emerging luminaries such as IREN, Applied Digital, and Cipher Mining, whose valuation ballooned with the velocity of a carnival balloon race.

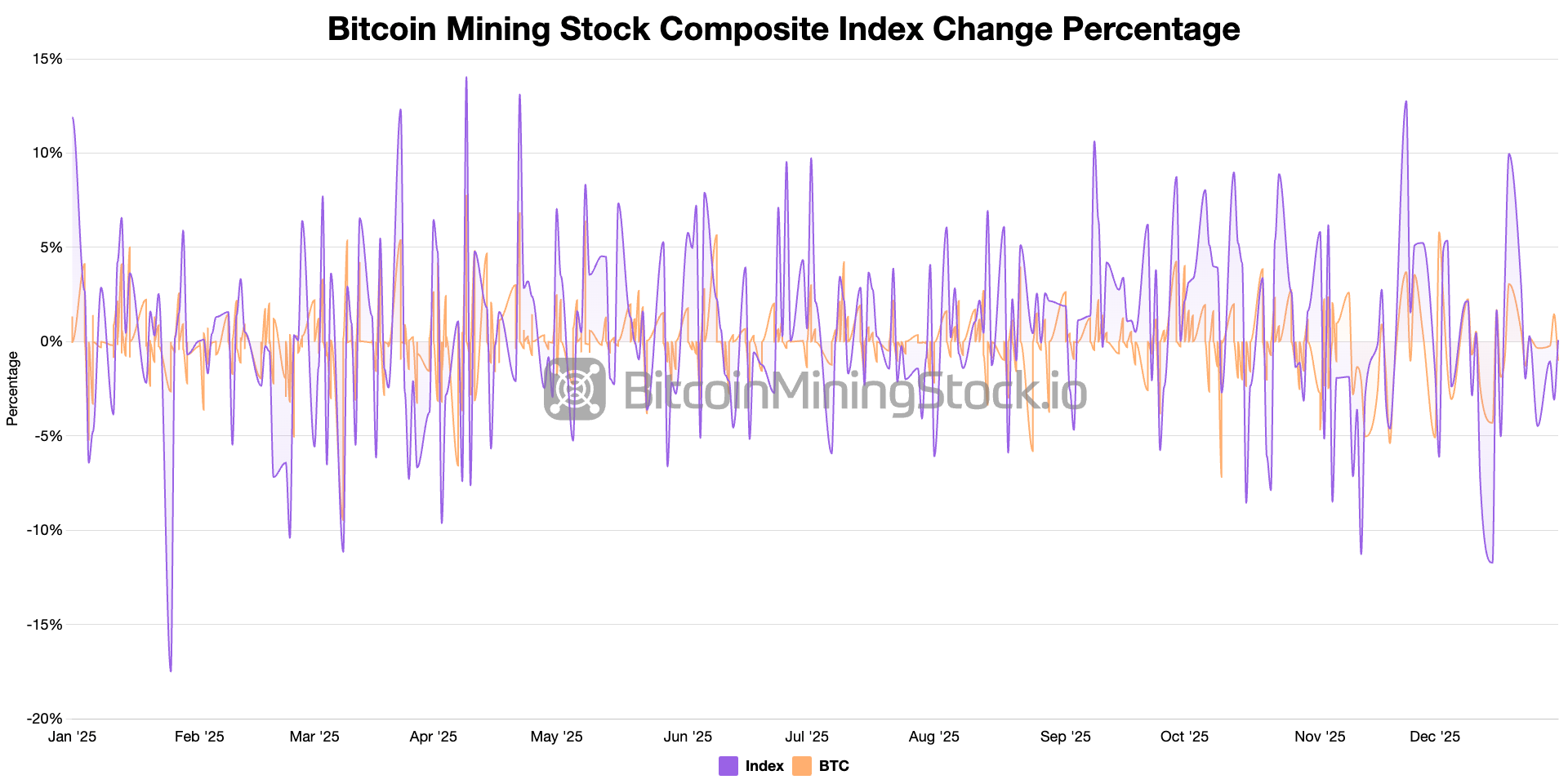

Viewed from the valiant lens of percentage change, mining stocks pirouetted with similar trajectory to Bitcoin, albeit with praise-worthy volatility showcased. Here lies their role as an overexcited acrobat of a high-beta proxy for Bitcoin, where BTC’s minute trembles are resonantly echoed in mining stock tumults.

