A disquieting divergence has emerged. The bond markets, those taciturn observers of creditworthiness, whisper of strain, while the equity markets, ever susceptible to the fever of innovation, continue to lavish capital upon the promise of artificial intelligence. It is a familiar pattern, this disconnect between prudent assessment and speculative excess, a recurring ailment of the modern financial body. We observe a distinct unease, a hesitancy in the pricing of risk, particularly concerning those enterprises most deeply entangled in this algorithmic pursuit.

The Bond’s Unspoken Warning

The signal originates, as it often does, from the periphery – from the cost of insuring against the possibility of failure. Oracle, a name once synonymous with stability, now bears the mark of increased scrutiny. Its credit default swaps, those instruments of quiet desperation, have risen fourfold since September – a stark testament to the bond market’s growing apprehension regarding the company’s obligations. It is not merely a tremor; it is a sustained pressure, a tightening of the financial noose.

The source of this consternation lies in the escalating costs associated with the infrastructure required to sustain this artificial intelligence – the vast data centers, the insatiable demand for energy, and, most notably, the audacious wager Oracle has made with OpenAI. Reports suggest OpenAI anticipates consuming over one hundred billion dollars before achieving profitability – a projection that strains credulity, even in an age of boundless optimism. The markets, it seems, are beginning to question the arithmetic of this ambition, to suspect a reckoning is at hand. It is a slow-burning realization, a dawning awareness that even the most dazzling innovation cannot defy the immutable laws of economics.

A Limited Contagion, or a Systemic Weakness?

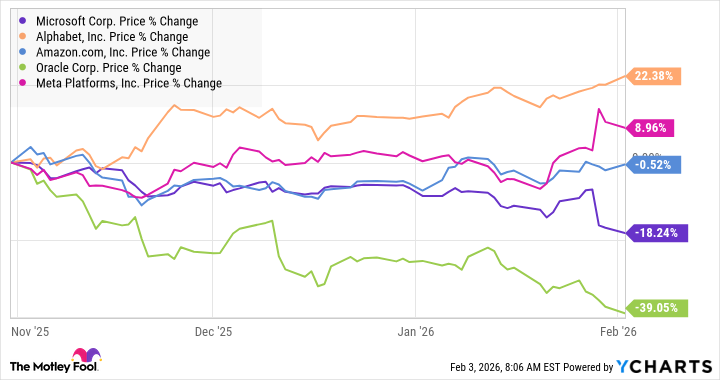

The alarm bells are ringing, certainly, but the scope of the disturbance appears, for now, contained. The equity markets, while not entirely oblivious to the risks, seem willing to tolerate a higher degree of uncertainty, perhaps blinded by the allure of exponential growth. A closer examination of the leading hyperscalers reveals a pattern of differentiation. Those most heavily invested in OpenAI, such as Oracle and Microsoft, have underperformed, while Alphabet, with its comparatively limited exposure, has demonstrated greater resilience. It is a subtle but significant distinction, a hint that the market is beginning to discern between genuine value and speculative excess.

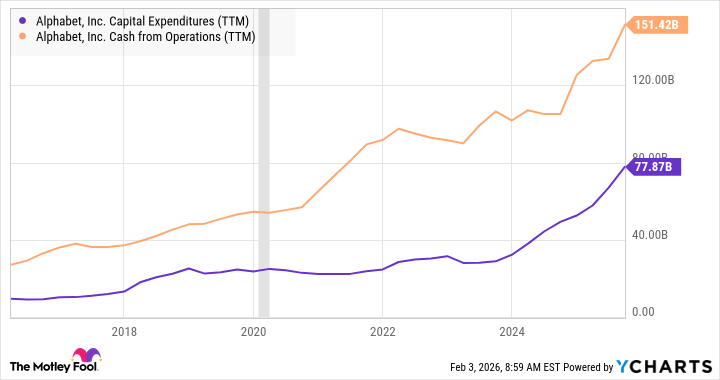

Alphabet’s superior performance is not merely a matter of exposure; it is also a reflection of its financial strength. The company possesses the resources to absorb the capital expenditures required to support its AI initiatives, while others may find themselves stretched to the breaking point. It is a simple truth, often obscured by the fog of innovation: even the most brilliant ideas require a solid foundation of financial stability.

The Illusion of Permanence

Is artificial intelligence a bubble? The question is, as always, fraught with nuance. History teaches us that technological revolutions are invariably accompanied by periods of irrational exuberance, followed by inevitable corrections. Capital flows towards the most promising ventures, but also towards those that merely mimic success. The “me too” mentality, that insidious force, drives investment towards unproductive sources, creating a mirage of wealth that ultimately dissolves into dust. It is a pattern as old as commerce itself.

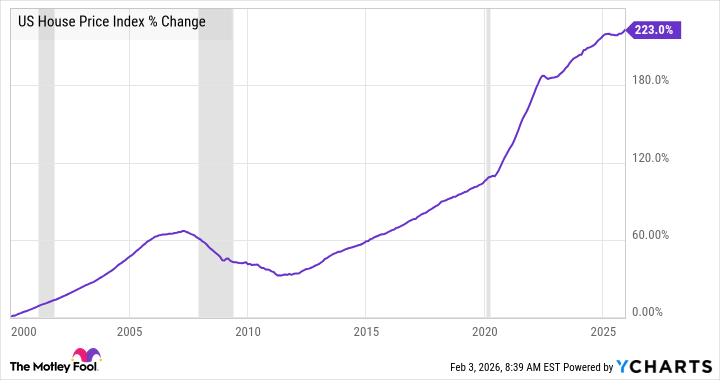

Predicting the precise moment of reckoning is, of course, impossible. The housing market, for example, peaked in 2006, two years before the full weight of the financial crisis descended. Even then, few could have foreseen the magnitude of the collapse. The illusion of permanence is a powerful force, blinding investors to the underlying risks. And selling before the crash, it turned out, was not a universally rewarded strategy.

If the bond and equity markets are indeed becoming more discerning, if they are beginning to reward quality and punish excess, then this may serve as a necessary corrective. A more realistic assessment of risk would rein in the most ambitious plans, forcing companies to focus on sustainable growth. It would be a welcome development, a sign that the markets are functioning as they should – pricing risk accurately and allocating capital efficiently. The shadow of the algorithm may yet yield to the light of reason.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-07 02:32