The winds of political change, sharp as the proverbial sting of a mosquito in the night, have swept through the pharmaceutical sector, tossing mighty companies like Pfizer, Merck, and Bristol Myers Squibb into the tempest. These venerable titans, once at the zenith of their market dominance, have seen their fortunes tumble, their stocks plunging like meteorites into an abyss, their yields rising like the crackling flame of a desperate bonfire.

Ah, the pharmaceutical realm, that beguiling dance of science, corporate strategy, and regulatory hurdles! It stands as an inviting haven for the contrarian investor-those who dare to swim against the tide of consensus. A mere $1,000, my dear reader, can open the gates to a world where risks and rewards intermingle in a beautiful, terrifying ballet.

What is it, precisely, that these drug makers do?

At its simplest, a pharmaceutical company is a factory of alchemy-crafting substances both mundane and miraculous. Companies like Pfizer, Merck, and Bristol Myers Squibb engage in the noble task of seeking out new drugs, nurturing them through the rigor of trials, bringing them into the fold of the FDA’s approval, and then, through the magic of marketing, selling them to the eager, health-conscious masses. The process is slow, painstaking, expensive-an elegant waltz of failure and success.

The joy of patent protection-ah, the sweet, brief thrill of monopoly!-is the elixir that enables these companies to recoup their vast investments. Yet, as with all things in this world, such protections must inevitably expire, giving way to generics that flood the market and leave the original creators with little more than a vague sense of financial nostalgia. A patent cliff, they call it-an inevitable drop after the euphoric rise.

And then, of course, there is the government-a shadowy figure looming over the entire affair. Washington’s current stance, more cynical and less lenient than ever, has cast a pall over the sector. Vaccine makers, in particular, feel the brunt of this government scrutiny. A less-than-affectionate mood has crept into the public psyche as well. But fret not; such pressures are neither unique nor particularly devastating in the grand scheme of the pharma labyrinth.

What is it about Pfizer, Merck, and Bristol Myers Squibb that makes them so… irresistible?

These companies, steeped in history, veritable old-timers of the drug-making world, have faced-nay, embraced-the vicissitudes of patent cliffs, regulatory red tape, and the Sisyphean task of research and development. Their names carry the weight of time, of failures and triumphs in equal measure. And yet, despite the storm that is currently battering their hulls, one might reasonably expect them to weather this tumult with their characteristic resilience.

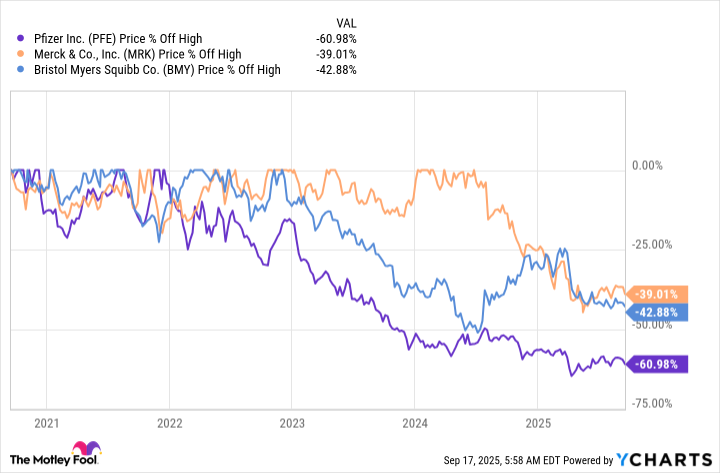

Indeed, the numbers speak for themselves: Pfizer, Merck, and Bristol Myers Squibb have all seen their stocks plummet, with Pfizer’s descent a particularly dramatic 60%. Merck and Bristol Myers Squibb, not far behind, have lost 40% of their former glory. And yet, this plummet has not been without its silver lining-an uptick in their dividend yields, as sweet as the fruit of the forbidden tree.

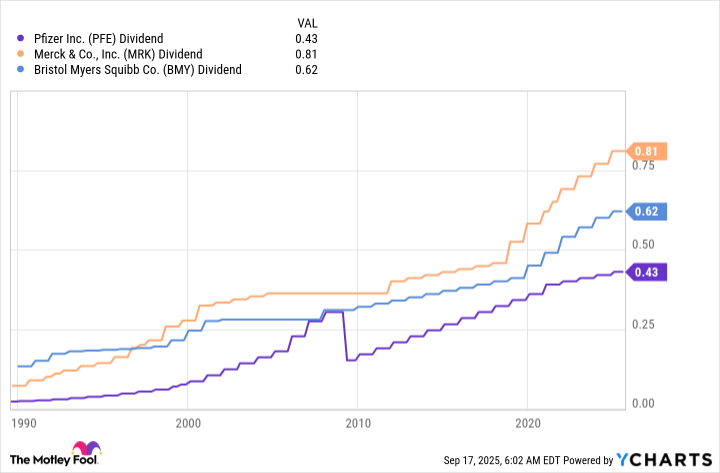

And now, the question arises: which of these pharmaceutical titans should one favor? Dividend investors, like the discerning connoisseur of fine wine, must turn to history. Ah, but here lies the rub! Pfizer, once a paragon of consistency, faltered in 2009 when it slashed its dividend after the acquisition of Wyeth. A cut that, while understandable, leaves a blemish on its otherwise unremarkable record.

Merck and Bristol Myers Squibb, on the other hand, are stalwart in their constancy. If dividends are your siren call, then the siren’s song of Bristol Myers Squibb with its 5.3% yield may prove irresistible. Yet, as with all things in life, beauty is in the eye of the beholder. From a valuation perspective, Merck emerges as the more enticing prospect, its P/S, P/E, and P/B ratios sitting comfortably below their five-year averages, a quiet signal of undervaluation.

Indeed, one must look beyond mere yields to the deeper currents of value. Merck’s low P/E, when compared to Bristol Myers Squibb’s lofty ratio, tells a tale of overlooked potential. A story, perhaps, of a company destined for resurgence, while others bumble through the throes of decline.

Merck, it would seem, should be your first stop in this curious, contrarian pilgrimage.

Merck’s Warts: The Unseen Side of the Coin

Ah, but nothing is ever as simple as it seems. Merck, for all its current allure, bears its own set of imperfections, like a beautiful yet flawed gem. Yes, the patent cliff looms large, particularly with the stalwart Keytruda, a drug upon which much of Merck’s fortunes rest. However, the international patents for this key drug extend into the 2030s, and a novel delivery method holds its patent until 2040-so not all is lost.

Moreover, there’s the matter of the slow uptake of Merck’s HPV vaccine in key markets-a challenge that even the most astute investor must reckon with. And thus, Merck is not the perfect diamond it first appears to be, but rather a gem with a few hidden cracks. To invest in Merck is to embrace the messiness of life itself-a dance with uncertainty and risk.

But if you, dear investor, are willing to play the game, if you can look past the warts, and if you possess the patience to observe Merck as it grapples with its current woes, then that $1,000 of yours will purchase a reliable, historically lucrative dividend stock at a valuation that screams “opportunity.” With a lofty yield and the promise of a turnaround, Merck offers a tantalizing invitation.

So, my friends, embrace the chaos, trust the numbers, and perhaps-just perhaps-this stock, with its hidden warts, will be the treasure you seek. 🌱

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

2025-09-24 15:08