The current infatuation with artificial intelligence, my dear readers, is a spectacle worthy of the grandest opera. For years, these algorithmic marvels have propelled the market forward with a vigour that would exhaust a younger bull. The S&P 500, quite pleased with itself, has enjoyed a trifecta of gains, fueled by the soaring ambitions of companies like Nvidia, Palantir Technologies, and the curiously named CoreWeave. But, as with all fashionable pursuits, a certain weariness has begun to set in. Some, in a fit of prudence – or perhaps mere boredom – have begun to withdraw their affections, troubled by valuations that seem to defy gravity, and a creeping suspicion that these clever machines might, just might, prove to be rivals, not servants.

The question, then, is this: should one abandon this glittering, yet potentially treacherous, landscape, or view these recent declines as a rare opportunity to acquire a piece of the future? Is this a moment for caution, or a chance to seize a bargain that may not present itself again in a decade? Let us, with a touch of detached amusement, examine the matter.

The Illusion of Revolution

It is, of course, undeniable that artificial intelligence possesses a certain…potential. To suggest it might revolutionize manufacturing, drug discovery, or even the mundane operations of an office is hardly hyperbolic. The prospect of exploding earnings for those who develop, sell, or simply utilize these tools is, shall we say, enticing. We have already witnessed companies reporting revenue gains in the double and triple digits – a rather vulgar display of prosperity, but prosperity nonetheless. And as the application of AI expands, this momentum may well continue.

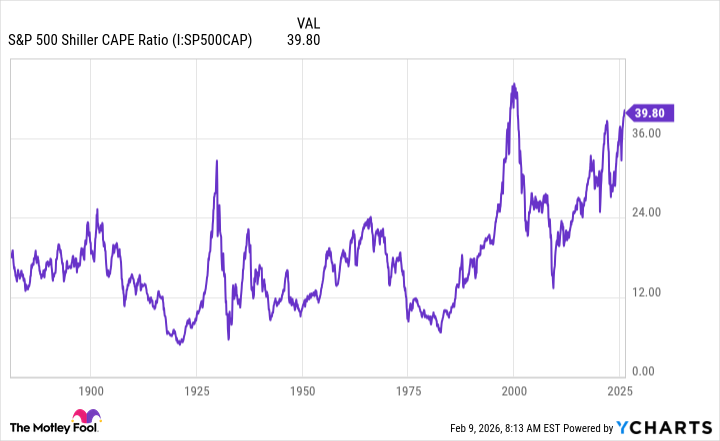

However, let us not mistake enthusiasm for reason. Some investors, observing these soaring valuations, have begun to whisper of bubbles – a tiresome cliché, but one not entirely without merit. The S&P 500 Shiller CAPE ratio, an attempt to impose a semblance of order on the chaos of the market, recently reached heights that suggest a certain…optimism. To put it plainly, stocks are expensive. It is a truth often obscured by the allure of novelty.

This, naturally, has stirred anxieties. The recent unveiling of new AI tools by Anthropic, while ingenious, has fueled concerns that these marvels might displace existing products – a rather ungrateful response to innovation, wouldn’t you agree? Nvidia’s Mr. Huang, with a touch of justifiable irritation, dismissed these fears as illogical. He rightly points out that AI is more likely to enhance existing software than to render it obsolete. After all, even the most brilliant invention requires something to build upon.

What Should the Discerning Investor Do?

The result, as one might expect, has been a period of…adjustment. Certain AI and technology players, particularly those involved in the software trade, have experienced a slight cooling of enthusiasm. Now, we return to our original query: should one retreat from these ventures, or view this dip as a chance to acquire them at a more reasonable price?

It is crucial to listen to what companies themselves are saying. Recent earnings reports reveal a remarkably consistent message: demand remains robust. Chip manufacturers like Taiwan Semiconductor Manufacturing and chip designers like Advanced Micro Devices have both reported impressive revenue gains. TSMC, with its close ties to both designers and cloud providers – those who directly serve the AI clientele – has a particularly clear view of the landscape. And so far, the picture is overwhelmingly positive.

The Cloud and the Algorithm

In recent days, we have heard directly from the cloud providers – those vast repositories of data and processing power. Both Alphabet and Amazon (AMZN 0.64%) have announced significant investments in AI infrastructure, eager to meet the ever-growing demand. Amazon, with characteristic ambition, plans to spend $200 billion on capital expenditures this year, and is already monetizing the new capacity as it comes online. A rather vulgar display of wealth, perhaps, but undeniably effective.

There is, therefore, no indication of a slowdown. And if we consider AI as a technology, we are still in the very early stages of its evolution. We are merely beginning to apply it to real-world problems. Further down the line, AI is poised to play a central role in robotics, drug discovery, and autonomous vehicles. This suggests considerable growth lies ahead – not just for AI stocks, but for software companies and others who utilize or develop these technologies.

Therefore, these recent declines in certain AI stocks and other quality tech companies should not be viewed with alarm. Rather, for the long-term investor, this represents a buying opportunity – one that may not present itself again for a decade. After all, a little turbulence is a small price to pay for a glimpse of the future.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-10 03:12