The relentless march of artificial intelligence, my dears, is not merely a technological phenomenon; it is a spectacle. To suggest that expenditure upon it will diminish is akin to predicting a surfeit of good taste – a most improbable notion. The hyperscalers, those modern titans of data, anticipate increased investment in their digital cathedrals, and where they lead, we, as astute observers of the market, must follow. A thousand dollars here, a thousand there… it’s a small price to pay for a glimpse into the future, wouldn’t you agree? And, naturally, one should act with a certain dispatch; the market, like a fickle socialite, rarely bestows its favors upon the hesitant.

1. Nvidia: The Painter of Pixels and Profits

Nvidia, that most successful of companies, has, since 2023, held a rather enviable position atop the artificial intelligence investment lists. And with good reason. It possesses the tools – those remarkable graphics processing units – with which the very fabric of this new digital reality is woven. Its ascent to becoming the world’s most valuable company is no accident; it is the inevitable consequence of possessing that which everyone desires.

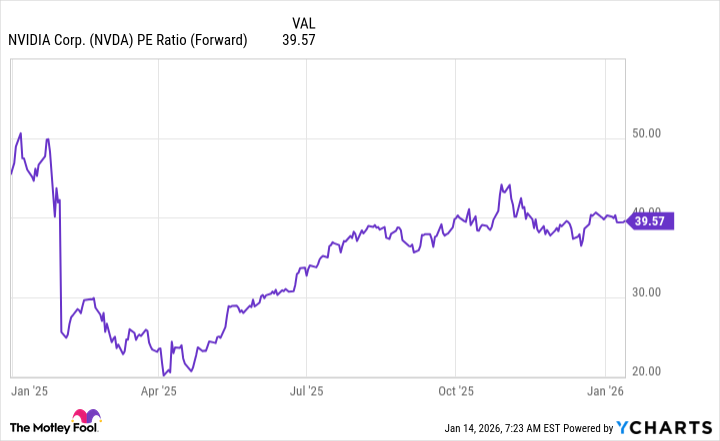

To suggest that Nvidia’s success over the past few years is impressive is a rather pedestrian observation. I anticipate 2026 will be even more… agreeable. The company currently trades at a valuation that, while not entirely unreasonable, is not precisely a bargain. Forty times forward earnings – a slight premium, perhaps, but a perfectly acceptable price for a company that is not merely participating in the future, but creating it. To expect anything less would be a display of remarkably poor judgment.

Wall Street, ever the pragmatist, expects a 50% revenue growth for fiscal year 2027. A robust performance, certainly, but one that merely confirms what any discerning eye could already perceive: that the demand for artificial intelligence is not merely persistent, but positively insatiable. Therefore, Nvidia remains a most compelling investment, and any growth-oriented portfolio would be decidedly incomplete without a measure of its brilliance.

2. AMD: The Aspiring Artist

AMD, while not enjoying quite the same level of acclaim as Nvidia, is nonetheless a company with potential. It has, for some time, struggled to match Nvidia’s established ecosystem, but there are signs of improvement. Its ROCm software, once considered a rather pale imitation of Nvidia’s CUDA, is beginning to gain traction. Downloads have increased tenfold year over year – a rather dramatic improvement, wouldn’t you say? This suggests that companies are, at least, investigating AMD’s offerings, and a shift in market share, however slight, is not entirely beyond the realm of possibility.

Management, with a commendable degree of optimism, believes it is poised for a significant acceleration. They anticipate a 60% compound annual growth rate from their data center business through 2030. A rather ambitious forecast, perhaps, but one that, if realized, would position AMD for a most enviable ascent. To dismiss such potential would be a demonstration of a lamentable lack of imagination.

3. Broadcom: The Master Craftsman

Broadcom approaches the artificial intelligence landscape from a rather different angle than either AMD or Nvidia. While the latter focus on broad computing environments, Broadcom specializes in optimization. It partners with the hyperscalers to design custom AI chips – ASICs – tailored to specific workloads. These devices, while lacking the flexibility of GPUs, offer superior performance at a lower cost. A trade-off, naturally, but one that many are willing to make.

Broadcom’s products will not entirely supplant GPUs, but they will complement them. Its AI semiconductor revenue increased 74% year over year to $6.5 billion in the fourth quarter of fiscal year 2025. And they anticipate this business will double year over year to $8.2 billion. Such growth is, quite simply, remarkable. Broadcom is collaborating with several other hyperscalers to design their own chips, and this is merely the beginning. Therefore, alongside Nvidia and AMD, Broadcom presents a compelling investment opportunity, and all three are likely to outperform the market considerably over the next five years, fueled by the relentless expansion of artificial intelligence. It is, after all, a most profitable spectacle.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 23:03