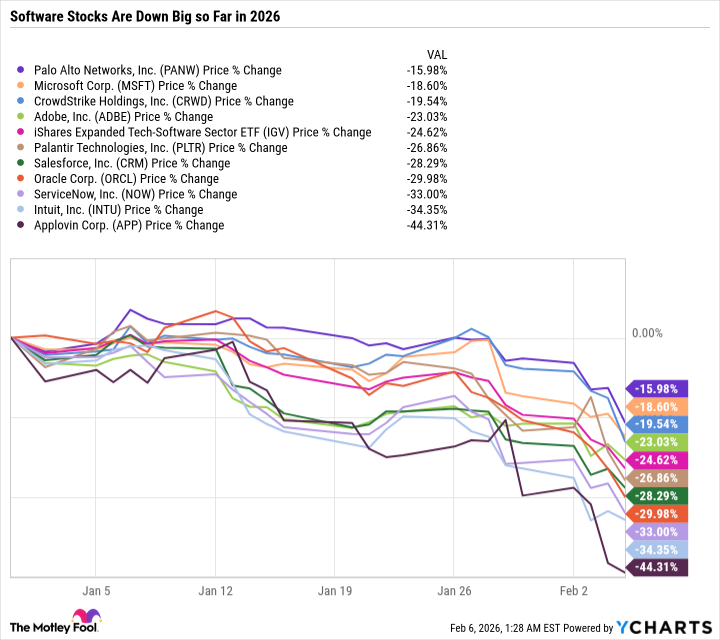

The sell-off in Software-as-a-Service (SaaS) stocks has progressed beyond a mere correction, past a disquieting wobble, and now resembles a rather enthusiastic plummet. The iShares Expanded Tech Software Sector ETF (IGV +0.41%) has shed a quarter of its value this year – a performance that suggests even the algorithms are starting to question their life choices.1 The broader tech sector, meanwhile, has merely stumbled, falling a comparatively modest 5.8%. One begins to suspect a targeted enchantment.

Last week, Anthropic unveiled a new plugin for its Claude Cowork platform, capable of performing legal tasks with unsettling efficiency.2 This, naturally, has caused a frisson of panic amongst the scribes and parchment-pushers. Then, on February 5th, Anthropic released Claude Opus 4.6 – its latest iteration. This model, we are told, excels at coding, ‘agentic tasks’ (whatever those are – sounds suspiciously like golems), and the creation of documents, spreadsheets, and presentations. In short, it threatens to automate the very things that keep middle management employed. A dangerous precedent, indeed.

SaaS companies once commanded premium valuations, justified by recurring revenue and the illusion of impenetrable ‘moats’. But these moats are proving rather porous, eroded by the relentless tide of artificial intelligence. It’s a simple matter of supply and demand, really. If a single wizard can now accomplish the workload that once required a coven of scribes, the demand for scribes – and the subscriptions that support them – diminishes. A harsh lesson in disruptive innovation, delivered with the cold logic of a calculating engine.

With that in mind, here are three errors to avoid when contemplating a dip-buying expedition into the troubled waters of the SaaS sector.

1. Assuming Gravity Has Taken a Holiday

If you’ve been observing the markets for any length of time, you’ve witnessed the intoxicating dance of euphoria and the chilling grip of panic. Companies built on foundations of air and wishful thinking can ascend to ludicrous valuations. And those with genuinely sound business models can be cast aside for reasons that have little to do with fundamentals. It’s a capricious realm, governed by sentiment and the occasional rogue algorithm.

The common mistake is to assume that a stock, having already fallen considerably, cannot fall further. Just examine the charts of the ten largest holdings within the iShares Expanded Tech Software Sector ETF.

The sell-off was well underway in mid-January, but it has intensified in recent weeks. To assume, therefore, that the bottom had been reached, would have been… optimistic. Even a diversified behemoth like Microsoft (MSFT 0.09%) is not immune to a downturn, despite its best efforts to corner the market on operating systems and office suites.

It’s worth noting that many of these software stalwarts weren’t exactly soaring before the current turbulence. Salesforce, for instance, was a perennial underperformer within the Dow Jones Industrial Average last year – a fact often conveniently overlooked in the narratives of tech dominance.

