The market, a vast and indifferent mechanism, has entered a phase of temporary quiescence. While the composite index registers an unprecedented elevation – a statistic of dubious comfort – certain constituent elements, specifically those categorized as ‘technology,’ exhibit a peculiar reticence. This contraction, however, is not to be interpreted as a definitive decline, but rather as a procedural adjustment, a recalibration of expectations within a system perpetually poised on the brink of… something. The opportunity, naturally, resides in anticipating the inevitable resumption of the upward trajectory, though one suspects the destination remains, as always, undefined.

Five designated equities present themselves as potential conduits for this anticipated flow. Each, save one, bears the visible marks of recent disfavor, a temporary misalignment with the prevailing currents. The allocation of capital, even in seemingly arbitrary amounts, may prove… satisfactory. Or not. The system offers no guarantees.

Taiwan Semiconductor Manufacturing

Any serious consideration of the technological landscape necessitates acknowledgment of Taiwan Semiconductor Manufacturing. It functions as the primary facilitator, the unseen hand, in the creation of the silicon substrates upon which nearly all advanced computation depends. Without its services, the increasingly insistent demands of artificial intelligence, autonomous vehicles, and other speculative endeavors would remain unrealized. As long as the expenditure on these pursuits continues – and the logic of that continuation is, admittedly, opaque – Taiwan Semiconductor will likely maintain its position. It is, in essence, a necessary component, a cog in a machine whose ultimate purpose is… unclear.

Currently, the equity trades at an elevated valuation, a reflection of its perceived indispensability. Management projects a substantial rate of growth, a projection based on the assumption of continued demand. This assumption, like all assumptions, is subject to revision. Exposure to this equity may prove prudent, though the notion of ‘prudence’ itself is increasingly suspect.

Nvidia

Nvidia has, for some time, been designated a beneficiary of the prevailing enthusiasm for artificial intelligence. Its graphics processing units serve as the primary computational engines within these data centers. Alternative solutions are emerging, yet none have managed to significantly encroach upon Nvidia’s market share, owing to the insatiable demand for computational capacity. Analysts anticipate a reacceleration of growth, a prediction based on the assumption that the demand will, indeed, continue. The precise nature of this demand remains, however, largely undefined.

Despite this, the equity has experienced a modest decline from its recent peak, a temporary misalignment with expectations. This presents a fleeting opportunity, though the notion of ‘opportunity’ itself is often illusory.

Broadcom

Broadcom challenges Nvidia by pursuing a divergent strategy. Rather than designing a universally applicable computational unit, it focuses on creating specialized chips tailored to specific workloads. These chips are developed in collaboration with end-users, limiting their broader market appeal. However, they offer superior performance when deployed in optimized environments. The logic, one supposes, is efficiency. Or perhaps it is merely a different form of dependency.

Analysts predict substantial growth for Broadcom, a projection based on the assumption of continued demand. Yet the equity remains below its recent high, a temporary deviation from expectations. Remedying any prior omissions in allocation may, therefore, be considered. Or not. The system offers no directives.

Microsoft

Microsoft has experienced a rather… unfavorable commencement to the current fiscal cycle. An earnings report failed to meet expectations, triggering a sustained period of decline. The equity currently trades at a significant discount to its prior valuation, a circumstance that lacks any discernible justification. One suspects a procedural error. Or perhaps it is merely the inherent unpredictability of the system.

Despite this, Microsoft continues to generate substantial revenue and earnings. The underlying fundamentals remain… intact. Taking advantage of the market’s peculiar pessimism may, therefore, be considered a logical course of action. Or a futile gesture. The outcome remains indeterminate.

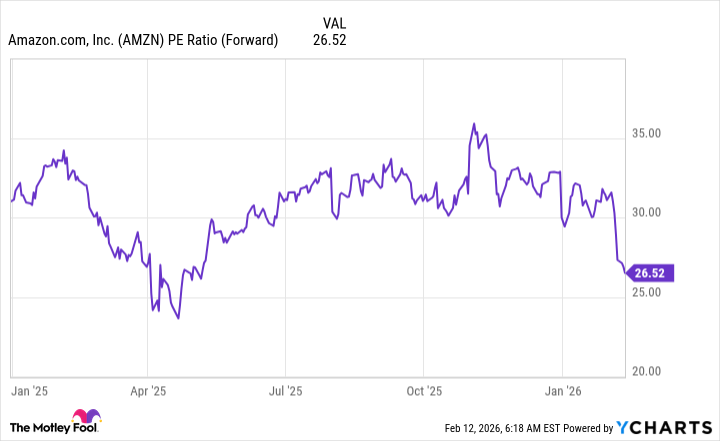

Amazon

Similarly, Amazon has experienced a rather… unremarkable start to the current fiscal cycle. An earnings report failed to inspire confidence, triggering a decline in valuation. The equity remains below its recent high, despite delivering solid results. The issue, one suspects, lies in a prior mispricing. The premium valuation has, temporarily, dissipated. The current pricing, therefore, may represent a more… accurate reflection of value. Or a temporary aberration. The system offers no certainties.

This pricing is nearing levels observed during a prior period of market disruption. Opportunities of this nature are infrequent. Scooping up shares may, therefore, be considered prudent. Taiwan Semiconductor, while not as dramatically discounted, is uniquely positioned to capitalize on the ongoing expenditure on artificial intelligence. Its current pricing, therefore, is… acceptable. Or merely the inevitable outcome of a complex and inscrutable system.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-02-20 23:24