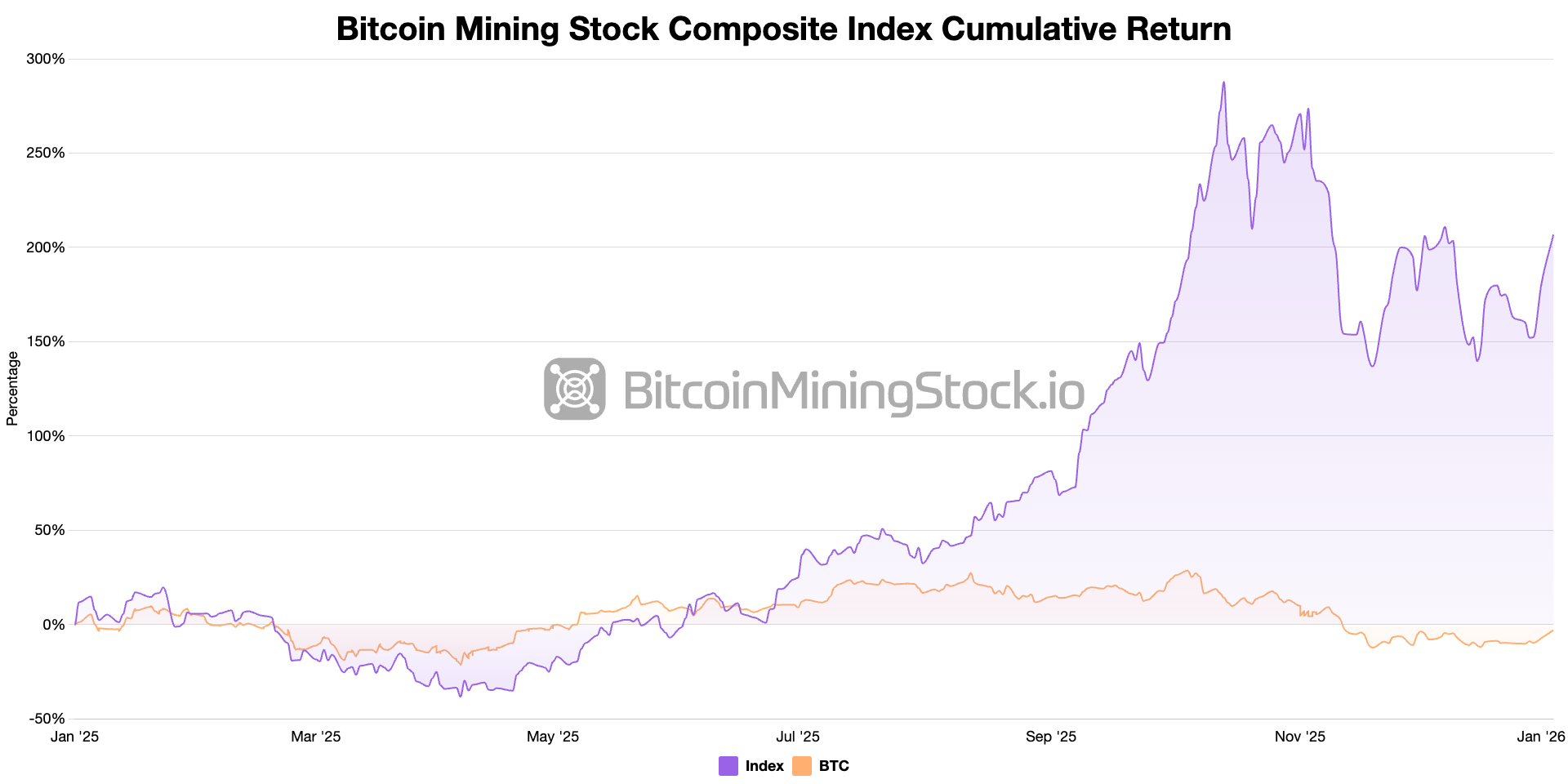

The spectacle of amplification rendered to visibility in an investment comparison as simple as a rhyme: allocate the equivalent of 1 BTC (valued at $96,903 on January 2, 2025, a princely figure indeed) into Bitcoin directly, and parallel that sum into the mining stock index. In the early dances of the year, Bitcoin led the waltz, but marked the dawn a dramatic reversal in the second half. A year’s gambol concluded with Bitcoin displaying a return of -9.71%, whilst the mining stock index executed an extraordinary leap of +152.34%.

This performance, however, was not without its precarious capers. The mining sector’s fortunes were marked with precipitous ascents and harrowing retreats, unveiling the labyrinthine challenge of timing one’s market escapades. Although the index serves as an estimable beacon, it is not a vessel for direct investment. Yet it yields sagacious insight into the temperament of a diverse congregation of mining stocks across varying fortunes of trade. Petitions for exposure may find solace in our treatise on Bitcoin Mining ETFs which explores accessible funds that pursue this peculiar segment.

Gazing into the crystal orbs at future reflections, one ought not to assume the dance between mining and the Bitcoin force remains the same. With miners increasingly venturing towards the lands of HPC and AI infrastructures, a potential divergence from Bitcoin’s capricious pricing may unfurl. And even should such correlation persist, history’s pages reveal that mining equities often prove as the unfortunate third wheel during protracted Bitcoin downswings – making the timing of one’s hoarding and shedding all the more critical.

Thus, we return to our timeworn query: should one reduce their stakes in mining equities to embrace Bitcoin’s embrace? The cryptic pages of 2025 data provide no enchanting omnipresent counsel. Yes, mining stocks dramatically outdid Bitcoin, yet such triumphs were heavily reliant on cyclical romances and championed by a choice few leaders. These conquests came paired with a great swell of volatility, compelling investors to weather through tempestuous shakes.

For those brave souls, such peculiar faculties of mining equities as a high-beta reflection of Bitcoin exposure are solidified. And for others, the allure of clutching onto Bitcoin directly during times of desirable value and reduced volatility stands steadfast.

Ultimately, your choice hangs in the subtle balance of two whimsical mysteries: within which stage of the market cycle do you believe we find ourselves ensconced?, and how much economic unrest are you willing to embrace in the charming quest for outsized spoils? Ah, but march forth and discover!

For those inclined to investigate the methodology behind the Bitcoin Mining Stock Composite Index and explore innovative applications, venture here. And who knows? Perhaps one might tailor a unique benchmark to suit their peculiar desires.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 🎁 AGF 2025 Coupon

2026-01-12 10:59