Amazon, currently designated as the fifth largest entity by the prevailing metrics – a valuation of $2.55 trillion, to be precise – exists as a consequence of its dominion over the exchange of goods and the storage of information. It is a position achieved, naturally, through the relentless accumulation of transactions, a process that now seems to operate with a detached, almost automatic quality. The reports indicate a revenue projection of $715 billion for the current reporting cycle, a figure that, while substantial, feels… expected. A subsequent projection of 11% growth for the following cycle is similarly unremarkable, a continuation of the established pattern. The machine continues to function, and we, as observers, record the output.

This measured progression explains, perhaps, the recent stagnation in the stock’s performance. A mere 6% increase over the past year, a figure dwarfed by the 16% appreciation of the broader index. It is a subtle discrepancy, yet it suggests a shift in the underlying currents. Two entities – Taiwan Semiconductor Manufacturing and Broadcom – currently trailing Amazon in the hierarchy of valuation, are exhibiting a more… vigorous growth. Their gains, while statistically significant, are less a cause for celebration and more a symptom of a system operating according to principles that remain, at best, opaque.

Let us, then, examine the rationale behind the potential for these two entities to surpass Amazon’s valuation within the next three years. It is not a prediction, precisely, but a tracing of existing trajectories, a mapping of the inevitable consequences of applied forces. The exercise, of course, is ultimately futile, as the system itself is subject to unforeseen perturbations, but the attempt is, nonetheless, required.

Taiwan Semiconductor Manufacturing

TSMC, currently designated as the sixth largest entity, possesses a valuation of $1.77 trillion, a figure representing 44% of Amazon’s. The stock price has increased by 65% over the past year, a statistically improbable event that demands further scrutiny. The company’s performance, however, is merely a reflection of the demand for its products, the microscopic components that underpin the entire digital infrastructure. A demand that, naturally, will continue to increase.

Recent reports indicate a 36% increase in revenue, culminating in a total of $122.4 billion. This increase is attributed to the demand for the chips TSMC fabricates, a demand driven by the insatiable hunger of artificial intelligence. The factories are operating at maximum capacity, churning out components with an efficiency that is, frankly, unsettling. The resulting improvement in gross margin – 3.8 percentage points – is merely a byproduct of this relentless process. Earnings have increased by 51%, reaching $10.65 per share. The company projects an annual revenue growth rate of 25% through 2029, a figure that feels… predetermined.

TSMC is also focused on reducing manufacturing costs and improving productivity, a process that resembles a bureaucratic ritual more than a genuine attempt at innovation. The increase in the price of advanced chipmaking nodes is a necessary measure, a recalibration of the system to maintain its equilibrium. Assuming an annual earnings increase of 30% for the next three years – a slight deviation from the projected top-line growth – the bottom line could reach $23.40 per share by 2028. Multiplying this figure by the forward earnings multiple of the Nasdaq-100 index – a somewhat arbitrary metric – yields a stock price of $608, a 76% increase from current levels. This, then, is the potential for TSMC to surpass Amazon, a logical consequence of the prevailing forces. The implications, of course, are irrelevant.

It is worth noting that this potential is contingent upon a multitude of factors, any one of which could disrupt the established trajectory. Yet, the system continues to operate, indifferent to the possibility of disruption.

2. Broadcom

Broadcom, currently designated as the seventh largest entity, possesses a valuation of $1.67 trillion, approximately 53% lower than Amazon’s. The reduction in the gap over the past year, however, is noteworthy, as the company’s shares have increased by 50% during this period. This increase is attributable to the company’s fast-growing revenue from sales of AI chips, a demand driven by the hyperscalers and AI companies. The design of custom AI processors and networking components is a necessary adaptation, a recalibration of the system to meet the demands of the new paradigm.

Revenue increased by 24% year over year, reaching $64 billion. Earnings increased at a stronger pace of 40%, reaching $6.82 per share. The company is sitting on a massive order backlog of $162 billion, $73 billion of which is related to AI. This backlog is merely a symptom of the insatiable demand, a confirmation of the system’s relentless momentum. The management expects AI revenue to double year over year in the current quarter, a projection that feels… inevitable.

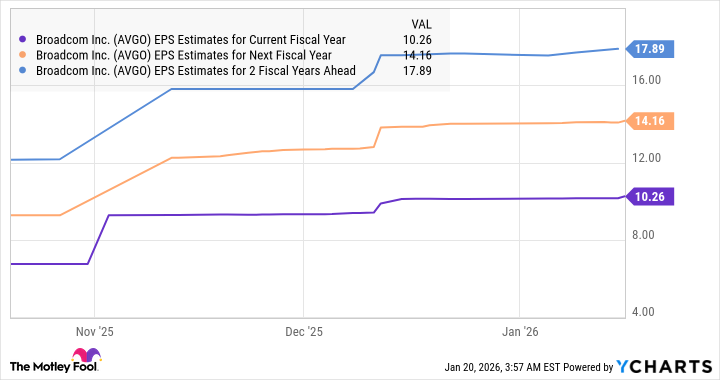

Consensus estimates project sales to increase by 51% this year, along with an almost identical jump in earnings. Broadcom stock trades at 35 times forward earnings, a premium to the Nasdaq-100 index’s average. This premium is justified, of course, by the company’s stronger growth prospects. Assuming Broadcom trades at 35 times earnings after three years and earns $17.89 per share, its stock price could jump to $626, a potential upside of 78%. This potential, then, confirms the possibility of Broadcom surpassing Amazon, a logical consequence of the prevailing forces. The implications, as always, are irrelevant. The machine operates, and we, as observers, record the output. It is a process devoid of meaning, yet we continue to participate.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-22 18:35