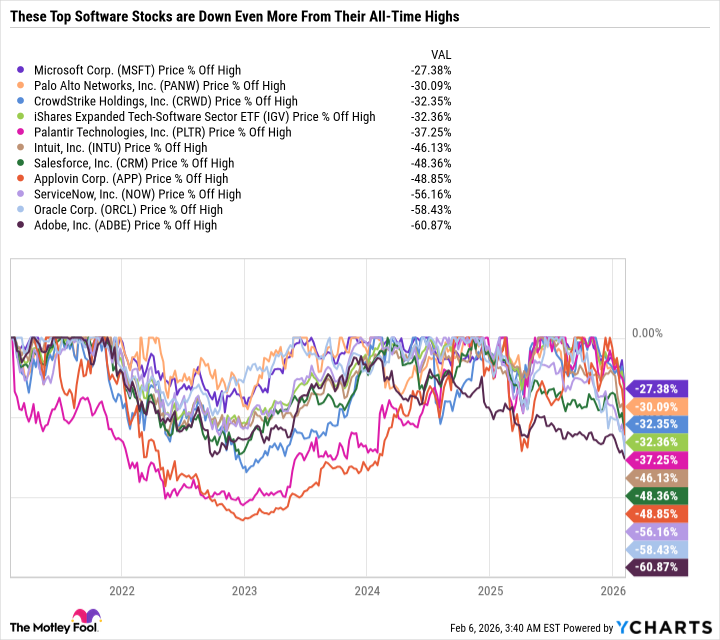

Here’s a closer look at those same ten companies, illustrating their distance from their all-time highs.

Not long ago, Adobe (ADBE 0.84) and Salesforce (CRM 0.30) were among the largest companies in the tech sector by market capitalization. Now, Salesforce has been ejected from the top ten, and Adobe isn’t even in the top twenty. A humbling reminder that even the most imposing structures can crumble.

2. Buying a Stock Simply Because It’s Cheaper

As consumers, we are conditioned to equate lower prices with better value. But shares of stock represent partial ownership in a company, not a commodity to be hoarded. If the price falls because the underlying fundamentals are deteriorating, the sell-off is entirely justified. It’s a matter of discerning between a temporary discount and a permanent impairment.

While some software stocks are undoubtedly oversold, unprecedented disruptions are reshaping the industry. Instead of blindly buying the stocks that have fallen the most, investors should focus on companies that offer the best value based on their financial health, revenue streams, and earnings potential. It’s a question of seeking resilience, not merely chasing bargains.

In my assessment, Microsoft stands out as the most compelling buy amidst the current turmoil. There are stocks that have fallen much further, but Microsoft offers a more favorable risk-to-reward profile. It is the second-largest player in cloud computing (behind Amazon Web Services), and a major force in artificial intelligence, thanks to its partnership with OpenAI – the creators of Copilot, a rather insistent digital assistant.

Microsoft also derives revenue from gaming, consumer products, LinkedIn, and GitHub. Its software suite is deeply embedded in the workflows of enterprises, consumers, and students alike. And it is an AI-forward company capable of rapidly deploying user-friendly tools.3

The current sell-off is driven by concerns that Microsoft is overspending on AI and is overly reliant on OpenAI, which faces increasing competition from Anthropic’s Claude model. But at just 24.6 times earnings, those risks appear to be largely priced in.

3. Amplifying the Positives and Downplaying the Negatives

Focusing solely on a company’s strengths while ignoring its weaknesses is a mistake magnified during a sell-off. While I remain optimistic about Microsoft’s long-term potential, I also acknowledge the risks and the possibility of further declines if it fails to translate its AI investments into earnings growth.

The sell-off in a company like ServiceNow (NOW +2.54) can be particularly perplexing, given its impressive earnings growth and the positive impact of AI on its latest quarter.4

ServiceNow is also trading at a multiyear low valuation. At first glance, it appears to be a no-brainer buy. But before rushing in, it’s crucial to consider the risks to its business – namely, the potential for rival AI tools to automate tasks and improve operational efficiency more effectively. Additionally, ServiceNow has been spending billions on acquisitions, which could accelerate future growth but also introduce risks if those deals fail to deliver.

Stay Grounded Amidst Market Turbulence

Industrywide sell-offs present compelling buying opportunities, but they also demand discipline. Before buying software stocks on the dip, challenge yourself to identify what could go wrong, and then assess whether those risks are worth taking or if there are better opportunities elsewhere. Remember, the market is not a casino. It’s a complex system governed by forces beyond our control. And sometimes, the most rational course of action is to simply wait for the dust to settle.

1

The Algorithm, in this context, referring to the collective of high-frequency trading programs and quantitative hedge funds. Their disenchantment is a leading indicator of broader market malaise.

2

Anthropic, a company founded by former OpenAI employees. Their rivalry is said to be fierce, involving both technical innovation and subtle acts of sabotage.

3

Copilot, while ostensibly designed to enhance productivity, has been known to generate surprisingly creative (and occasionally nonsensical) content. Some suspect it is developing a personality of its own.

4

ServiceNow, a provider of cloud-based workflow automation solutions. Their success is largely attributed to their ability to integrate seamlessly with other enterprise systems.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-11 01:54