It is a curious paradox of our age that the most essential things are so easily misplaced. America finds herself, it seems, in a position of peculiar vulnerability – a dependence upon distant shores for the very magnets that power her ambitions. A most unseemly state of affairs, wouldn’t you agree? To rely on others for the sinews of innovation is akin to requesting a loan from one’s creditors – a temporary respite, certainly, but hardly a foundation for enduring prosperity.

These magnets, you see, are born of rare-earth elements – substances abundant in the earth’s crust, yet frustratingly elusive in concentrated form. Mining them is merely the first act in a rather elaborate drama; refining them into something genuinely useful is where the true artistry – and the true expense – lies. And it is here, in this realm of geological alchemy, that USA Rare Earth (USAR +1.81%) has chosen to stake its claim.

The company aspires to be more than a mere miner; it seeks to construct a complete ecosystem – from ore body to finished magnet. A noble ambition, to be sure, though one must always approach such grand designs with a healthy dose of skepticism. The notion of self-sufficiency is, after all, a delightful fantasy, but rarely a practical reality.

The surge in demand for these magnetic marvels has, naturally, inflated the company’s prospects. But let us not mistake aspiration for achievement. The path from potential to profitability is often paved with unforeseen obstacles – and substantial capital expenditure. A ten-thousand dollar investment, one is led to believe, might blossom into a fortune. However, one must remember that hope is a charming companion, but a most unreliable guide.

Constructing a Supply Chain – A Most American of Endeavors

USA Rare Earth, in essence, is attempting to build a pipeline – a conduit for transforming geological deposits into tangible industrial assets. They control the Round Top Deposit in Texas, a site rich in not only rare-earth elements, but also a collection of other minerals that might prove useful in the American industrial landscape. Their plan, should they succeed, is to bring this mine into commission by 2028.

Mining, as anyone with even a passing familiarity with the subject will attest, is a capital-intensive undertaking. To that end, the company also operates a research laboratory in Colorado, where they are experimenting with techniques to streamline the refining process – a potentially lucrative endeavor, if they can unlock the secrets of efficient separation.

Furthermore, they are developing a magnet manufacturing facility in Oklahoma, projected to come online in 2026, with a capacity of 5,000 metric tons of sintered permanent magnets annually. A considerable undertaking, to be sure, and one that, if successful, could position them as a significant player in the global supply chain.

The mine, the laboratory, the factory – all these elements, if brought together harmoniously, could create a vertically integrated rare-earth company – a rare bird indeed, outside the confines of China. But let us not run before we can walk. The company, at present, lacks a demonstrable history of commercial operations. It is, at this juncture, entirely reliant on external funding – a precarious position, to say the least. Until the mine yields its bounty and the magnets begin to roll off the production line, it will likely continue to consume capital and report losses.

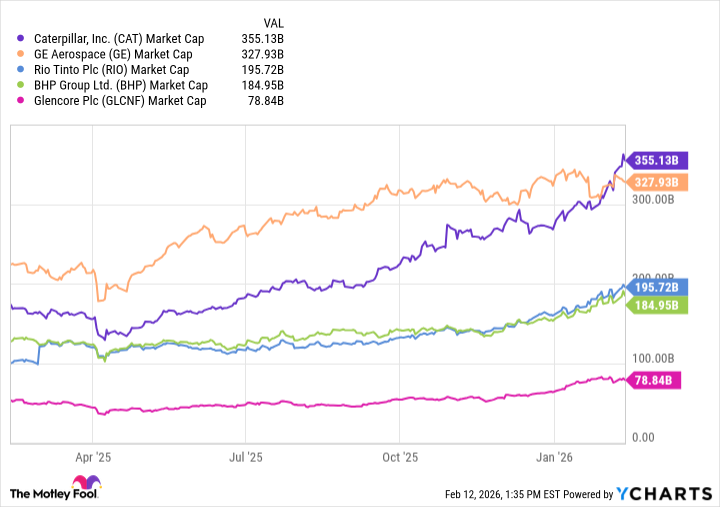

For a ten-thousand dollar investment to multiply a hundredfold – to reach the magical million – USA Rare Earth would need to achieve a valuation exceeding four hundred and twenty-four billion dollars. A rather ambitious target, wouldn’t you agree? The largest industrial and mining companies rarely exceed such lofty heights.

USA Rare Earth possesses the potential for growth, certainly. A modest stake in this venture might yield a reasonable return over the long term. However, I would caution against making it the cornerstone of one’s portfolio. Prudence, after all, is the better part of valor – and a far more reliable investment strategy.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Games That Faced Bans in Countries Over Political Themes

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

- Top 20 Educational Video Games

2026-02-14 22:54