Ah, artificial intelligence (AI)-the great, mystical creature that promises to change everything from our jobs to our ability to binge-watch Netflix without ever leaving the couch. While it’s true that AI is transforming our world at a pace that could give the Flash a run for his money, choosing the right investments in this ever-evolving space can be like trying to pick a needle out of a haystack-if the needle was constantly changing shape and the haystack was on fire.

So, you ask, “What’s an investor to do in this futuristic nightmare?” Enter the world of AI ETFs, where the stocks are already picked for you, and all you need to do is sit back and-hopefully-watch your portfolio grow. But wait, there’s one ETF that’s different from the pack, and it’s the Ark Autonomous Technology and Robotics ETF (ARKQ). Think of it as the Ferris wheel of ETFs-rides high, goes fast, and just might leave you breathless (in a good way, hopefully).

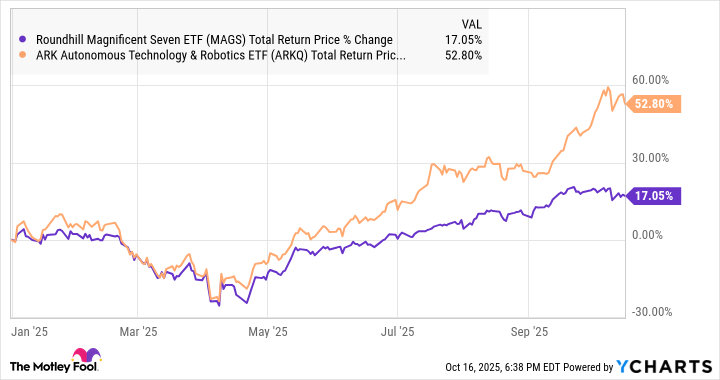

Now, let’s break it down. ARKQ isn’t just another passive index fund, sitting there all quiet and unassuming. Oh no, this one’s got spunk, personality, and a whole lot of direction. Managed actively by none other than Cathie Wood (you know, the tech investor who’s not afraid to take a risk or two), this fund doesn’t just follow the crowd-it aims to beat it. And boy, has it been doing a great job so far, outpacing the “Magnificent Seven” (you know, those seven tech giants we all love to hate) by a staggering margin in 2025.

Unlike most AI ETFs that pile all their chips on the Nvidia and Microsoft duopoly (seriously, those two could start a band with all the market share they control), ARKQ plays it a bit differently. Sure, Tesla’s hanging out at the top of the leaderboard, but most of the real action is with the underdogs-companies like Kratos Defense & Security, Archer Aviation, and Teradyne. It’s like the Rocky Balboa of ETFs, going up against the Goliaths and knocking them out of the ring.

Now, before you go running off with your checkbook, let’s talk numbers. ARKQ comes with a 0.75% expense ratio-basically, it’s like paying for the world’s greatest roller coaster experience. It might sound steep compared to a boring S&P 500 index fund, but remember: you’re not here for a nap, you’re here for a thrill ride. And guess what? Even with that fee, it’s still cheaper than a lot of the AI index funds out there that only aim to track the market and not do anything remotely exciting. Yawn.

Will the Ark ETF Make Your Portfolio 3 Times as Fun by 2030?

Okay, buckle up, because here comes the part where we get to the hard-hitting stuff. Will ARKQ really triple your money by 2030? Well, it’s possible-but not without a few stomach-churning moments along the way. You’re dealing with an actively managed ETF that focuses on smaller, high-potential companies. This could lead to bigger rewards-or it could crash harder than a drone trying to land on a moving car.

Sure, some of ARKQ’s holdings, like Rocket Lab USA and Palantir, have already seen 10x returns in recent years, proving that high-tech innovation can really pay off. And if companies like Archer Aviation succeed in turning their dreams of autonomous flying taxis into reality? Well, my friend, you might just find yourself sipping margaritas on a beach in 2030, watching your portfolio soar.

But-and here’s the big “but”-remember, AI investments can be volatile. If the economy stumbles, if interest rates spike, or if that next recession rears its ugly head, you could find yourself holding onto this roller coaster for dear life, wondering why you didn’t just invest in something as steady as an oak tree. But hey, where’s the fun in that?

In conclusion, if the winds of the economy blow in your favor, the Ark Autonomous Technology and Robotics ETF could easily make your portfolio look like it’s been hitting the gym. Just keep your hands and feet inside at all times-because the ride will definitely be a wild one.

And if you make it out alive, well, maybe you’ll be that investor who looks back and says, “I told you so.” 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-18 16:38